As Americans hunt down and wait to be vaccinated, the toll of coronavirus pandemic continues to rise.

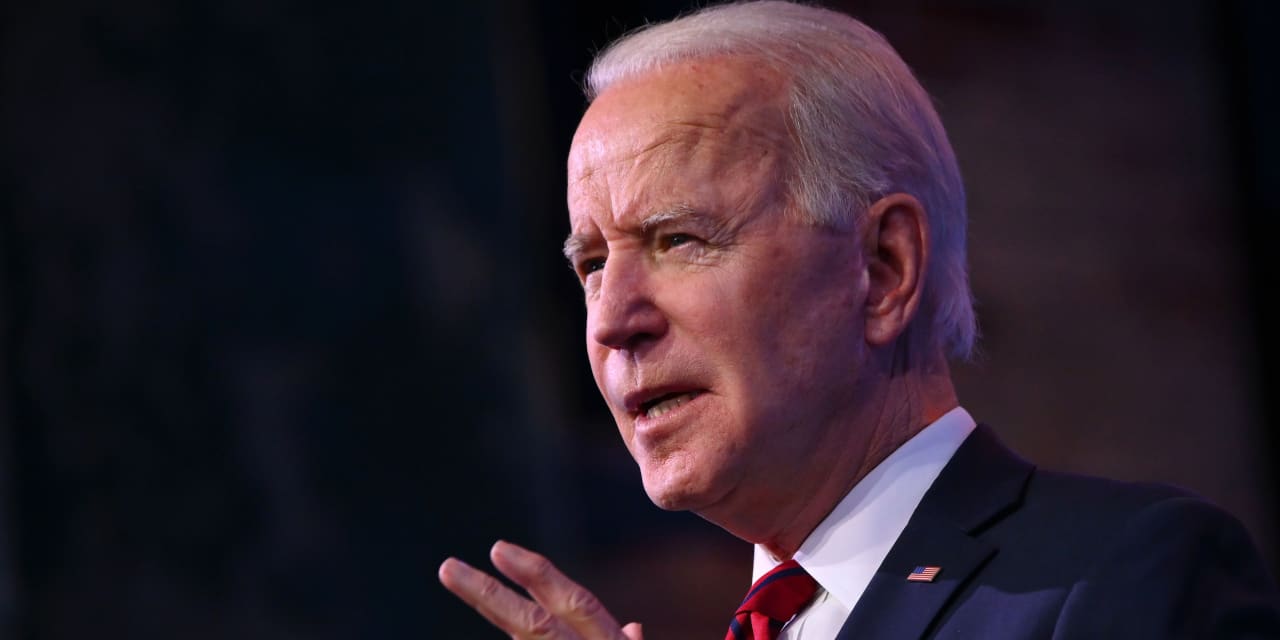

His expenses, both in life and livelihoods, prompted President Joe Biden on Thursday a $ 1.9 trillion “first step” spending package to help fight the spread of meat, even before he takes office next week.

However, as Washington prepares to discuss another major relief campaign, manual labor on Wall Street has already begun as investors worry that the bull market for stocks could be threatened by an economy that could heat up and cause borrowing costs, and which could also make the U.S. difficult with unsustainable debt.

“War is an attraction,” said Bryce Doty, senior portfolio manager at Sit Investment Associates, in Minneapolis. “The current situation is dire, but six months on, we hope to have many more vaccines. ”

Equity markets have largely been looking beyond the harsh chapter this winter of high levels of COVID-19 fatalities and fatalities, and the resumption of lockouts over oaths by the U.S., Europe and Europe. China. The focus is instead on the spread of the vaccine and the prospects for the incoming Biden administration to get more funding from Congress to shut down the economy through a coronavirus crisis.

Biden highlighted Thursday’s “crisis of deep human suffering” that is “in clear vision,” while urging Congress, soon to be under Democratic control, to approve $ 1 trillion to receive another $ 1,400 in direct payments to households, as well as $ 440 billion to roll out small businesses and $ 20 billion to accelerate what he described as a “disgraceful failure” of the national vaccination program.

check out: Biden economic plan to test for weakness of COVID relief at Congress

If passed, Congress ‘s total spending last year on coronavirus aid would reach $ 4.8 trillion, as well as the Federal Reserve’ s cash incentive and bond purchase program that expanded its balance to about $ 7.3 trillion from $ 4.2 trillion from February last year, MarketWatch writes a Michael Brush column.

