Outside the Bank of England in London, UK, on 22 March.

Photographer: Jason Alden / Bloomberg

Photographer: Jason Alden / Bloomberg

With growing confidence that recovery is just around the corner in the UK, sectors are hardening at the Bank of England on economic growth.

These divisions were reflected in a series of presentations by members of the Monetary Policy Committee this week. BOE Chief Economist Andy Haldane, who believes Britain is ready to recover quickly, has opposed officials including Silvana Tenreyro who say another boost may be needed. still.

“Who’s right?” It is too early to say, ”Sanjay Raja, an economist at Deutsche Bank, wrote in a note to delegates. “We do not know the answer until we go deeper into the recovery. We should get a real sense of the scale and extent of the recovery by the fourth quarter. “

The split highlights the deepest uncertainty facing an emerging economy that has deepened in more than 300 years. Hopefully the worst was over and policymakers could turn to controlling falling bond price inflation in recent weeks, raising the yield on gilts beyond where it was. them a year ago when the pandemic began. This week ‘s debate highlighted some of these benefits.

Hanging over the scene are doubts over whether Prime Minister Boris Johnson’s government can meet its ambitious goal of vaccinating almost all adults by the middle of the year. While ministers plan to ban pandemics, there is controversy with the European Union and AstraZeneca Plc is over loads of the vaccine threatening to slow down the program.

“Despite reducing risks, there are still a number of situations where I would expect to call for a tighter policy later this year,” said Tenreyro, an outside member of the rate setting panel. BOE, in a speech to the U.S. Federal Reserve Bank of San Francisco on Friday.

That statement contradicted Haldane’s hopes of “getting over a rut” when he spoke to ITV earlier in the week.

Others on the MPC cited reasons to wait before taking action. Michael Saunders said working from home and online shopping may have given the UK a dose of extra productive capacity, suggesting that the economy can grow longer without the recovery of the UK. -inflation. He said he needed to see a steady rise in prices before voting to tighten policy.

What our economists are saying …

“It is clear that there is a high demand and there will be a greater increase as the discount becomes longer. Consumer spending will also benefit once closure the hospitality and entertainment sector is coming to an end. ”

–Dan Hanson, Bloomberg Economics. Click for full REACT.

