London Stock Exchange Group offices in Paternoster Square in London.

Photographer: Simon Dawson / Bloomberg

Photographer: Simon Dawson / Bloomberg

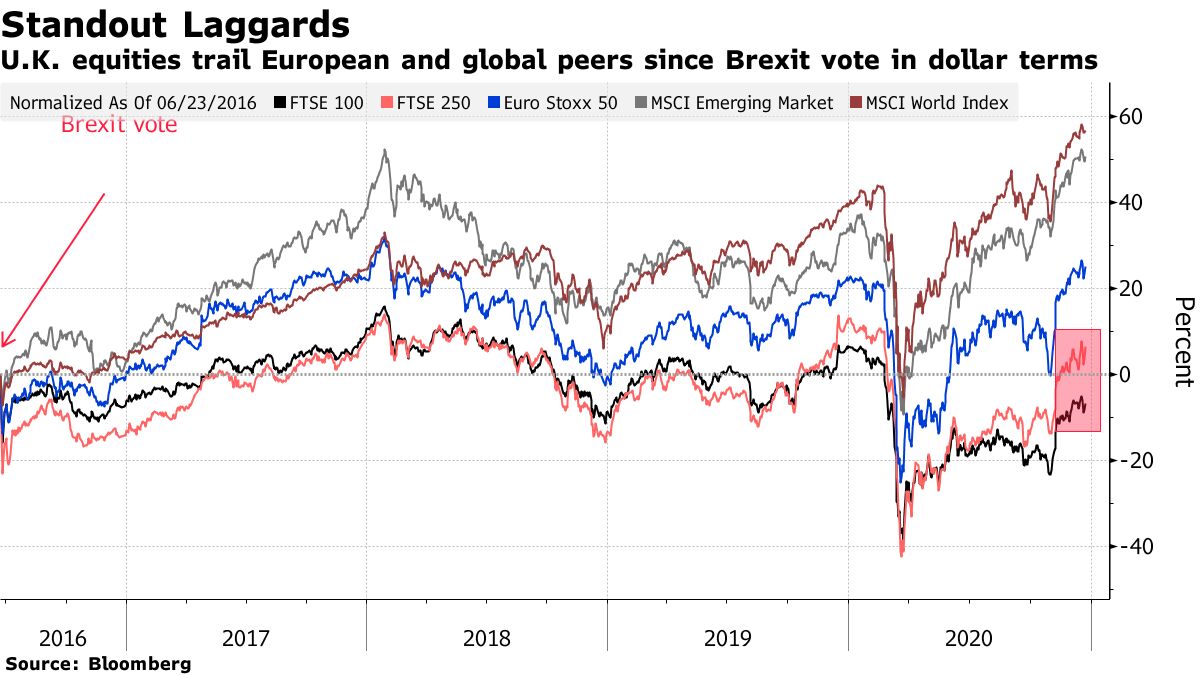

After years of lagging behind peers, UK stocks are emerging from the shadow of Brexit just as cheap stocks are booming from a bet on global recovery from the pandemic.

The country has been the worst player among major equity markets since the 2016 Brexit referendum, both in terms of local currency and dollar. For investors who have stayed away from UK shares during this period, their cheapness may hold up as value stocks are expected to shine in the coming year. .

On Christmas Eve, UK they secured a historic trade deal with the European Union when negotiators finalized the deal, which will end Britain’s separation from the bloc. The news comes as the UK does locked down 16 million Britons amid spike in Covid-19 cases and appearance of a new strain of the virus, with more restrictions on the route from 26 December.

“The last-minute agreement between the EU and the UK is a good thing to do for the UK market in the context of value hunting,” said Sylvain Goyon, BHF Oddo strategist. “The ‘end’ of the Brexit saga could be an exciting stimulus to rediscover the FTSE 100. “The benchmark targets businesses that are aware of the synchronous economic recovery expected in 2021, said Goyon, with materials, energy and finance accounting for about 40% of the index.

The agreement will allow tax-free and quota-free trade in goods after December 31, but that does not apply to the services industry – around 80% of the UK economy – or the financial services sector. Companies shipping goods to prepare for return of customs and border inspections will be put on hold at the end of the year amid warnings of a riot at British ports.

The FTSE 100 heavy exports have risen 2.5% since the 2016 vote, falling below the 14% gain for a broader regional criterion, the Stoxx Europe 600 Index, despite a rise from the pound falling. On the dollar, the UK index has fallen by 6.7%.

