All commodity markets have their own investment portfolio. Crude oil has wildcat research and production companies; mining of gold and precious metals outside does the dirty work in the ground. Commodity futures, bitcoin, are an exception to the rule, when there is a scarce resource to exploit the world, and investors value it more, miners tear in. to turn their claim into wealth.

Recent gains in what could be the high-risk bitcoin bet of all led Leeor Shimron, vice president of digital asset strategy at Fundstrat Global Advisors, to take a look at the “digital gold rush” in bitcoin mining.

These mining companies are relatively new and young, do not have good records, and some have come to market in “roundabout ways” – and some of the largest ones, such as Riot Blockchain, have drawn up early days regulatory scrutiny. They have also been working at a loss, but Shimon noted that they have reached more than $ 1 billion in market cap after investing heavily during the bitcoin downturn in the UK. hardware and the resources that helped it to “hit it big” in the current bitcoin bull market circle.

High-beta, high-risk bitcoin trading

Shimron described the miners in a note last week to clients who expressed interest in the surging stocks as a “high beta play” on bitcoin. During the recent bull run for the cryptocurrency, when bitcoin is up 900%, the average yield among the publicly traded miners was 5,000%, according to his analysis.

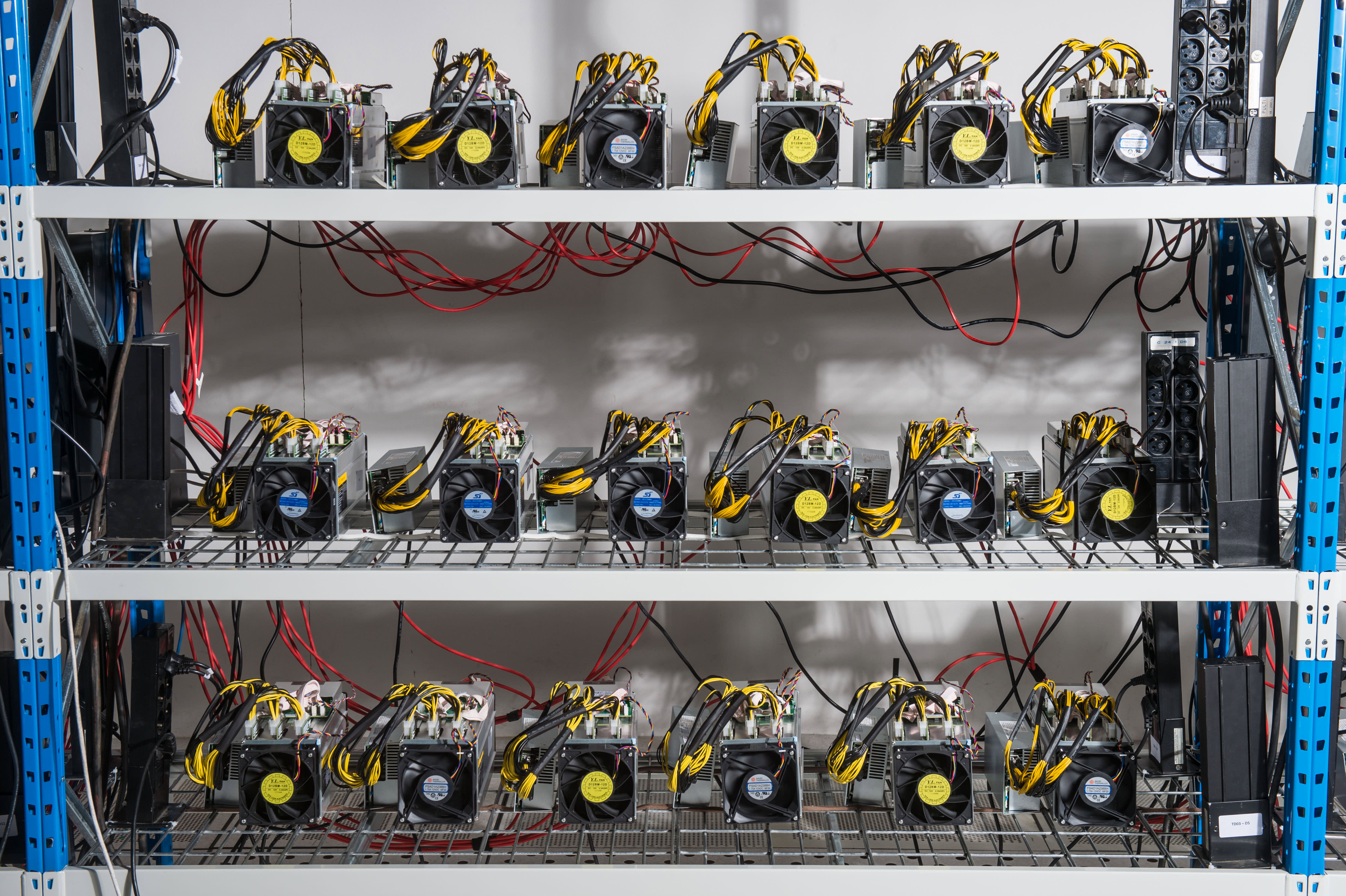

Bitcoin miners, in Shimron’s words, are creating the main backbone of a bitcoin blockchain, as they “burn electricity to computer-generated estimates aimed at solving cryptographic puzzles” and generate revenue. -into in mined bitcoin format. As the bitcoin is mined, the miners sell the assets to cover their costs. Many choose to keep a portion of their bitcoin on their physical balance, a move that is beginning to gain traction with the more digitally-oriented Leader class and disrupt the market in general. , such as Jack Dorsey at Square and Elon Musk at Tesla. Musk just added “Technoking” to his action title and the Tesla CFO recently added “Master of Coin”. North American mining company Marathon Digital Holdings recently announced it had purchased an additional $ 150 million worth of bitcoin to keep it on balance.

