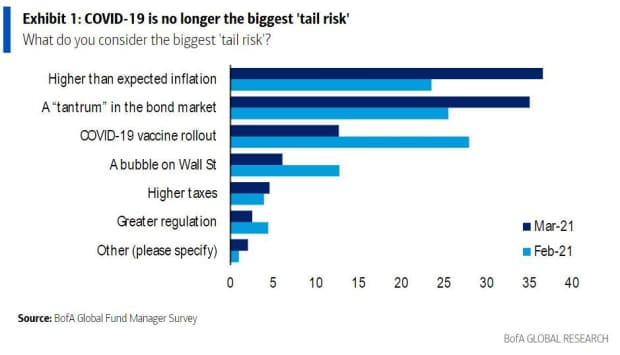

Here is one clear possible sign. COVID-19 is no longer a “tail risk” for investors, for the first time since February 2020, Bank of America said in its latest asset manager survey. Tail risk is an unlikely event that can result in significant loss or gain.

Scroll down for that card.

Meanwhile, the Federal Reserve’s two-day policy meeting begins Tuesday, and investors will be on the lookout for any hawkish signals that could take some steam out of stocks. The pre-market is showing mixed activity, although many are still embracing the idea of a post-pandemic rise, at least in the U.S. as vaccines spread.

Read: Value stocks are coming back. Don’t be behind you, these analysts say

That has kept the records coming for the Dow Jones industrial average DJIA,

and S&P 500 SPX,

and those stocks that are aiming to get over it. Yes call of the day comes from Bank of America strategists, who offer up to 17 stocks to buy for the three Rs they see coming – pass, rebound and recycle.

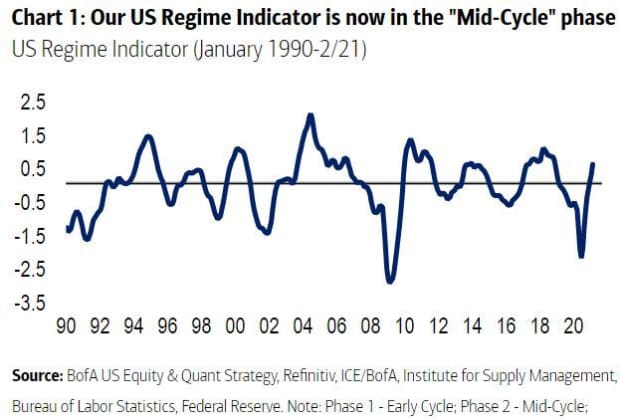

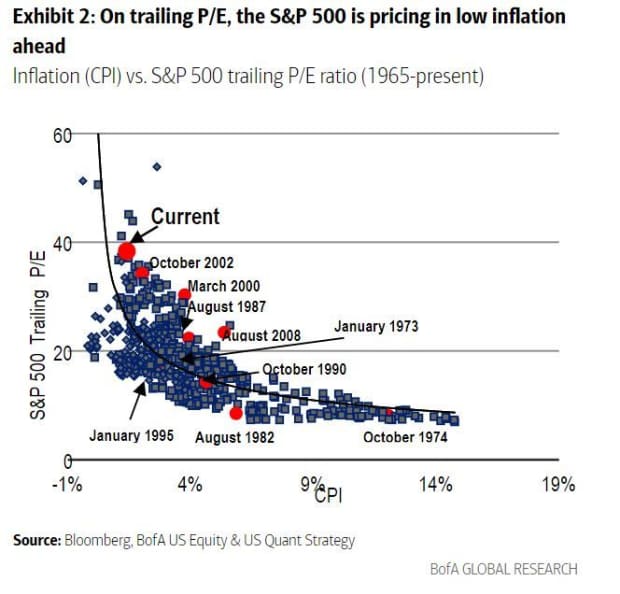

Strategies Jill Carey, Savita Subramanian and Ohsung Kwon say the economy has reached the middle of the circle, where inflation is generally stronger. In previous stages, with the exception of the technology bubble, small caps have outperformed larger ones, and growth has been impacted by value.

