Shares of Apple Inc. down to a one – month low on Wednesday, and broke below two key card levels in the process, after the two biggest shareholders at the technology behemoth announced that they were trimming their promises.

The stock is AAPL,

lost 2.1% in afternoon trading, enough to accelerate DJIA Dow Jones Industrial average,

refuse. The head was closed for the lowest level since January 19th.

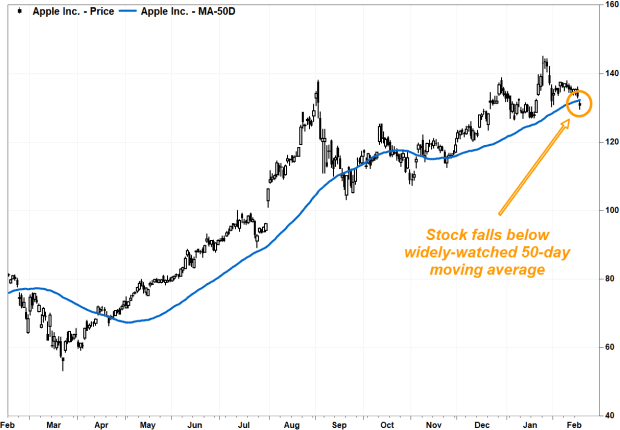

The stock is expected to close below its 50-day moving average (50-DMA) for the first time since November 23. Many card viewers are looking at the 50-DMA as a guide to the short-term movement, with trades. above it suggests an upward bias and a trade below warns of potential weakness.

FactSet, MarketWatch

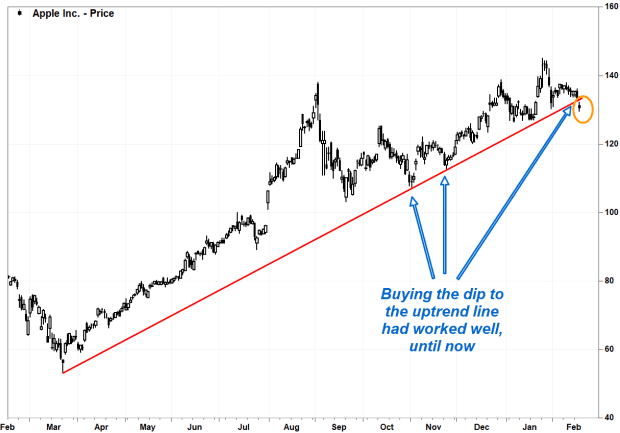

But perhaps more worrying for bulls, the stock has broken below the uptrend line that explained how it recovered from March lows.

Many technologists use uptrend lines as a place to buy stock on a dip. The fact that Apple’s uptrend line was marked by three intervertebral lows since the line began shows that strategy has worked well, until Wednesday.

The Dow Theory of market analysis, which has been relevant on Wall Street for more than a century, states that there is still movement to give signs of a return. So a break of uptrend line suggests that a new recession may have just begun.

Read more: Don’t dismiss Dow Theory just because it’s over 100 years old.

FactSet, MarketWatch

The sale of the stock comes after Warren Buffett Berkshire Hathaway Inc. BRK.B,

announced late Tuesday that it owned 887.14 million Apple shares, or 5.28% of its outstanding shares, as of Dec. 31. That’s down from the 944.30 million shares, or 5.55% of the shares that were unpaid, it was at Sept. 30. Berkshire Hathaway remained Apple’s second-largest shareholder.

But despite the share sales there was an effective rebalancing, as the value of Berkshire Hathaway ‘s stake in Apple rose to $ 117.71 billion as of Dec. 31 from $ 109.36 billion on Sept. 30, as Apple stock rose 14.6% in the fourth quarter.

Meanwhile, Apple’s largest shareholder, The Vanguard Group Inc., cut Apple’s interest by 25.51 million shares. Vanguard owned 1.26 billion shares, or 7.48% of the outstanding shares at December 31, down from 1.28 billion shares, or 7.53% of the outstanding shares, on September 30.

Separately, Epic Games, the developer for the “Fortnite” whistle, said Wednesday that it has lodged a complaint against trust against Apple with the European Commission. Epic Games claims that Apple has “not only done harm but completely eliminated competition” for the distribution and payment of apps on the Apple App Store.

Apple stock has gained 9.4% over the past three months, while the Nasdaq-100 NDX Index,

it has accumulated 14.3% and the Dow has handled 6.0%.