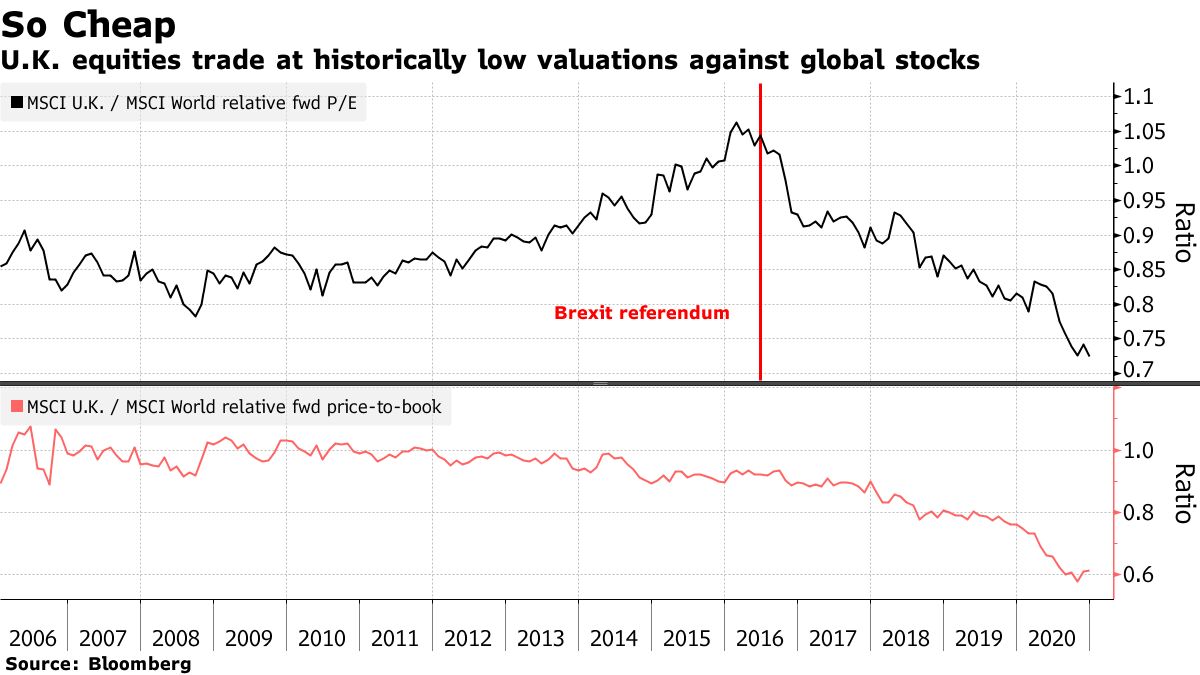

In another sign of UK inconsistency, investors paid little attention to the employment growth of major FTSE 100 companies, offset by the lack of visibility on Brexit. That has left British stocks trading near valuations that were not as high compared to global stocks, based on estimated earnings.

“We remain positive about UK equality,” Goldman Sachs Group Inc. strategist Sharon Bell wrote on Friday. “The market is already looking cheap compared to other assets and compared to other key equities indexes. ”

Most UK regions trade at a “huge discount” to both European and US peers, Goldman said. The obese company is the FTSE 100 compared to the Stoxx Europe 600 Index, announcing strong valuations and tilt towards value segments and seeing the megacap criterion as far more sensitive to Brexit consequences than the FTSE 250 or domestic stock.

