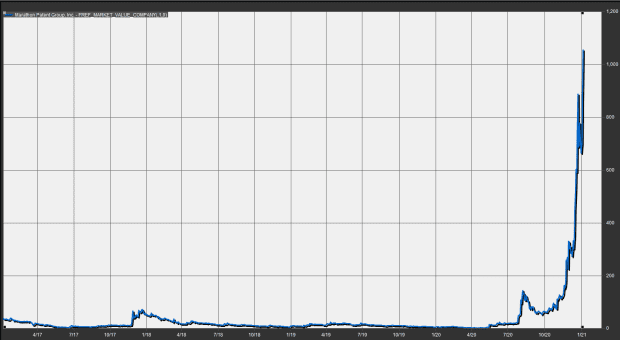

Shares of cryptocurrency miner Marathon Patent Group Inc. burned up about 20% Wednesday, helping to make the company the newest member of the $ 1 billion digital mining group, as bitcoin hit a new record of nearly $ 36,000.

According to FactSet data, the market value of Marathon Patent MARA,

it was at $ 1.030 billion, after its shares acquired a fifth of value adding to a $ 165 million gain in market capitalization since yesterday ‘s rise.

FactSet

Marathon has gained more than 55% so far in January and Wednesday’s rally puts it in a league with rival mining company Riot Blockchain RIOT,

which has a market value of $ 1.3 billion, after joining the billion-dollar club last month.

check out: Here ‘s how bitcoin could soon be worth $ 146,000 according to JPMorgan

Digital mining refers to the use of high-powered computers to generate new units of the cryptocurrency, solving complex problems that have become more difficult over the years due to the fact that bitcoins were originally coded.

Bitcoin “mining” costs a lot of electricity and now requires special hardware.

And miners like Marathon and Riot Blockchain, play a key role in maintaining bitcoin’s self-sustaining network, run the decentralized software that verifies transactions.

The gains in these companies have come when bitcoin halted stratospheric growth in the last several months, shutting out 2020 up about 300% and starting 2021 with an increase of more than 20% so far.

At the last review, one bitcoin BTCUSD,

it was valued at $ 34,758, up nearly 2% on the day, but where its intrasession peaked at $ 35,879, FactSet data show.

Higher prices for bitcoins can justify the high cost of mining for new coins, however. The daily profit from a single bitcoin miner is currently $ 10.06, according to mining-calculator site BTC.com, backed by recent gains in prices.

Last year, Marathon Patent shares rose above Marathon Patent over 1,000%, while trying to grow their mining enterprise.

To be sure, these companies are a risky investment, experts warn, especially if the price of the asset falls significantly, but the rise in shares of these companies reflects the a new impetus around bitcoin and the like.

Bitcoin benefits draw investments away from GOLD gold,

experts say, as a downturn in the Dow Jones industrial average DJIA,

and S&P 500 SPX index,

whether market participants are concerned about high valuations in shares against a background of interest rates at or around 0%.