Wall Street traders hunted for a troubled stock retail store Friday that helped trigger a sale in which $ 33bn worth of Chinese technology companies and U.S. media outlets such as ViacomCBS were devalued.

The sale of the shares, which was nearly $ 19bn, has been a mystery, with rumors circulating swiftly that a hedge fund or family office had exploded and moved to reduce the billions of dollars worth of its jobs. The trades have caught Wall Street in what is set to be another volatile year, with big wrong moves honoring assets.

The email explosions from Goldman Sachs about fire sales began long before the trading day began, with $ 6.6bn worth of stock in Baidu, Tencent Music and Vipshop on the block. Wall Street’s investment bank told supporters that the sales were prompted by a “forced disqualification,” a sign that assets may have been seized outside and hit by a fringe call, according to people familiar with the matter. issue. Goldman signed up the contracts several times, they said.

Money managers accepted that the sale was targeted at U.S.-registered Chinese technology groups ahead of a new move introduced by the Securities and Exchange Commission under U.S. Vice President Donald Trump to they might see them listed from U.S. exchanges.

But as the big blocks of stock continued to come, with the sale of shares now restricted to Chinese groups, profitability suddenly came on Wall Street. Some asset managers have made the fire sales mean that a major hedge fund or family office was in trouble.

During the day Goldman and its downtown rival Morgan Stanley’s equity retail traders tossed the phones as they tried to move billions of dollars of stock. Shares in U.S. companies such as Discovery as well as online retailers Shopify and Farfetch were put on the block, sweeping billions of dollars from valuations.

The shares were executed in five blocks as Goldman began trading with $ 6.6bn worth of stock, followed by another $ 2.3bn in the afternoon and $ 1.7bn worth of ViacomCBS shares.

Morgan Stanley sold shares worth $ 4bn earlier in the day, followed by another $ 4bn batch in the afternoon. The bank initially allowed investors to choose their shares of individual stocks, but later moved to a “total” offer where traders would buy a whole basket of securities, two said. a source who was familiar with the process.

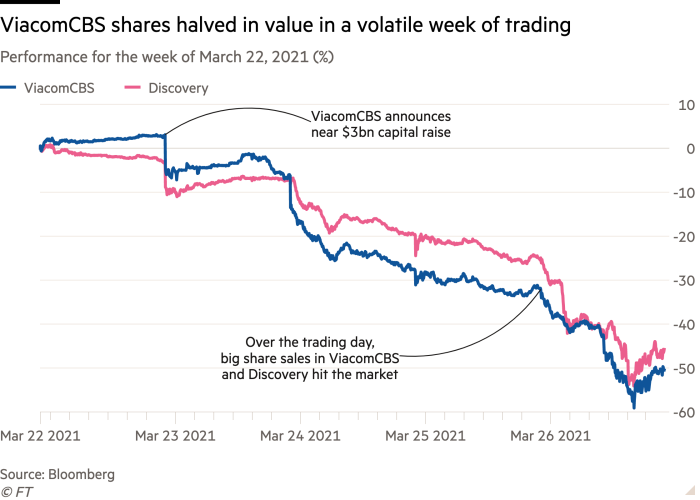

There was no place in the sharper pain than in shares of ViacomCBS, as more than $ 11bn was written off the valuation of MTV and Nickelodeon owner alone on Friday.

By the end of the week, the company’s shares had declined in value. While news reports pointed to the decline of analysts from investment banks such as Wells Fargo and Moffett Nathanson, traders believe the catalyst was something else.

On Monday, shares of the company closed at an all-time high and cable television group Morgan Stanley and JPMorgan Chase hit to raise nearly $ 3bn to plow it into their business.

From the moment the press release hit the wire, ViacomCBS stock began to fall. Shares closed 9 percent lower Tuesday before falling another 23 percent on Wednesday. The recessions were visible for ration sales.

“I don’t think anyone has seen it trade like this,” said one banker to the contract, who said it was “probably too much” of capital raising in the end.

One source said they were told that the recession that began in ViacomCBS began after a capital increase hit hard in a family office, forcing him to resign, while a second said Morgan Stanley confirmed that at least some of the trades from the same vendor.

But the sheer volume of sales has raised questions about whether more than one family asset or office was caught in the trade.

It follows three months of unusual and somewhat unexplained trading in ViacomCBS and Discovery stocks. Shares of the companies had accumulated 170 and 148 percent, respectively, between the beginning of the year and the end of Monday. They were the two highest performing stocks in the S&P 500, up more than double the best performing stock.

Morgan Stanley, Goldman Sachs and ViacomCBS declined to comment.