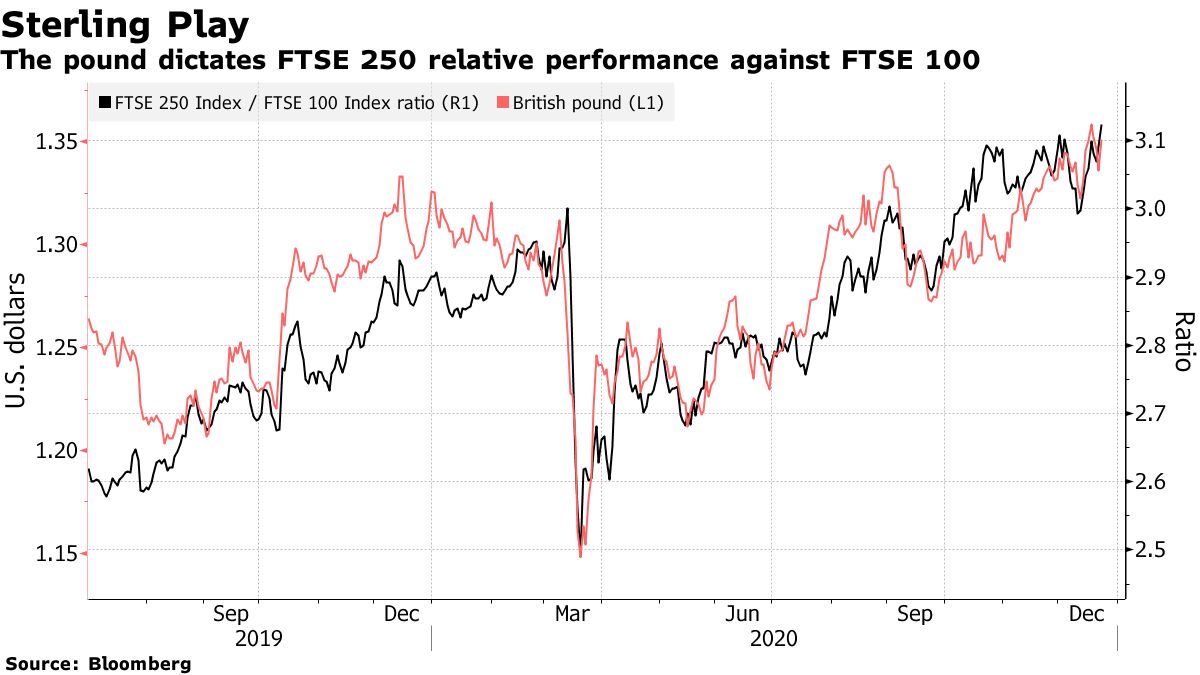

Within the UK, stocks that have been at very slow rates are also likely to benefit from the resolution, including banks and home builders. And while a strong pound will usually weigh on the FTSE 100, both have had a good chance correlation from October.

Financial and energy sectors, which are heavily weighted in the megacap criterion, may gain further impetus from value trading. In addition, Artemis Revenue Fund manager Nick Shenton predicts an increase in shares in 2021 as companies become more confident in moving away from “real this year’s temperance. ”

There is already at least some Brexit rise in stock prices, with hopes rising over an agreement a few weeks ago. That, coupled with a bet on economic recovery by vaccine fuels, has pushed the FTSE 100 up 17% since the end of October and the FTSE 250 up 19%.

Asset managers turned less bearish on UK equities in the-up to Brexit deadline, according to Bank of America Corp. In a survey by the bank, 18% of respondents were under the weight of the country’s shares in December against 34% the previous month. However, the country continued the suspicious divergence as a favorite among major stock markets in December, the study showed.

While most strategists agree that the Brexit deal is going well for the UK market, and that it is well placed to benefit from the vaccine-led economic recovery, the bullish rate is fluctuating.

UK funds are under control, undervalued and offering greener growth for investors, Societe Generale SA strategists led by Alain Bokobza wrote on 16 December, while Liberum Capital strategy said Joachim Klement last month said a diversified bull market has begun for British stocks, predicting they will revise -rate as much as 50% over the next two years.

On the other hand, strategist JPMorgan Chase & Co. Mislav Matejka expects UK equities to outperform the eurozone or global peers, saying FTSE 100 defensive stocks could hold back as the economy recovers and could the strength of the pound to be a drag at least in the short term.

While the majority of any UK trade contract investors would prefer to leave the EU without one, it remains to be seen whether the agreement reached will be enough to build confidence in return UK allowances. Beyond the short-term kick-off, Brexit may take the off-market outlook in the long run, according to Seema Shah, chief strategist at Chief Global Investors, as jobs and capital flows falling away from the single market.

“One of the big unanswered questions is whether these international investors will be aggressively sold their UK equity after the 2016 referendum is brought back to market, with valuations still attractive. compared to developed market peers, ”said Richard Buxton, head of strategy, UK Alpha at Jupiter Asset Management. The process may be slow, he said, with many likely to “wait and see” how the UK is thriving outside the EU.

– Supported by Sam Unsted, Ksenia Galouchko, James Cone, Felice Maranz, and Divya Balji