Photographer: Qilai Shen / Bloomberg

Photographer: Qilai Shen / Bloomberg

Chinese regulators ordered Jack Ma’s online financial titan Ant Group Co. to return to its roots as a payment services provider, threatening to thwart growth in its most profitable industries of consumer lending and wealth management.

The central bank called Ant officials over the weekend and called on them to “correct the company’s lending, insurance and wealth management services,” the People’s Bank of China said in a statement on Sunday. Although he briefly stopped calling for a breakdown of the company, the central bank stressed that Ant needed to “understand the need to modernize the business” and schedule create as soon as possible.

The series of edits represents a major threat to the expansion of Ma’s online financial empire, which has grown rapidly from PayPal-like operations to a full suite of services over the past 17 years. Before regulators intervened, Ant was ready for a public listing that would have cost him more than $ 300 billion. The Hangzhou-based company now needs to move forward with setting up a separate financial property company to ensure it has sufficient capital, and to protect private personal data, the central bank said.

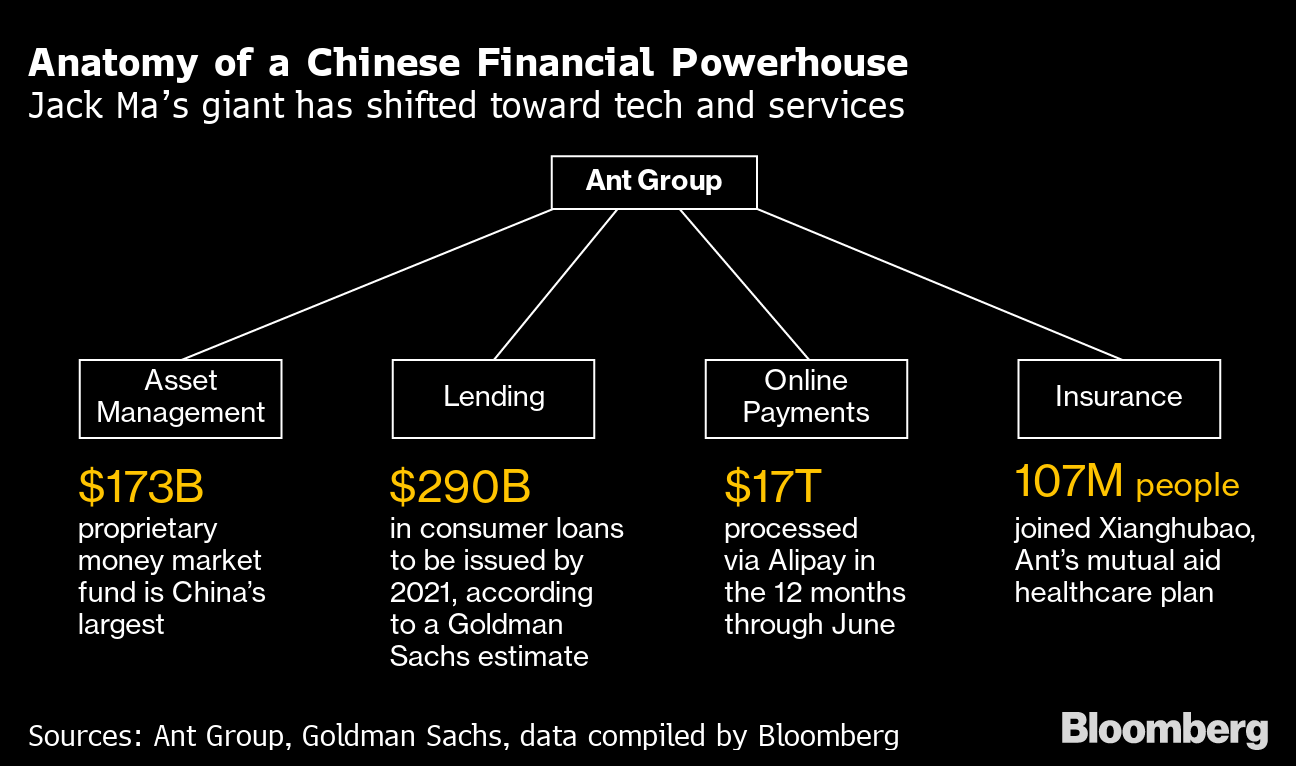

Anatomy of a Chinese financial powerhouse

The giant Jack Ma has moved towards technology and services

Sources: Ant Group, Goldman Sachs, data compiled by Bloomberg

“This is the result of a series of rules and sets the direction for Ant’s ongoing business,” said Zhang Xiaoxi, a Beijing-based analyst at Gavekal Dragonomics. “It simply came to our notice then break up still. Ant is a big player in the world and any breakup needs to be careful. ”

Authorities also tasted Ant for sub-par corporate governance, disregarded regulatory requirements, and engaged in regulatory negotiations. The central bank said Ant used its leadership to ban competitors, hurting the interests of hundreds of millions of users.

China last week made a significant contribution to its investigation into the two pillars of billionaire internet land Ma when they also began investigating monopolistic practices accused at Ant Affiate Alibaba Group Holding Ltd. The US e-commerce companylisted sections the biggest thing ever fell on the probe news.

The State Administration for Market Regulation sent inspectors to Alibaba on Thursday and the site inspection was completed on the day, according to Saturday. a report posted on a news app run by the Zhejiang Daily. The report cited an unnamed official from the local market control watchdog in Zhejiang province, where Alibaba is based.

The emphasis on Ma is at the heart of a broader effort to block an increasingly influential internet domain.

Once identified as drivers of economic wealth and symbols of the country’s technological potential, the emperors who built Ma, The chairman of Tencent Holdings Ltd., “Pony” Ma Huateng, and other tycoons are now under scrutiny after gathering hundreds of millions of customers and influencing almost every aspect of Chinese daily life.

Ma’s own empire is in crisis mode. In early December, with Ant under regulatory scrutiny, the government advised the closest of meteoric rise in China Inc. living in the country, someone familiar with the case has said. Alibaba has lost more than $ 200 billion in market value since November, when regulators torpedoed the first $ 35 billion Ant record.

Its chief officers are part of an action group that interacts almost daily with watchdogs. At the same time, regulators, including China’s Banking and Insurance Regulatory Commission, are measuring what businesses Ant should provide to contain the risks it poses to the economy. , officials with knowledge of the case have said. They did not decide whether to carve out their different lines of work, share their online and offline services, or follow a different path altogether.

Read more: Jack Ma goes quietly after the amazing show at Ant Group

“Ant’s growth potential will be limited by the backward focus on its payment services,” said Shujin Chen, head of China’s Hong Kong financial analysis at Jefferies Financial Group Inc. “On the mainland, the online payments industry is in full swing and Ant’s market share has largely been reached. ”

– Supported by John Liu, Jessica Sui, Jun Luo, and Lulu Yilun Chen

(Updates with more information from the second paragraph)