The S&P 500 index sat on Tuesday about to record its 12-month best performance in index publication history, following the dramatic fall in the bear market a year ago.

If the S&P 500 SPX,

avoiding Tuesday’s seemingly 2.9% decline, it marks the biggest 12-month gain for the index since it began publishing in 1957, according to Tim Edwards, managing director index investment strategy at S&P Global, which owns the Dow Jones Records.

But beyond the first anniversary of the U.S. stock market hitting the lows seen last year after a pandemic pandemic outbreak, the S&P 500 could be close to second year to reap the benefits.

“After falling nearly 34%, it took the S&P 500 only five months to recover its losses,” Ryan Detrick, LPL Financial’s chief market strategist, wrote in a note on Monday. S&P 500 to 23 March 2020 low from the previous peak 19 February 2020.

His recovery was marked in August last year with the fastest ever kick-off for the S&P 500 from a loss of more than 30%, while the gains he received for the year took a toll. pre-strikes for financial markets.

“Things have matured now that stocks have held strong, with new highs happening around the world and the economy recovering at a faster pace,” said Detrick. “To put it bluntly, the S&P 500 lost 34% in 1987, but that recovery took 20 months to recover to new highs.”

Last year’s stock market normalization in the U.S. began in February with the rise of coronavirus infections and new restrictions on travel and business activity, which initially attracted the S&P 500 SPX

Dow Jones industrial average DJIA,

and Nasdaq Composite Index COMP,

down 10% to correction mode, and then quickly 20% lower into bear market area.

To help avert a financial crisis, the Federal Reserve lowered its benchmark interest rate to a range of zero to 0.25%, a level it expects to maintain through 2023, and resumed the purchase of central bank bonds to tune of $ 120 billion per month. He also released an unprecedented slate of pandemic lending facilities, including buying corporate debt for the first time ever.

After that, it took little time to find the U.S. stock market, with the S&P 500 entering its current bull market on April 8, 2020, according to Dow Jones Market Data. The Dow’s recovery began earlier on March 26, while the Nasdaq Composite continued on April 14.

For the Dow Jones, a bull market starts when a stock rises 20%, and a 20% fall marks the beginning of a bear market. Under his approach, stocks are always in the bear or bull market area until a 20% reversal.

Bear to Bull

More bullish views on the U.S. economic recovery began to consolidate last summer as progress on the development of COVID-19 vaccines began to show.

By July, Moderna Inc. MRNA,

offering updates on its vaccine candidate and a month later, all three major stock indices hit new full-time levels.

So now what? The U.S. vaccination effort has swept across Europe, where German Chancellor Angela Merkel on Tuesday described the dominant variant of the virus in the UK as a “new pandemic,” while also explaining more restrictive measures hard over the Easter holiday period.

But if history could be a guide for today’s market, the S&P 500 could still be ready for a second year of flagship gain.

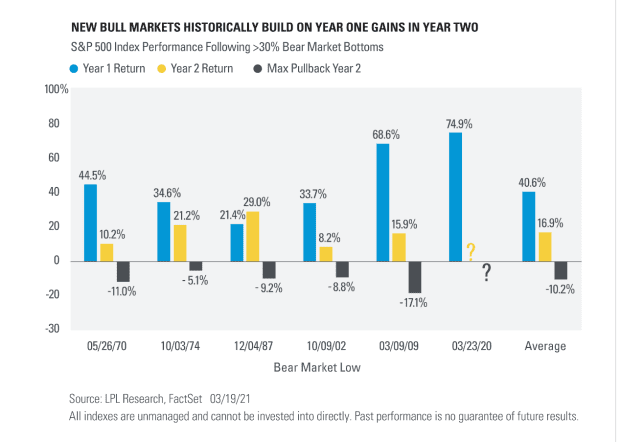

This chart shows bull market gains in the first year averaging 41% for the S&P 500, following the six bear market reversals at more than 30% since World War II.

Bull markets, after falling more than 30%

LPL Research, FactSet

But the chart also shows gains in the second year averaged nearly 17%, while draws averaged 10.2%.

Reaction rate

Mark Haefele, chief investment officer at UBS Global Wealth Management, said he expects risk funds to see more upside down as the market enters the “reflation” phase of the recovery, in the note Tuesday.

The CIO also said investors should “hunt for yield,” while also pushing for high growth, rising inflation and low policy interest rates.

Yield in an investment rate slice of the US $ 10.5 trillion corporate bond market was last seen close to 2.27%, according to BofA’s ICE Corporate Index, up from a pandemic low of about 1.79% in January.

Investors have become increasingly concerned about the potential for rising government bond yields to reap some of the high spread benefits seen in the tech sectors and high growth in the stock market, even though banks and finance companies may stand to benefit from the ability to cut more. interest for lenders.

Matthew Bartolini, head of Global State Advisors of the American SPDR study, noted Tuesday that interest in value-based and bicycle-based areas of the market included $ 8 billion of new funds flowing into the SPDR. SPDR Property Select Department of Finance

XLF,

so far in 2021. The fund rose 13.3% year-on-year to Tuesday, outperforming the S&P 500 by about 9%.

10-year Treasury Product TMUBMUSD10Y,

it was nearly 1.65% Tuesday, after climbing seven weeks in a row to 1.729% on Friday, close to its one-year high.

“While building normal volatility like this level of a bull market would be strong, we believe investors may be a good idea to consider buying the dip,” Detrick said. “Vaccine distribution, fiscal and monetary stimulus, and a strong economic recovery are highly encouraging.”