Photographer: Krisztian Bocsi / Bloomberg

Photographer: Krisztian Bocsi / Bloomberg

The first cold explosion this winter that has pushed European power and gas prices to their highest levels in years may be spreading, but it will have an impact feeling for months to come.

From a snow storm in Madrid to record spikes in the UK energy market as winds fell – the weather has been the main driver behind the rally. Bullish gas price forecasts from Goldman Sachs Group Inc. and Wood Mackenzie Ltd. reveals that the wild journey may not be over yet.

“It has been a very exciting year and there is every chance that the coming weeks and months will also be very volatile,” said Bo Palmgren, chief operating officer of Danish trading company MFT Energy A / S in Aarhus.

This is a big change from a year ago when pandemic activity brought paralysis and even a spike in gas prices following oil below zero due to an unprecedented cry. An increase in vaccine distribution could also stimulate economic recovery and demand.

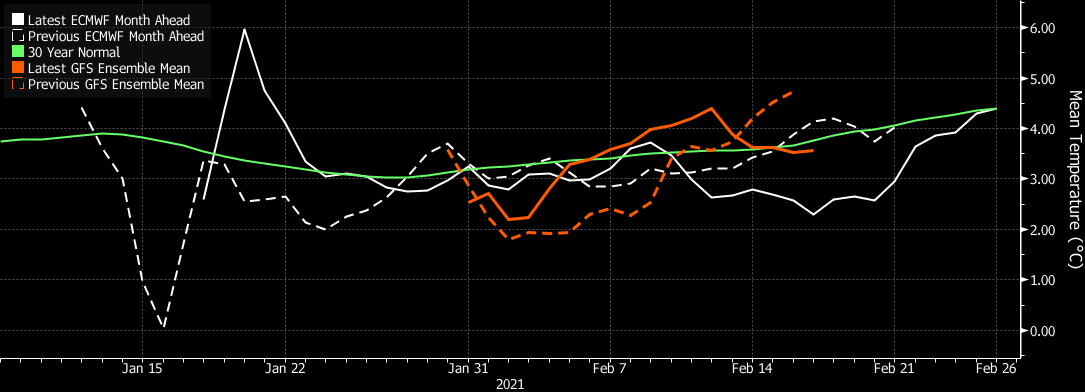

The weather is extremely sparse with the ability to block the polar vortex – the winds that usually hold cold air in the north – threatening to send another Arctic eruption across America that North, Europe and Asia since late January.

Read more about the chaos caused by the cold weather around the world

People who turn up their heating could face a drop in the area ‘s gas supply in the spring. The effect of this is that summer prices will be strengthened by the demand for filled fields and salt caves to fill ahead of next winter.

“The current cold situation in the northern hemisphere paves the way for a tighter global gas market throughout the year,” said Massimo Di Odoardo, European gas director at WoodMac.

Goldman Wednesday raised the forecast for the Dutch monthly contract, the regional benchmark, 19%. Woodmac expects the average price to be 75% higher than last year, it said Thursday.

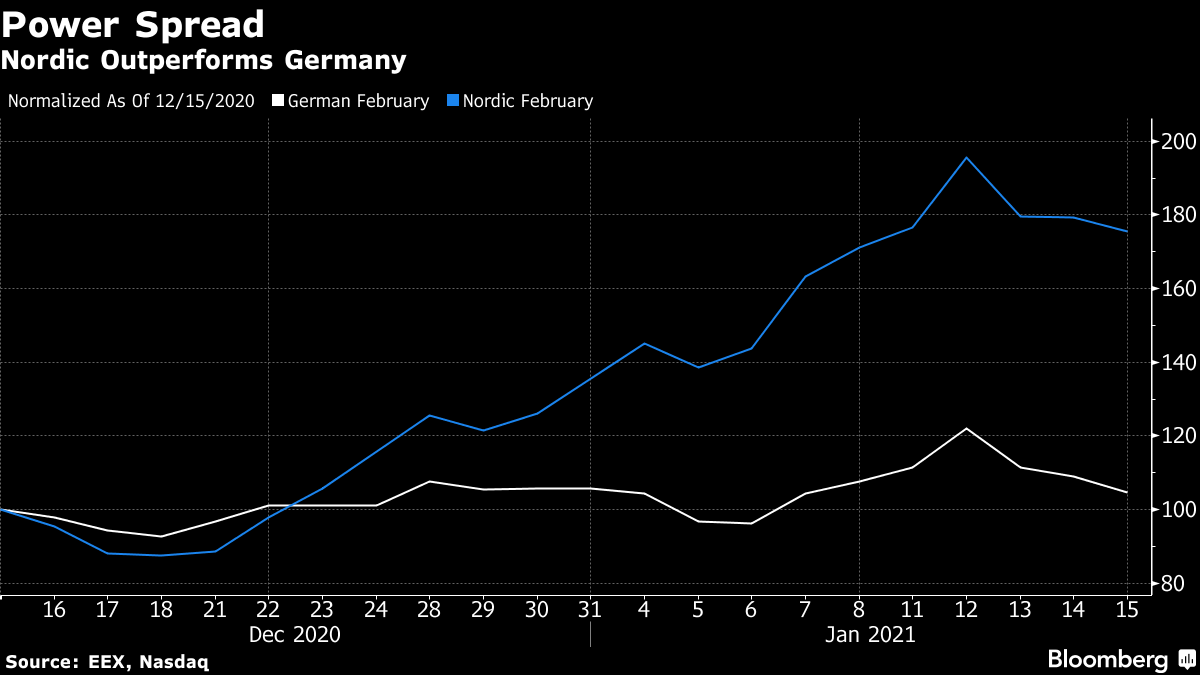

If the cold weather continues over the next month, power prices in Germany and the Scandinavian market could gain as much as 10% due to a rise in demand, said Arne Bergvik, chief analyst at Swedish facility Jamtkraft AB.

Except for a balmy start to next week, temperatures in northwestern Europe are well below normal seasonal levels for the next month. That should support everything from gas to power and carbon futures, which reached new heights last week. The region’s steady supply of leach natural gas shipments could typically sail away to Asia, where benefits will impact even Bitcoin’s rally to new heights.

Last week showed what the volatility is all about. Tuesday’s 18% jump in the benchmark contract was followed by the biggest drop ever a day later. Prices have moved at least 10% from the five-day average on 66 times over the past year, according to ICE Endex.

While traders are fond of that kind of variability, it could also be a barrier for some new consumers, said Nikos Tsafos, a natural gas analyst at the Center for Strategic and International Studies in Washington. .

Despite the fact that it is possible for several more weeks of application lock-in Germany, power prices in Europe’s largest market is headed for the most expensive February since 2008. The Scandinavian market is even more bullish after prices jumped 39% this year. A lower base price could reduce normal power flows to the continent from the Scandinavian region.

“Situation has completely reversed at the beginning of 2021 compared to a year ago when the weather was wet and wet,” said Arne Bergvik, chief analyst at Swedish facility Jamtkraft AB. “If the weather stays cold and dry then prices should go up.”

– Supported by Vanessa Dezem, Andy Hoffman, and Guy Johnson