Photographer: Mark Wilson / Getty Images

Photographer: Mark Wilson / Getty Images

Treasury market bears had better pay attention: There is a wall of global money to enter and buy, possibly limiting the upside yield.

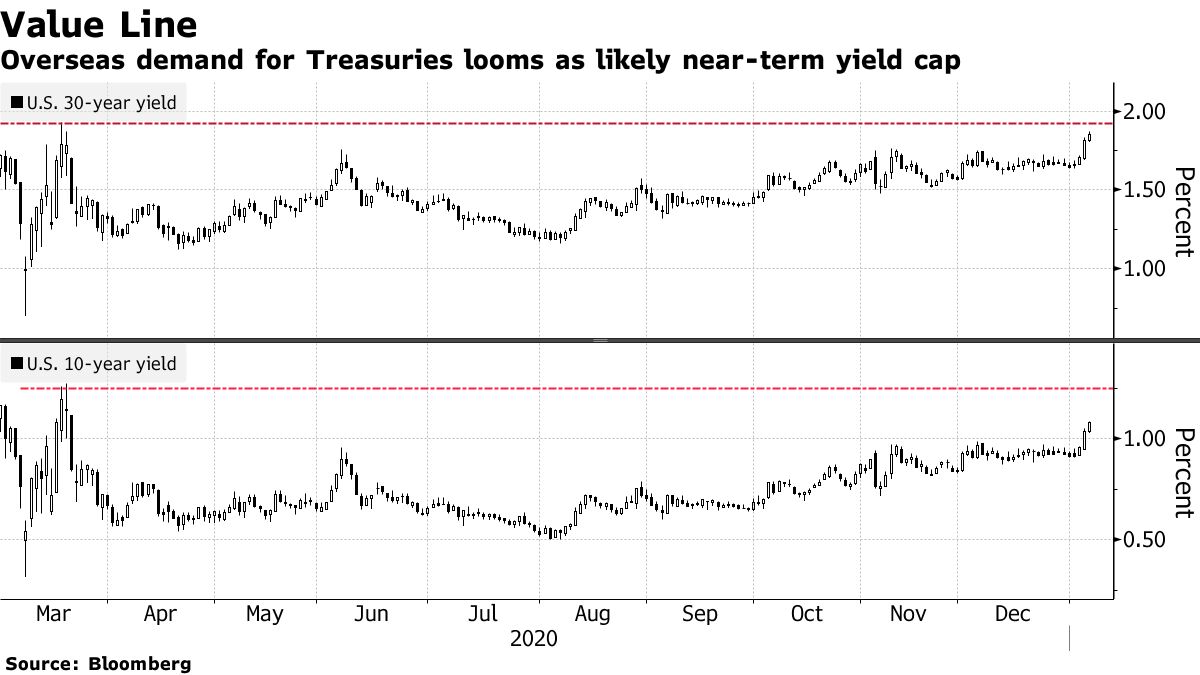

The united Democratic government outlook has begun to anticipate inflation, taking the Treasury’s long-term yield back to a high seen in March 2020 – and approaching levels where many investors are between -nationals say they would want to buy it.

For money managers in Asia and Europe monitoring the world’s largest economy, there is a perception that yields may not be the highest, amid concerns about the consequences of high-risk viruses. and the slow distribution of vaccines. President Joe Biden is also likely to be A $ 1.9 trillion incentive proposal is going to address obstacles in a closely divided Congress that is also set to engage in impeachment proceedings.

The result is that investors in Europe, and especially in Japan – the largest overseas owner of American government debt – have put their sights on buying more if the 10-year into the 1.25% to 1.3% range and the 30-year to around the 1.92% -to-2% range. In each case that is only 10 basis points, even slightly less, above the most recent peaks seen before the surging reflation trade appeared to be losing momentum.

“The path of the virus creates downward risks for economic data,” said Mark Dowding, chief investment officer in London at BlueBay Asset Management, which has over $ 67 billion. “Over the next few months, the 10-year yield should be between about 1% and 1.25%,” and the company would be looking to buy if a product broke the headline, he said. , with 2% serving as a key point for 30-century bonds.

Demand from abroad has always been a key part of prognosticating in the Finance market, and this new desire has a far-reaching impact. For one thing, it is responsible for limiting the cost to U.S. taxpayers of financing the country’s debt, at about $ 21 trillion and counting. But it also means that investors in other asset classes may not be as scared of hoarding Treasury yields.

See here for more on how rising yields are forcing traders to discuss the risks for stocks.

The largest bond sellers have a mixed impact on product yields. HSBC this week They suggested buying finance on what they called a “sale”. Meanwhile, Goldman Sachs it raised the end-of-year target for 10-year yields to 1.5% from 1.3%, with the apparent “greater fiscal impulse” under the government’s unified Democratic control.

‘Extreme’ risks

But foreign buyers may not be waiting for rates to reach that high level, with cracks in the growth-rebound story emerging. This week saw the biggest jump in filed for jobless claims from March, and the an unexpected decline in retail sales.

“The risks to the outlook for the economy are huge,” said James Athey, London-based cash manager at Aberdeen Standard Investments, which has more than $ 560 billion. “There are risks on both sides, but I would argue that the majority are declining – towards less positive growth outcomes, less positive virus outcomes, fewer vaccine outcomes. If I get a 10-year return to 1.25% to 1.30%, I would be comfortable adding to my long-term careers. ”

Wall Street card viewers are also looking at that area as the next big hurdle for production, as the rate of about 1.27% represents the peak seen in the March market pandemonium.

There are already signs that the link market sales are attracting buyers. This week, investors stopped the Treasury sale of 10-year notes and 30-year bonds. Next week comes the auction of $ 24 billion in 20-year debt.

