Treasury finance output is driving trends through the stock market, particularly for high-tech stocks. But history shows that when yields rise “for the right reasons,” tech and stock-sensitive segments tend to thrive, according to Raymond James.

The real reasons are “developing economic growth and a‘ healthy ’rise in inflation,” Larry Adam, chief investment officer for Raymond James ’private messaging group, said in a weekend note. And those reasons have guided the result on TMUBMUSD10Y’s 10-year Treasury note,

just a shy of 1.4%, or around the highest in a year. Yields are also coming off their biggest weekly increase in six weeks.

Related: These are the most vulnerable market segments to a bond market ‘taper tantrum’

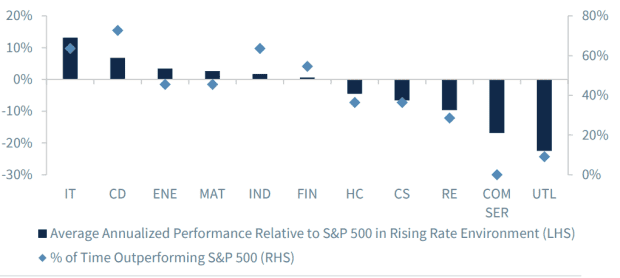

Adam picked up the chart below, which breaks down the average annual performance of each of the 11 S&P 500 divisions and the percentage of time each division outperforms the S&P 500 in a rate environment. rising.

Raymond James

“Since 1990, in rising rate environments, the more cycled sectors have performed better,” said Adam. “Average annual performance compared to the S&P 500 and percentage of time it outperforms the largest S&P 500 for the technical, consumer and business segments – three of our preferred sectors , ”While higher yielding sectors such as utilities, real estate. and consumer staples tend to perform lower.

Stocks posted mixed performance Monday, with the Nasdaq-100 NDX,

down 1.7%, and the Nasdaq Composite COMP,

down 1.5%, suffering the steepest declines. Both have shifted towards large, technology-based stocks.

Dow Jones industrial average DJIA,

a bit optimistic, though the S&P 500 SPX,

it was off 0.5%.

The rise in output is largely blamed on expectations for a possible rise in inflation thanks to government spending and ultraloose monetary policy. There are fears that the Federal Reserve may move to start withdrawing some liquidity sooner than expected helping to stabilize stocks, analysts said.

But Adam argued that inflation is not only “short-circulating” the rally, but may be a welcome development for stock market bulls.

“When analyzing how the S&P 500 performed below different levels of core inflation, above-average allowances performed in an environment where core inflation ranged from 1-4%,” he wrote.

Inflation at these levels is generally considered healthy when it coincides with the development of economic activity, Adam said. The reason is that companies have price power, allowing them to raise prices, while also reaping the benefits of productivity, which help stimulate employment growth.

Raymond James expects core inflation to be around 2%. Adam said that when core inflation runs between 1% and 3%, average performance compared to the S&P 500 year over year has been stronger for technology (+ 6.8%), healthcare (+ 2.3%) and user optional categories (+ 2%).