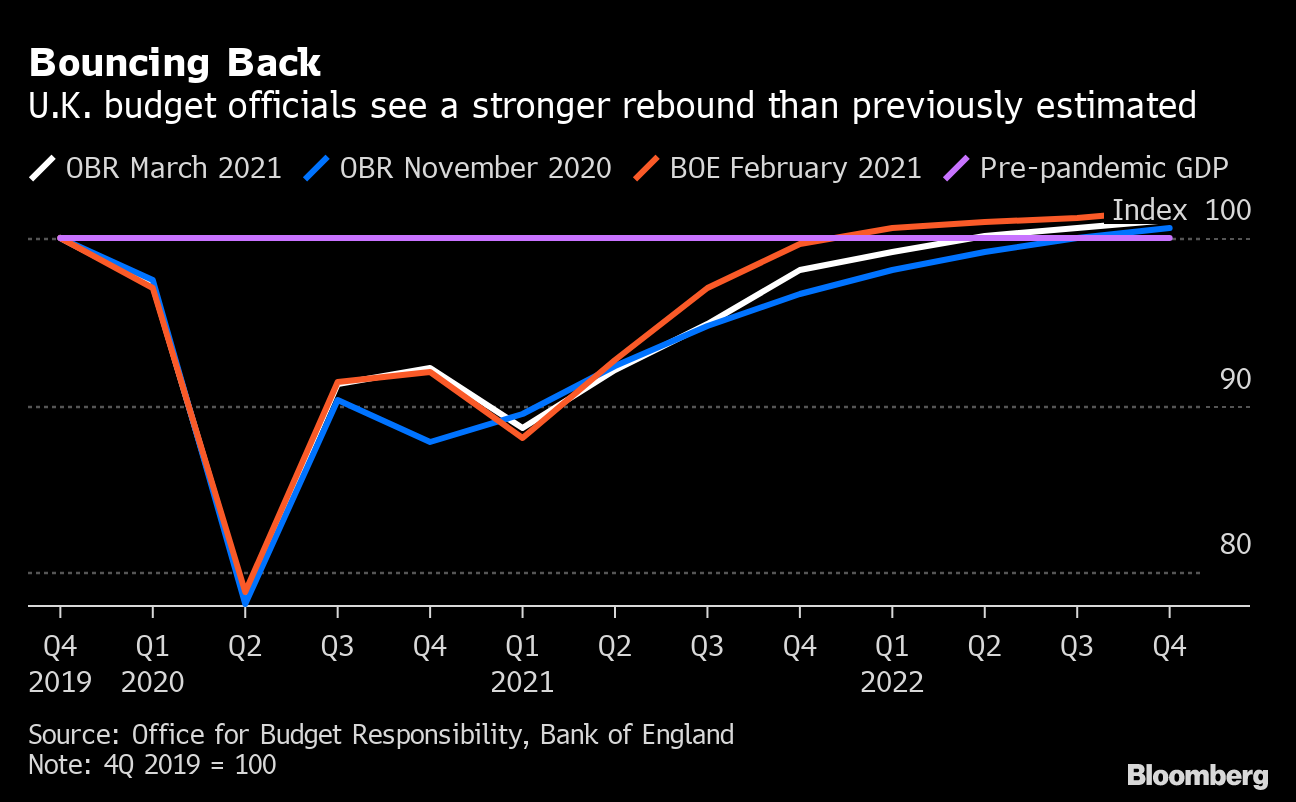

Kicking back

UK budget officials are seeing a stronger reversal than previously thought

Source: Office for Budget Responsibility, Bank of England

The latest data from the government show little threat of inflation coming off, despite a prediction from the central bank that the 2% target will be reached later this year. Consumer prices rose 0.4% less than expected in February from a year earlier, extending 1 1/2-year stretch below target.

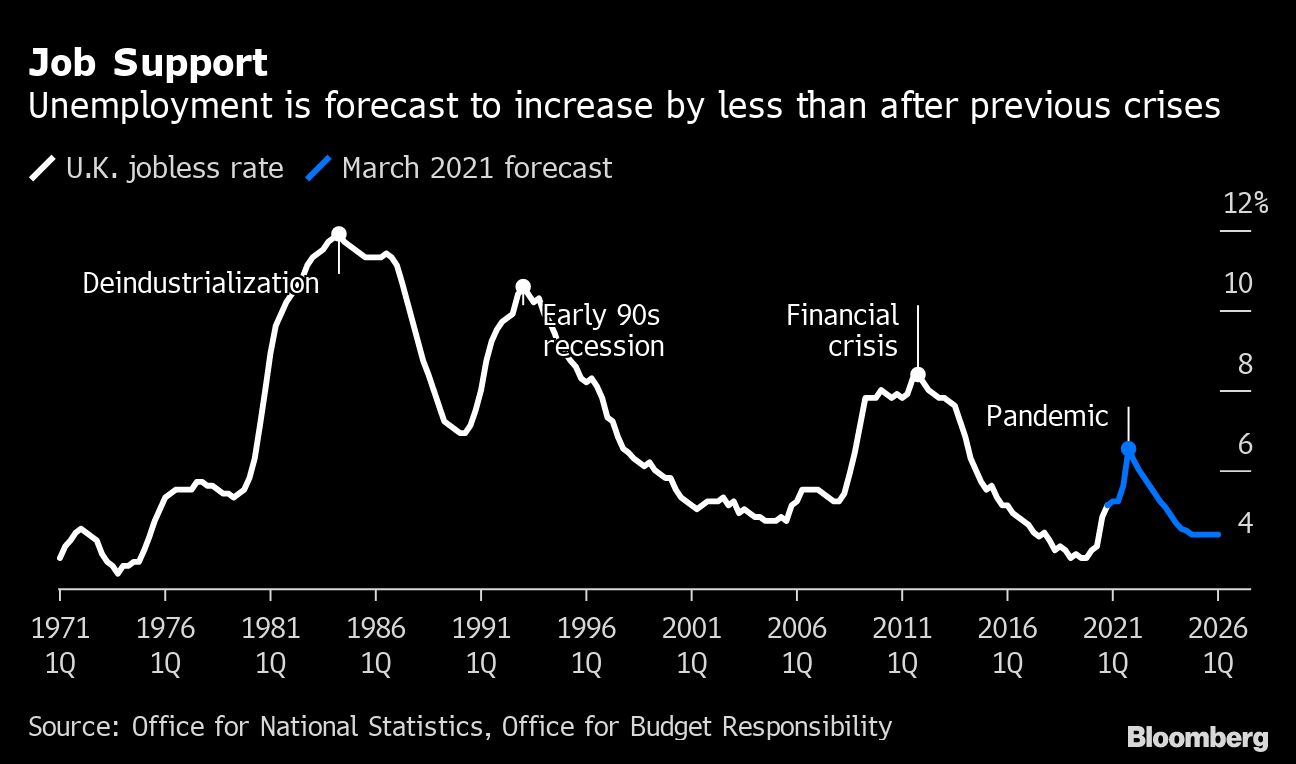

Saunders said he put more emphasis on unemployment figures as a result of the economic downturn than inflation, noting that a return will be less stable as long as the unemployment rate is above 5% – the rate is a quarter through January.

Work support

Unemployment is expected to rise less than after previous emergencies

Source: Office for National Statistics, Office for Budget Responsibility

Read More: