Stock market timers, which in the past two weeks were unusual, have dealt with a recent correction in the market by hitting a rapid retreat.

This is a positive sign, from a contrarian point of view. While short-term marketers are not yet as tough as they are in the “too bearish” sector, they are approaching.

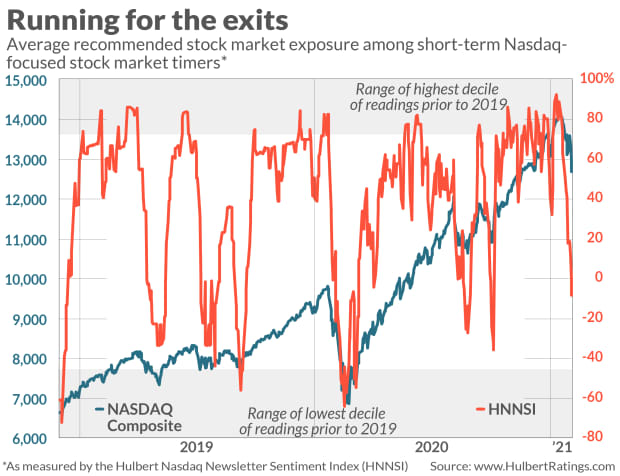

Consider how fast the Nasdaq-focused stock market timers my strong analysts have jumped on the bearish bandwagon. As of February 12, their recommended average exposure rate was 88.9%, which was higher than 97.9% of daily readings since 2000.

Today, by contrast, their average exposure rate is less than 10.0%, which is at 24.7th percentile of historical distribution. (This average exposure rate is that reported by the Hulbert Nasdaq Newsletter Index, or HNNSI.)

In just three weeks, in other words, the Nasdaq-based average stock market timer has reduced its proposed equity exposure rate by 108 percentage points. Where an orderly backdrop is, that’s an unusual stampede.

As you can see from the accompanying chart of the HNNSI, this rush to jump on the bearish bandwagon reminds us of what happened twice last fall, once in September and a second time in October. .

In the first of these periods, the Nasdaq Composite Index COMP,

fell 11.8% and the HNNSI fell 74 percentage points before the market began its march up. In the second, the Nasdaq fell 8.1% and the HNNSI fell 98 percentage points before the market reversed.

So far this time, the Nasdaq has fallen 9.7% and the HNNSI has fallen 108 percentage points. If the current correction and the response of market timers play out in the same way as before, we could be near the end of that correction.

How do we know when the final peak of the bull market is at hand, wherever that may be in the future? The answer is that, from a contrarian perspective, market timers will be at a much stronger level than they have shown over the past few weeks.

Perhaps the best historical picture of this came at the top of the internet bubble in March 2000, when the HNNSI rose sharply after the Nasdaq fell 10% from the high bull market.

Fortunately, that is not what we are seeing now.

Bonds and gold

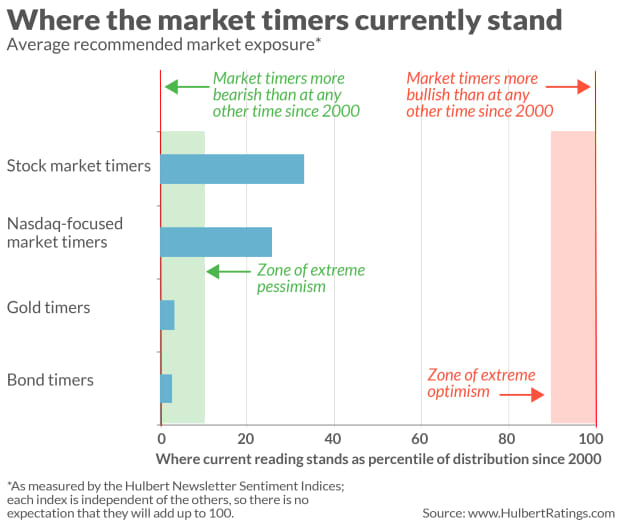

The Nasdaq stock market is just one of four areas in which I monitor the average exposure levels of marketers. The others are general stock market, gold and bonds. Each month in this place I clarify one of them and examine what it says from a contrarian perspective.

In the meantime, the chart above summarizes where the timers are currently in the four ranges. Notice the extreme bearish among both gold market and market timers, suggesting from a contrarian perspective that both markets could be near the start of a commercial rally.

Mark Hulbert contributes regularly to MarketWatch. His Hulbert Ratings monitors investment newsletters that pay a flat fee for being audited. He can be reached at [email protected].