Photographer: Ali Mohammadi / Bloomberg

Photographer: Ali Mohammadi / Bloomberg

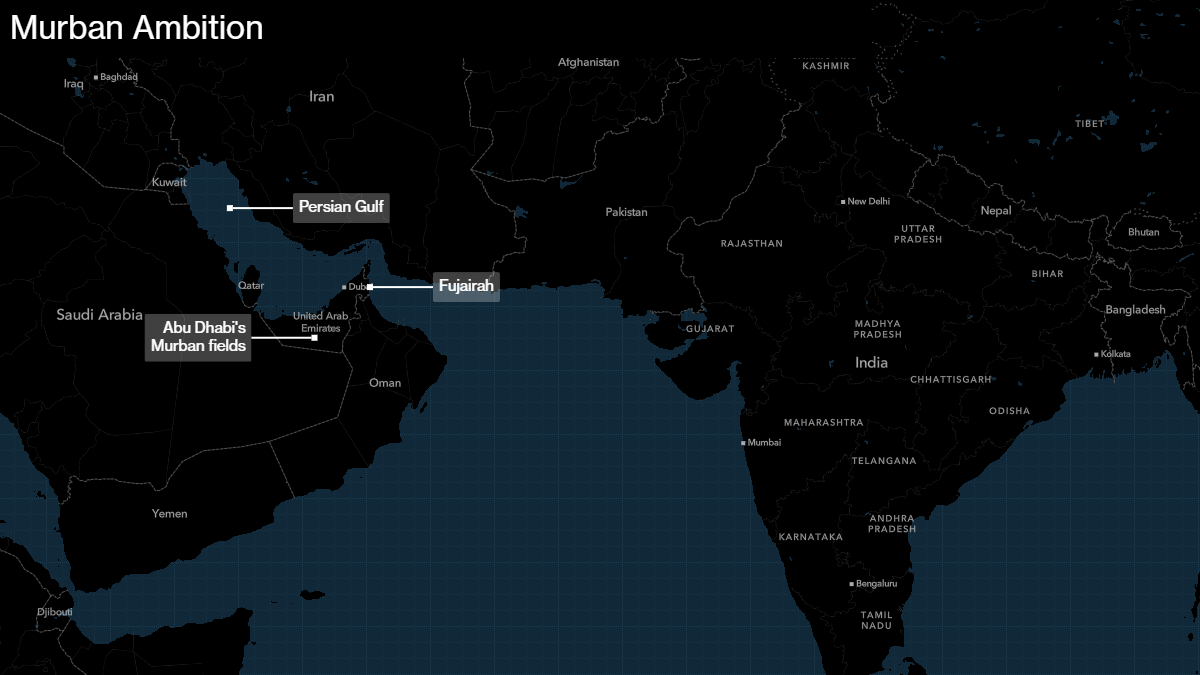

Connected between the Gulf of Oman and a rocky mountain range, the dusty port of Fujairah is not an obvious base for trying to revitalize the Middle East oil markets.

But on Monday, when Abu Dhabi starts selling futures contracts for its oil and then delivering the barrels from Fujairah, it marks an aggressive move by the emirate. He hopes to change the way nearly one-fifth of the world’s crude.

The Gulf states of Persia pump nearly 20 million barrels of oil per day and Abu Dhabi wants the futures for its Murban prime to be the main benchmark in the region.

Abu Dhabi hopes to change the way almost one-fifth of the world’s oil is changed

The largest producers in the Gulf – including Saudi Arabia, Iraq and the United Arab Emirates, of which Abu Dhabi is the capital – have traditionally priced their barrels based on rods. measurements from other sectors. They have mostly sold them directly to greens and international companies with sticks in their fields. Crucially, they are they stopped these buyers from reselling the oil and taking advantage of arbitrage opportunities that exist in global energy markets.

Now, Abu Dhabi’s removing these loops with the aim of opening up its oil to financial traders as well as corporate traders. Investors are all over the world clamoring for commodities because of the high yield compared to other assets and to protect themselves from rising inflation.

Once sold on an exchange, Murban will be piped to Fujairah, where the desert areas of Abu Dhabi will be physically connected to global markets.

“If they succeed – and I think the chances are good – Murban futures could be a crucial moment for Middle Eastern crude prices,” said Vandana Hari, founder of the oil-based consultancy. the Singapore Vanda Insights. If “a large chunk of the Middle East’s crude crude trades freely in the spot market,” that could push other regional representatives to follow Abu Dhabi’s lead, she said.

Storage caves

To help its cause, Abu Dhabi National Oil Co., the state energy company, is spending about $ 900 million to build 40 million barrels of storage space in caves beneath the Fujairah mountains. That, and Adnoc’s existing tanks at the port, will ensure that Murban has enough on hand to manage future supply disruptions, said Khaled Salmeen, the UK’s head of marketing and trade. company, to reporters this month.

Adnoc can pump about 2 million barrels per day of Murban and has pledged to give half of that amount to the exchange over the next year – in line with or more than today’s major oil supply standards such as Brent and West Texas Intermediate.

Liquidity is “vital to the equation as a whole,” said Chris Bake, director of Vitol Group, the largest independent oil trader, which supports the exchange.

Creating a new criterion is almost impossible. Oil traders do not want to change, especially when they believe that markets are already doing a good job of matching supply and demand. S&P Global Platts caused upset this year after announcing it would refurbish Dated Brent, the world’s leading crude price. He had to defend the plan forever.

Enter Goldman

Murban will also oppose competition regionally. Platts publishes price estimates for Dubai oil and Dubai Futures Trading futures trading for Omani crude. Both serve as benchmarks for Middle East transportation to Asia.

But Abu Dhabi says a combination of high supply, easy access to oil consumption markets from Fujairah and a lack of trade restrictions will attract enough buyers for the exchange. Philippe Khoury, a former energy banker of HSBC Holdings Plc that hired Adnoc in 2018 to build its trading operations, said Murban even said it would compete with Brent and WTI.

The futures platform will be run by Atlanta Intercontinental Exchange Inc. and called ICE Futures Abu Dhabi. Last week, ICE Goldman Sachs Group Inc., Citigroup Inc. agreed. and 22 other banks and brokers as exchange members.

Wider ambition

Adnoc’s plan reinforces the UAE’s broad desire to make money faster on its hydrocarbon resources in case oil demand begins to decline with the global shift to greener energy. The country aims to increase production capacity from around 4 million barrels per day now to 5 million by 2030, which would make OPEC the largest producer after Saudi Arabia.

Read more: UAE’s Ola Ambitions show tension at the heart of OPEC

Murban exchange and increased capacity could build tensions within the Petroleum Exporting Countries Group, according to Hari of Vanda Insights. The Gulf states control the cartels and tend to gain unity. They also began unprecedented production cuts last year to boost prices as the pandemic spread of coronavirus.

However, the UAE says Murban times will not affect OPEC or its ability to stabilize oil prices.

“It simply came to our notice then hope”Other regional representatives will accept Murban as a benchmark for their own raw, Adnoc’s Khoury said this month at the Fujairah Bunkering & Fuel Oil Forum.