Without credit

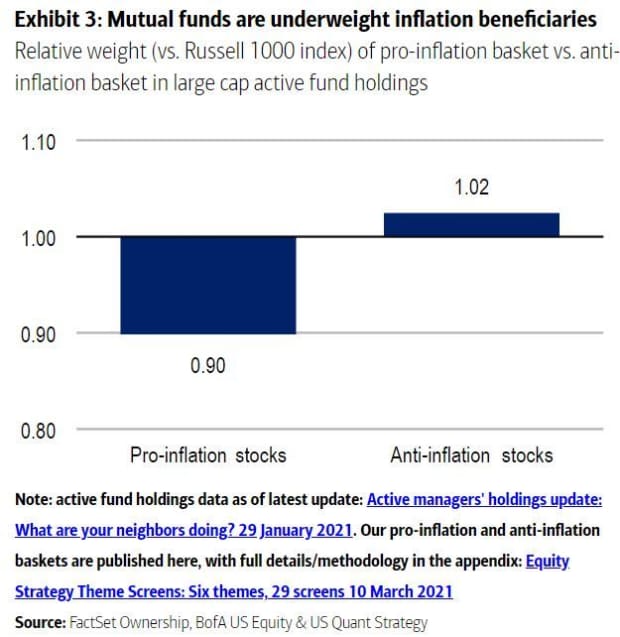

The Bank of America team says there are two reasons for the popularity of these stocks: many of the companies they clarify are still not expensive, and active money is not setting for the that inflation is rising, with a heavier mega release than smaller caps.

Without credit

Without credit

Onto the stocks (almost half are small to medium sized companies)…

Alcoa AA,

– BofA has an allotment price target of $ 37 for the miner. Aluminum prices could go one way, but growth in global demand benefits Alcoa.

Axalta AXTA Coating Systems,

– £ 37 share price target for the world coat agency. Speed will get past basic cars and a stronger dollar and lower raw material costs could be an incentive.

Broadcom AVGO,

– $ 550 share price target. Risks for the semiconductor company include vulnerability to US-China trade relations and competition in networks, smartphones and other markets.

Hess HES,

– $ 95 share price target. Energy company risks include oil and gas prices, as well as slowing developments in drilling.

Marriott International MAR,

– A target share price of $ 150. Weak economic and spending weakness among businesses and consumers are among the risks to the hosting company.

Walt Disney DIS,

– Aim price of $ 223 for the entertainment giant with “best in class assets.” Downstream risks include slow ESPN growth from people deciding not to maintain a cable TV subscription, weaker consumer confidence, and low subject park attendance. Look out for possible film flops.

As for the rest, they like CNH Industrial CNHI,

Comcast CMCSA,

Emerson Electric EMR,

Herc Holdings HRI,

Knight-Swift KNX Transport,

Occidental Petroleum OXY,

Parker Hannifin PH,

Chief Finance PFG,

Robert Half RHI International,

Union Pacific UNP,

and Global Fuel Services INT,

The card

Here’s that “tail risk” card from BofA’s latest monthly asset manager survey. There are greater risks in higher than expected inflation and “tantrum” in the bond market.

Without credit

The markets

YM00 stock futures,

ES00,

NQ00,

moving slightly, but European stocks are higher SXXP,

It was also a day up for Asian markets. Elsewhere, oil CL.1,

and the DXY dollar,

they are softer and bitcoin BTCUSD,

returning further away from the $ 60,000 hit over the weekend.

The buzzard

Sale and import prices are payable ahead of the open market, followed by industry production and the National Home Builders Association index. In addition to the start of the Fed meeting, investors also monitor the auction yield of 20-year financial bonds.

Ray Dalio, founder of Bridgewater, the world’s largest hedge fund company, said investing in bonds is “stupid” and investors should stick to a “well-mixed portfolio.”

AstraZeneca AZN,

AZN,

shares are higher after Jefferies updated the drug company to buy from a seizure. AstraZeneca has been in the hot seat as several European countries are suspending their COVID-19 shots over reports of blood clots from inoculations.

Nokia Finnish Telecommunications Group Nokia,

NOK,

cutting up to 10,000 jobs to save $ 716 million over two years.

A team from the US government’s road safety agency is heading to Detroit to investigate a “violent” crash after Tesla TSLA,

a vehicle driven under a semitrailer, leaving two seriously injured.

Randomly read

Office nostalgia – Redditers exchange coworkers-from-hell stories.

When a crawler gets all your texts for $ 16.

Need to Know starts early and updates until the opening bell, but sign up here to have it delivered once to your inbox. The email draft will be sent out at around 7:30 am East.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning preparatory meeting for investors, including a special report from Barron and MarketWatch writers.