The largest publicly listed mining companies reviewed by analyst Fundstrat include the two companies listed Nasdaq, Riot Blockchain and Marathon Digital Holdings, and two cross-market stocks, Hive Blockchain and Hut 8.

Over the past year, bitcoin miners have done much better than bitcoin, a dynamic that Fundstrat Global Advisors says will continue as the bull market plays out, but they could turn violently to the downside in any correction.

Fundstrat Global Advisors

Shimron’s study shows that the beta that these bitcoin mining companies are exhibiting generates a yield of 2.5% for every 1% movement in the cryptocurrency. While there is not enough historical data to draw firm conclusions, miners ’performance is clearly tied to the price of bitcoin, and their trading profile is rising both upside down, he said.

It is a “highly competitive business,” in Shimron’s words, where the potential for profitability can come down to cheap electricity and access to specialized mining hardware. As the price of bitcoin rises, “miners will spin up new rigs or upgrade their hardware with more powerful and efficient machines.”

Marathon recently made a $ 170 million contract for 70,000 SIC 19-ASIC miners from Bitmain, whose mining power will go up to 103,000 devices when it is installed later this year.

This high cost of doing business in bitcoin mining leads to low or negative free cash flow and quiet earnings, Shimron writes. But the mining companies for now have grown to capture the conventional bitcoin bull circle as a result of their consumption.

They have also drawn attention from some of the latest market forces, as a recent Bloomberg piece about the bitcoin miners discussed on the WallStreetBets message board on Reddit also put the mania in sections of GameStop.

“For investors who want to experience mining, that beta makes it a great opportunity through the roast bull market. … There are discounts and start – ups and downs, but we still have a lot of room to grow here , “Shimron said in an interview with CNBC.

Investing in bitcoin in 2021, and beyond

It is the broadest bull market in cryptocurrency that has fueled the miners and Shimon believes that can continue in 2021, driven by macroeconomic and demographic factors. Inflation fears support bitcoin prices, and even amid recent yield pressures from the 10-year Treasury Department that can work on cryptocurrency as it does on technology stocks, he said that it is clear from Fed indicating that the central bank wants to keep its dovish policies in place until 2023.

Another driving force is the adoption of new digital technology and digital assets from younger investors. “You see younger people are desperate for bitcoin and other digital currencies rather than gold and commodities and it speaks to a demographic shift. … For them it’s not deceptive to interact with money in a way that is just digital, “he told CNBC.

Last week, Morgan Stanley became the first major Wall Street bank to offer their wealthy clients access to bitcoin. It restricted access to clients by at least $ 2 million with the risks involved.

There are already ways in the crypto market in addition to the underlying currencies, such as the exchanges that trade coins and will soon be available to more investors. Coinbase was recently valued at $ 68 billion in the private market and plans to list directly on the Nasdaq.

Waiting for a bitcoin ETF in the US

There are three bitcoin ETFs in Canada, and at some point, a bitcoin ETF may be available in the U.S. The latest attempt by the Securities and Exchange Commission was filed in mid-March by VanEck ETFs, but with investors not holding out high hopes the SEC will soon approve bitcoin funds, they are looking elsewhere for cryptocurrency investment ideas that go beyond buying bitcoin itself.

Shimon, who ran an early cryptocurrency and blockchain venture fund before joining Fundstrat, said he believes the miners are the foundation for the crypto space. “The major companies will be here to stay,” he said, pointing to economies of scale investing in equipment that new entrants will have a harder time competing against.

After making the “smart move” during the bitcoin bear market to build out operations, a supply chain shortage in the tech sector caused by Covid may help further the position of these miners after the capital. which they put into special machines for the place.

However, as many traders and hedge funds do with gold miners and low-cap oil explorers, bitcoin miners tend to trade in a bull run market, rather than see them as investments to sustain it in the long run.

Shimron still prefers bitcoin as a long-term investment, as well as any ETF ultimately agreed with the SEC for U.S. investors. “It is only a matter of time before the SEC approves a bitcoin ETF,” he said. “When it comes to BTC ETFs, the fees will be low and it is the safest and easiest way to use traditional rails so you can experience bitcoin,” he said.

The miners have resisted criticism about the large amounts of electricity required in bitcoin activity, but Shimron’s view comes down to market finances and performance. (He says there is plenty to criticize about the impact of the fiat money system on the world as well.)

“It is very clear that the U.S. dollar as a global reserve is on its last legs, never to disappear anytime soon, but we are in the longest levels of dollars the US as a reserve, and decentralization is the next step. “

Even if the bitcoin mining stocks are at too high a risk for most investors, it is reassuring to say that the world of cryptocurrency should be on everyone’s radar. “This is where it all goes. Finance has finally become a vestige that hasn’t happened with the internet,” Shimron said.