After the cessation of multi-east pit, bitcoin prices are going up like never before.

The unchanged price acceleration to a recent close to a whopping $ 42,000 on CoinDesk has taken true believers out of many of the benefits of the Wall Street situation, which could have turned their collection noses up at digital assets that have only been around for a little over a decade.

However, the highly parabolic move for bitcoin, which at the last review, up 2.5% on Friday at $ 40,202 has raised big questions about bubbles, like Tulip mania in the 17th century.

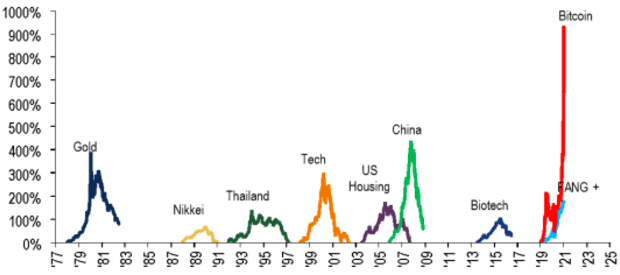

BofA Global Research in their weekly report “The Flow Show” dated January 7 raised the question of whether the bitcoin price movement represents “the mother of all bubbles.” Take a look at the following chart that stops comparing asset growth versus other assets over decades.

through the BofA Global Investment Strategy

Of course, the cart does not go all the way back to the Tulip crack, where a single tulip ordered the same price, and often more, as a house at the height of the Dutch scene from 1636-1637.

But BofA’s point is well taken, bitcoin is highly valued and basically maintains a steep climb that deserves attention and, perhaps, caution.

So far in the first full week of 2021, bitcoin has already gone up nearly 37%. In contrast, the Dow Jones industrial average DJIA,

higher, but more variable, 1.5%, S&P 500 SPX index,

on track for 1.6% gain and the Nasdaq Composite Index COMP,

has returned 1.4% so far.

This year’s Bitcoin rally has put cryptocurrency market capitalization up to a record over $ 1 trillion and as Michael Hartnett of BofA and his team put it, rising, of the “cryptocurrency market now> $ 1tn as Bitcoin passes on 2 years blowing-an-bubbles beforehand. “

The benefits seem far from over if you believe predictions from JPMorgan Chase, whose researchers argue that the digital currency could be worth $ 146,000 if bitcoin challenges for GC00 gold,

as a port-like property. That would certainly be worth a respectable home.

Of course, this isn’t the first time bitcoin has been described as a bubble.

In evidence prepared for the Senate Banking Committee hearing back in 2018, Turkish-born economist Nouriel Roubini said digital currencies are “the mother of all bubbles” and, in fact, have to enter an apocalypse.

Howard Wang, co-founder of Convoy Investments, also named bitcoin the biggest bubble in history before it finally collapsed back in 2017.