Japan decision

For the global bond market, many ride on Asian-based investor options. Japan had about $ 1.3 trillion in treasury as of October, the largest foreign pile. China next with about $ 1.1 trillion, the lowest level since 2017. On Tuesday, the government will release data for November. Markets are closed Monday for Martin Luther King Jr. Day.

See here for more on the recession in China.

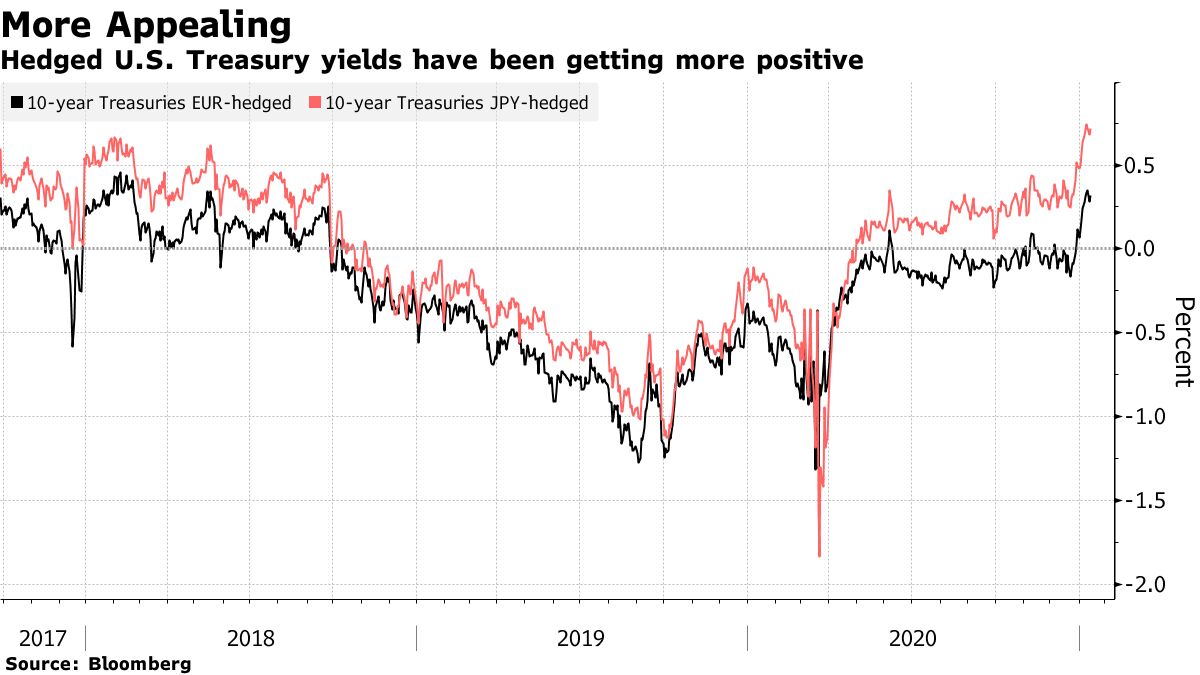

So far, there are Japanese buyers spending their time. For this major investment segment, yields are not high enough to give them confidence that they have lost capital. That’s even as the yen has reached its strongest end recently and the cost of a cash hedge has fallen.

“There will be little outflow from Japan until Treasury yields stop rising,” said Takenobu Nakashima, chief rate strategist at Nomura Securities.

For Nakashima, there will be one strong signal if U.S. 10-year rates, adjusted for hedge costs, are consistently higher than the yield of 30-year Japanese government bonds – which is about 0.65%, up from about 0.25% in March. That has been true for about a week now.

“Japanese investors tend to make big buys once they confirm that yields have arrived – they are not momentum cyclists,” said Masahiko Loo, AllianceBernstein-based revenue care manager at Japan. “There will be no major outward movement until 10-year yield rises to 1.3%, as normal rates would return just around 80 basis points after hedges, and buying at those levels tends to be just covered briefly. ”

To be sure, some investors – such as life insurers with longer yen liabilities – may be happy to keep more money at home after Japanese yields climbed last year on supply concerns.

Parsed tokens

The next step in the bond market may depend in part on signals from the Federal Reserve related to its bond buying program. The yield targets aimed at those overseas buyers grew a little further this week after Governor Fed Lael Brainard pushed back against proposals that the central bank could buy later this year.

See here for more on Brainard ‘s comments.

Comments from other officials that discussions on such a move could be possible in 2021 have moved a key measure of the yield curve to its steepest level since 2017. That move and falling costs are a risk to hedge funds make it more attractive for foreign accounts, with about $ 17 trillion of global debt yields less than zero.

“The U.S. Treasury has a significant yield advantage over these other markets,” said John Taylor, London-based money manager at AllianceBernstein. “The cost of hedging the currency is very small – all central banks are at zero – so global flows are likely to move into the US market if the yield gap widens more. ”

What do you look

- In a week shortened by a holiday with no big data releases, the key features may be the January 19 confirmation listen to Janet Yellen for the secretary of the Treasury, and then set up Biden the next day

- The economic calendar:

- January 19: International Capital of the Treasury Department flows

- January 20: MBA Mortgage Applications; NAHB housing index

- January 21: Building permits; Philadelphia Fed business outlook; weekly jobless claims; housing begins; Bloomberg economic prospects / consumer comfort

- January 22: Markit US PMIs; sale of an existing home

- The Fed calendar is empty before the Jan decision. 27

- List of auctions

- Jan. 19: 13-, 26-week bills; 42-, 119-day money management bills

- January 20: 20-year bonds

- Jan. 21: 4-, 8-week bills; 10-year TIPS

– Supported by Tom Lagerman, Vivien Lou Chen, and Daniela Sirtori-Cortina