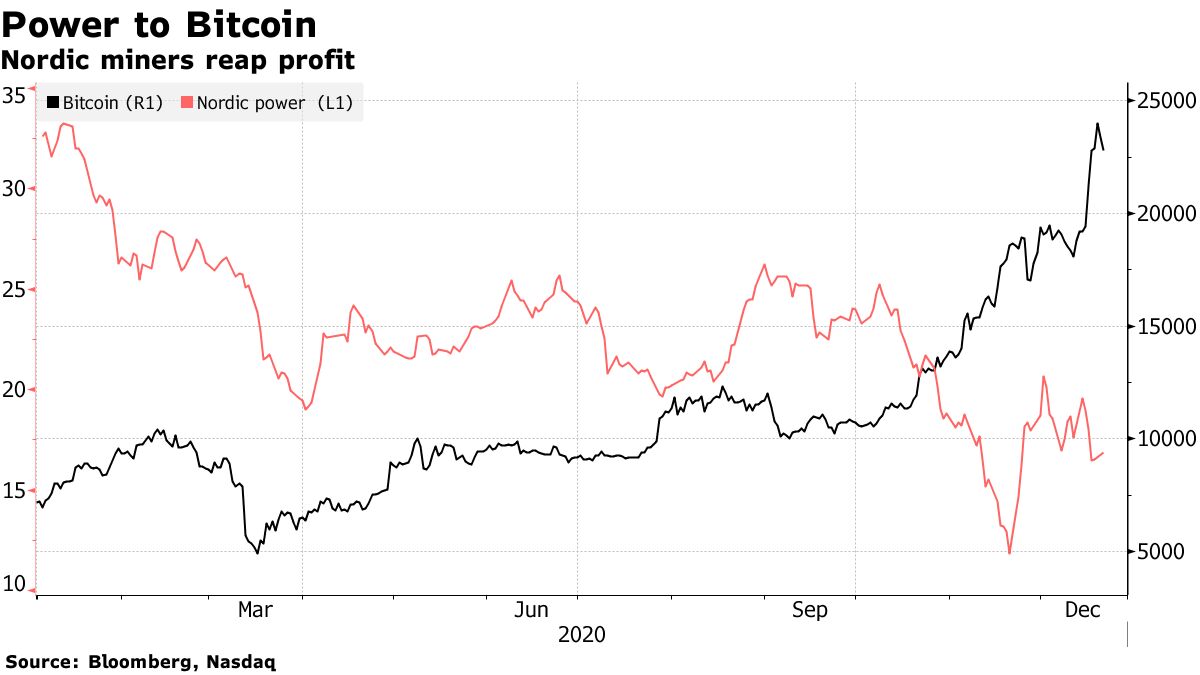

The Scandinavian region has once again become a lucrative place for crypto-Arian mining, thanks to a fall in electricity prices.

The wettest weather in at least 20 years has boosted production from hydroelectric plants, leaving Sweden and Norway with some of the lowest power prices in the world. The resulting cry of the most important raw material for making the coins was at the same time as a year when the price of Bitcoin tripled.

The money is made in large computer farms that process complex algorithms in halls as large as airport hangers. That makes electricity one of the main inputs, with jobs sometimes consuming as much power as those used by 70,000 households. Market dynamics currently offer miners alternatives to places where Bitcoin is typically created such as China, Kazakhstan and Canada.

Good luck follows several years of bad margins from higher electricity costs and lower prices for most real currencies. Many of the miners attracted to the area during the last rally in 2017 are gone.

“Those who have lived through the difficult time, like us, are very happy now,” said Philip Salter, head of operations at Hong Kong-based Genesis Mining Ltd., which works in a data center in Boden, Sweden. “There were times when we weren’t making a profit, but in the last year our profits have tripled. ”

Unusually wet weather and mild temperatures stimulated hydroelectric reservoirs throughout the Scandinavian region to their highest level in more than 20 years, leaving the region awake in generational potential. The result is power prices close to zero for long periods. Average prices this year are around a third of that of Germany, the largest energy market in Europe.

Norway had the lowest electricity prices for industrial consumers last year among the 30 member states of the International Energy Agency. It also had its lowest prices for non-EU households in the first half of this year, beating Iceland, another crypto-currency hotspot.

“These prices are some of the lowest you can find in the world if you disregard taxes and fees,” said Tor Reier Lilleholt, head of analysis at Norwegian adviser Wattsight AS. “What we have seen this summer is that low levels have been recorded over such a long period of time.”

The main environmental benefit from the establishment of mining in the Scandinavian region is the fact that electricity is virtually carbon neutral, consisting mainly of hydroelectric, nuclear and wind power. That is increasingly important for the many institutional investors attracted to crypto-Arian and one of the key factors behind the latest ones. price increases. Getting a cash flow flowing from the Scandinavian region helps reduce Bitcoin’s political risk profile.

“There is a very important strategic shift away from mining in China to mining in western countries like Sweden as Bitcoin investors become more public and demand more urgent stability and security,” said Salter. at Genesis. “This is one of the biggest developments in Bitcoin mining.”

It is difficult to compare electricity prices around the world as they differ between businesses and sectors due to taxes, levies and subsidies. One an effort by the World Bank, which measures imaginary warehouse bills in each country’s capital, places Sweden and Norway significantly lower than China but above other centers for crypto-currency making, such as Kazakhstan and Mongolia.

The cost of power is poised to become even more important to miners. The hash rate, the amount of hash required to extract each coin, is constantly going up. And in May, the miners ’rewards were cut by something called half, a reduction in the number of tokens they receive as a means of maintaining scarcity.

Many of the miners who left the area after the hustle and bustle of 2017-18 could return. November The announcement of a $ 35 million investment from Dutch blockchain company Bitfury Holding BV to expand their Norwegian site could mark the start of a new move.

“We have seen a significant increase in investor appetite for Bitcoin mining opportunities in Norway,” said Tyler Page, a business developer at Bitfury. “This year’s energy prices were particularly low as Bitcoin prices have gone up.”

– Supported by Lars Erik Taraldsen