Smaller Chinese companies and those in the retail industry are struggling to gain credibility amid a weak recovery in consumer spending, according to China Beige Book International, an independent economic data provider.

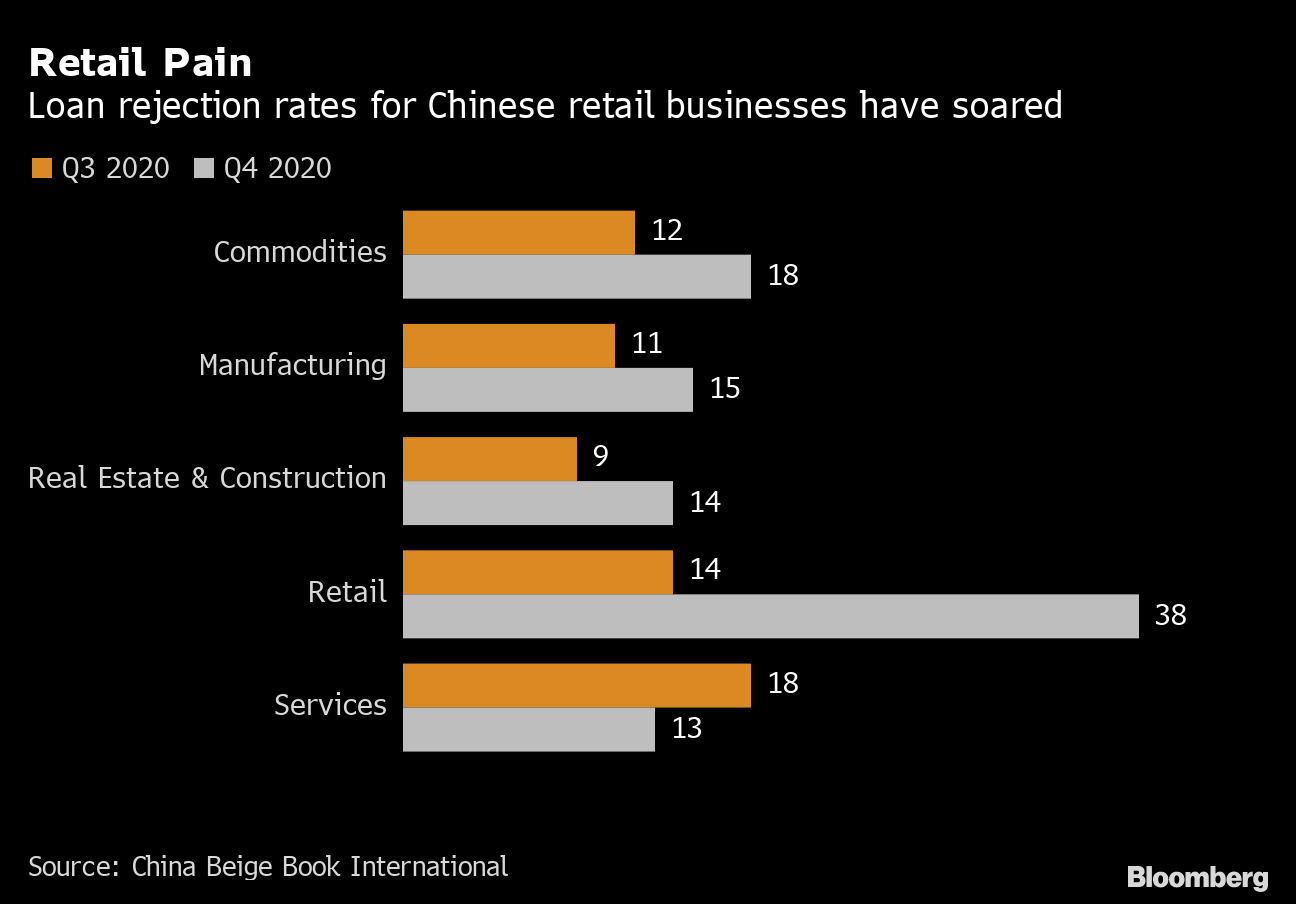

Loan rejection rates for retail businesses increased to 38% in the last quarter of 2020 from 14% in the previous quarter, according to the latest quarterly report from CBBI. Rejection rates for SMEs rose to 24% in the last quarter, double the rate set by large companies over time.

Pian reic

Loan rejection rates for Chinese retail businesses have gone up

Source: China Beige Book International

“Large companies will continue to build whatever credit was available, with much lower capital costs than their smaller counterparts, coupled with higher loan applications and still falling rejections,” CBBI said. “This is different from the small and medium enterprises that have quagmire.

The CBBI study paints a harsher picture of China economic recovery than official data show, indicating that consumer consumption remains weak. It also commends Beijing’s efforts to encourage more lending to small private sector businesses by assigning loan quotas to banks and providing price discounts.

Business revenue revenues were driven by businesses in telecommunications, shipping, and financial services, but those in forward-looking industries, such as chain restaurants and travel, going last, according to CBBI.

“Don’t bother getting past the fourth quarter services with the statement‘ Chinese consumer is back ’,” said CBBI Managing Director Shehzad Qazi. “This is a business service – not a consumer side – get over it. Sales department data makes this even clearer, with spending on non-permanent soaking. ”

CBBI indicators showed that commodity prices, wages and other entry costs have been rising since the second quarter of 2020. This contrasts with official producer and consumer pricing measures, which show deflation over the past month.

“Inflation is both worse than official figures and means a more sensible economic path,” he said.

The report was based on more than 3,400 interviews with company officials and bank staff in November and December.