“At the same time, your investors are worried about the Fed withdrawing from incentives, while Biden’s administration wants to throw an extra ton of incentives at the pandemic,” Doty told MarketWatch. “But the more Biden punch inspires, the faster the Fed will start to pull back. ”

Federal Reserve Chairman Jerome Powell said talk of buying bonds was brewing by the Fed prematurely, during Thursday’s virtual speech hosted by Princeton University’s Bendheim Financial Center.

Powell also said the Fed wants to avoid “people losing the lives they did” because of the pandemic.

Will it work?

Biden administration intends to act swiftly to provide relief where it is most needed. Key priorities include a massive increase in vaccines, helping hard-core restaurants feed the hungry, and forcing K-8 grade schools to reopen safely.

“We need to move heaven and earth,” Biden said of his goal of getting 100 million vaccinated against COVID-19 in his first 100 days in office, as well as his broader rescue plan that some seen as a “lifeline” that can come a minute too soon.

Laura Veldkamp, a finance professor at Columbia University’s business school, compared money spent on strengthening the U.S. economy with investment decisions made in the business world.

“If a U.S. company were to embark on a major spending spree on low-value projects, they would not be solved for long,” she told MarketWatch. But if a company chooses to invest instead in valuable projects, especially at low rates today, it is likely to succeed, she said.

“A lot of spending on COVID, that’s a very high value,” said Veldkamp. But she also sees the potential risk in Biden’s plan for markets. “We are in a situation where there is a lot of money in circulation,” she said, warning that inflation and the rise in Fed interest rates in the future could lead to near-above-average levels. on zero today.

“But I don’t think we should allow marginalized communities to suffer,” she said, pointing to investors’ fears of rising rates that will become a potential “at some point” down the road. , particularly from two, previous rounds of fiscal stimulus have already passed through the economy, “and we still have very low inflation. ”

Minneapolis Fed President Neel Kashkari said Friday that there is little risk in reducing the firing range above 2%, but even if it does, the Fed has tools to deal with it.

Investors have been worried about being blinded by any changes in Fed’s current easy money policies, but this month when the Treasury Department launches 10-year TMUBMUSD10Y,

inched back above 1%. That compares with a yield of about 1.5% to 3.5% for much of the last decade.

U.S. stocks closed lower for the week on Friday, as investors weighed concerns about the ability to partially pay for Biden’s rescue plan through higher taxes, including for potential corporations. gaining weight, against hopes that additional support would give families and businesses a stronger economic recovery.

The Dow Jones business average

DJIA,

lost 0.9% for the week, S&P 500 SPX index,

1.5% and technology-heavy Nasdaq Composite Index

COMP,

1.5%, according to FactSet data.

Still room to run

Even with a strong vaccine rollout planned for the coming months, that doesn’t necessarily mean that high-powered technology stocks that are rising higher during the pandemic are seen to be. prices are falling, especially as more people have found themselves comfortably buying online, working from home and investing in greener companies.

“There have already been good moves at the areas that Biden focuses on,” said Rhys Williams, chief investment officer at Spouting Rock Asset Management, in Bryn Mawr, Pa., Speaking on future energy plays -independent, but also stocks that could rise from Biden digital infrastructure plans. “I think they are still in a package. ”

Parts of an electric car do Tesla, Inc.

TSLA,

have been raining for months, and ended Friday up another 17.1% so far in January, while hydrogen fuel cell company Plug Power Inc. PLUG,

shares rose 77.4% year-on-date, according to FactSet data.

Similarly, an online shopping site Etsy, Inc.. ETSY,

Friday ended up 14.9% on the year to date, though Stitch Fix Inc.. SFIX,

a personal style platform for clothing, which ended up 25.8% higher over the same stretch.

Kent Insley, chief investment officer of Tiedemann Advisors, said it has been focusing on single-family home investments, either in debt or equity, even before Biden promised Thursday to strengthen not -only tenants, but mom-and-pop landlords through the rest of the pandemic.

He noted the construction shortage in homes that has occurred in the twelve years since the global financial crisis.

“That’s almost at a decadelong time where we’re not built on demand,” he told MarketWatch.

“We believe that single-family households, as an asset class, benefit from a very appropriate monetary policy, low interest rates and low mortgage rates,” he said.

U.S. stocks and the bond market are closed Monday for Martin Luther King Jr. Day, but markets will enter Biden’s establishment on Wednesday, as well as an update from the National Association of Home Builders. On Thursday, there will be a focus on weekly jobless claims, as well as more household data, followed on Friday by manufacturing and home sales data for December.

See: US Economic Calendar