The headquarters of Ant Group Co. in Hangzhou, China, on Wednesday, January 20, 2021. For the first time since the Chinese government began to overthrow its industrial empire, the co-founder of Ant Jack Jack Ma was resurfaced, featured in a live streaming video released by Alibaba Group Holding Ltd’s affiliate Ant stock. going up above but left plenty of unanswered questions about what happened to the billionaire.

Photographer: Qilai Shen / Bloomberg

Photographer: Qilai Shen / Bloomberg

The Ant Group Co. and Chinese regulators have agreed a restructuring plan that will turn fintech giant Jack Ma into a financial investment company, leaving it subject to capital requirements similar to those for banks.

The plan calls for you to turn all of Ant’s businesses into the real estate company, including its technology offerings in areas such as blockchain and food delivery, people familiar with the matter said. One of Ant’s early recommendations to governors was expects only to put financial works into the new structure.

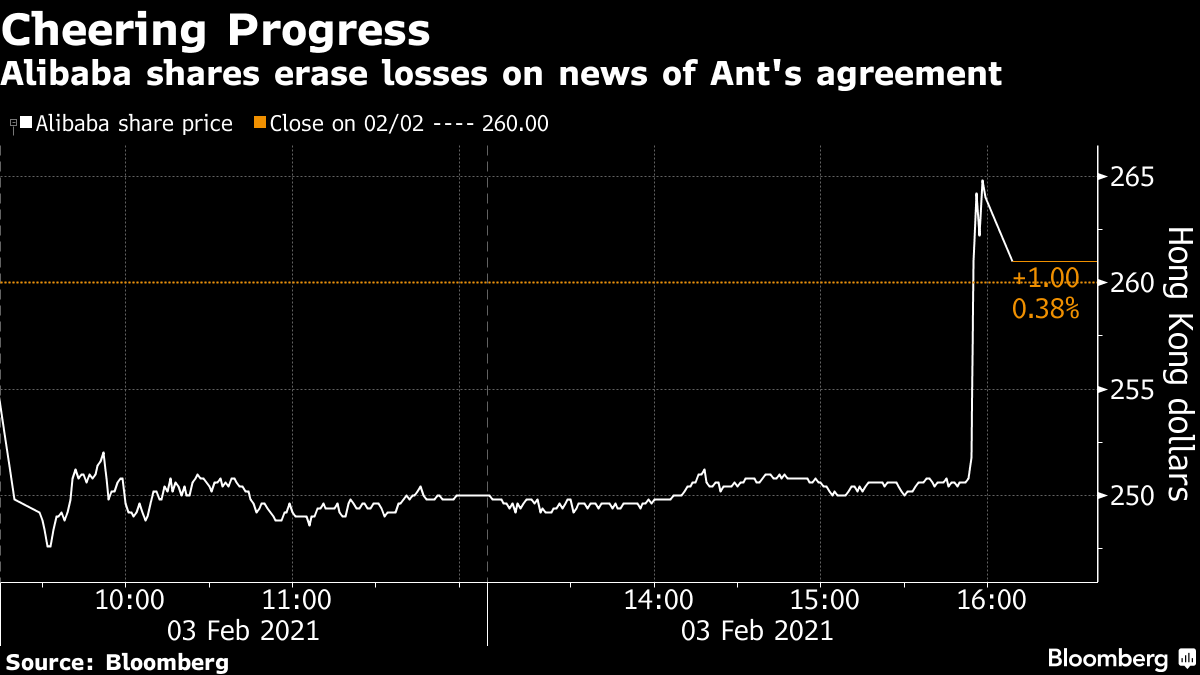

An official announcement of the renewal could come before the start of the New Year holidays in China next week, the people said, wanting not to be identified talking about private information. Alibaba Group Holding Ltd., which owns about one-third of Ant, made a loss in Hong Kong trading on Wednesday after Bloomberg reported on the deal. The stock closed with a 0.4% gain.

Photographer: Marlene Awaad / Bloomberg

Ant’s restructuring plan marks the first major step in what is expected to be a lengthy refurbishment process, as regulators design detailed capital requirements and other guidelines for companies that span several lines of financial industry.

China only introduced the framework for financial investment companies in September and many of the specifications are still being rolled out. While the rules will give Ant greater regulatory clarity, they will certainly force the company to reduce the slow pace of expansion that has made it a major fintech player in China and one of the most valuable start-ups in the industry. the world.

Ant is still exploring opportunities to revive their first public offering, which was abruptly suspended by regulators in November, one familiar with the case said. But with the framework of the financial property companies being so new, it is not clear how long it could take for authorities to sign up to a listing.

Ant declined to comment. The People’s Bank of China, which oversees financial property companies, did not immediately respond to a fax request for comment.

Ant’s restructuring is part of a broader government initiative to provide more control over the finance and technology sectors. In recent months, regulators have focused on everything from healthcare crowdfund funding to consumer lending. In January, they did proposed measures to prevent market congestion in online payments, where Ant and Tencent Holdings Ltd. as the biggest players.

The clampdown has provoked intense profiteering about the status of Ma, who co-founded both Ant and Alibaba. The e-commerce giant has also opposed further government scrutiny in recent months, becoming a target for anti-trust scrutiny in December.

Ma’s appearance at a live video conference in January – after several months out of public view – has helped talk about the worst conditions for his business empire. However, there is still a lot of uncertainty: even after Wednesday ‘s gain, Hong Kong’ s Alibaba shares are trading around 15% lower than the October high.

– Supported by Lulu Yilun Chen, Zheng Li, Heng Xie, and April Ma

(Add Alibaba shares in the third paragraph.)