With the pace of new COVID-19 cases slowing, many investors expect economic growth to accelerate over 2021. John Buckingham, editor of the Prudent Speculator newsletter, has taken a standard screen of 25 stocks which meets the following criteria:

-

“The prudent speculator finds that they are not of sufficient value to buy today.”

-

Expect growth in earnings per share of at least 15% over the next 12 months.

-

Put forward price-to-earnings ratios under 20. (In contrast, the forward P / E for S&P 500 SPX Index,

-0.18%

weight is 22.1, according to FactSet, up from 17.6 years ago and 16.6 two years ago.) -

For non-financial companies, an estimated increase in sales of at least 10% over the next 12 months.

The Prudent Speculator is published by Kovitz Investment Group in Chicago. Kovitz manages approximately $ 6 billion through value strategies specifically for private clients. Buckingham co-manages the Al Frank VALUX Fund,

which is rated four stars (out of five) by investment research firm Morningstar and follows strategies outlined in the Prudent Speculator.

Starting with a group of around 2,800 companies, the Prudent Speculator team applies property scraps to identify stocks that are “undervalued” relative to the broader market. The list is constrained by analysis of cash rates, debt, debt maturity records, debt service charges, capital expenditures and profit margins.

Buckingham and his team then consider qualitative factors, such as brand positioning, to narrow their list to a group of about 120 stocks they recommend over five strategies covered in the round- letter.

Prudent Speculator’s core strategy has achieved the highest overall yield for the past 30 years among newsletters followed by Hulbert Financial Digest.

The case for value in the aftermath of the economic downturn

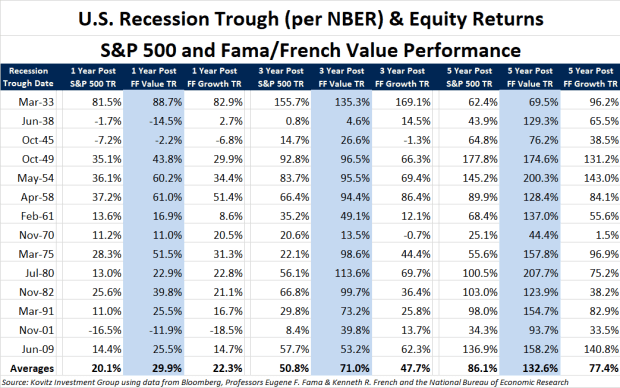

In an interview, Buckingham cited data for the previous 14 economic rebounds after a downturn showing that value stocks tend to outperform the market as a whole:

In the chart above, the value and growth groups are as identified by criteria developed by Eugene Fama and Kenneth French. NBER stands for National Bureau of Economic Research, a research institute that defines when there is a recession.

Some growth stock in the value camp

While Buckingham is a value investor, there are growth stocks that made the list, including Cohu Inc. COHU,

and Kulicke & Soffa Industries Inc. KLIC,

both of them make equipment used by semiconductor manufacturers.

Here are the 25 stocks meeting all the criteria. The companies are listed in alphabetical order:

Kovitz Investment Group, FactSet

Scroll the card to see all the data, including the Prudent Speculator price targets.

The emphasis here has been on increasing earnings per share. For value stocks – in this case, stocks trading at P / E ratios well below the S&P 500 Index – it can be expected that rising employment will support higher stock prices, and perhaps even higher P / E ratios, in the long run.

The charter includes expected increases in sales, but only for non-financial companies. A major spread of employment growth for the banks is expected to release loan loss reserves, as credit losses are going to be lower than the companies prepared for the first and foremost. the second quarter of 2020. A higher loan demand would also help, as would a continued increase in spreads between long-term interest rates and short-term rates, as has happened in recent weeks.

Getting back to Cohu and Kulicke & Soffa Industries – two growth stocks that made the list – Buckingham said shares of most companies involved in semifinal manufacturing had gone up due to high demand .

“Their earnings have skyrocketed and it looks like they will continue to do so. Stock prices have not risen to where they are, ”he said.

While share results were not part of Buckingham’s selection criteria, you can see them if you write the board on the right. Listed stocks with a yield yield higher than 3.5% include Comerica Inc. CMA,

KEY KeyCorp,

Leggett & Platt Inc. LEG,

Corp Newmont NEM,

and Pfizer Inc. PFE,

Don’t miss: These select business companies are expected to increase sales in 2021 from pre-pandemic levels