Das Shaktikanta

Photographer: Kanishka Sonthalia / Bloomberg

Photographer: Kanishka Sonthalia / Bloomberg

India’s central bank is under pressure to step in to monitor yields after the government surprised bond markets with a larger-than-expected lending plan.

That puts the burden on Governor Shaktikanta Das to settle the bond traders when he meets to decide policy on Friday. He must already accept that a recent step to map excess liquidity is not a step towards changing the RBI’s agricultural policy and the central bank has rejected claims at two auctions of benchmark debt after investors yielded higher returns. to seek.

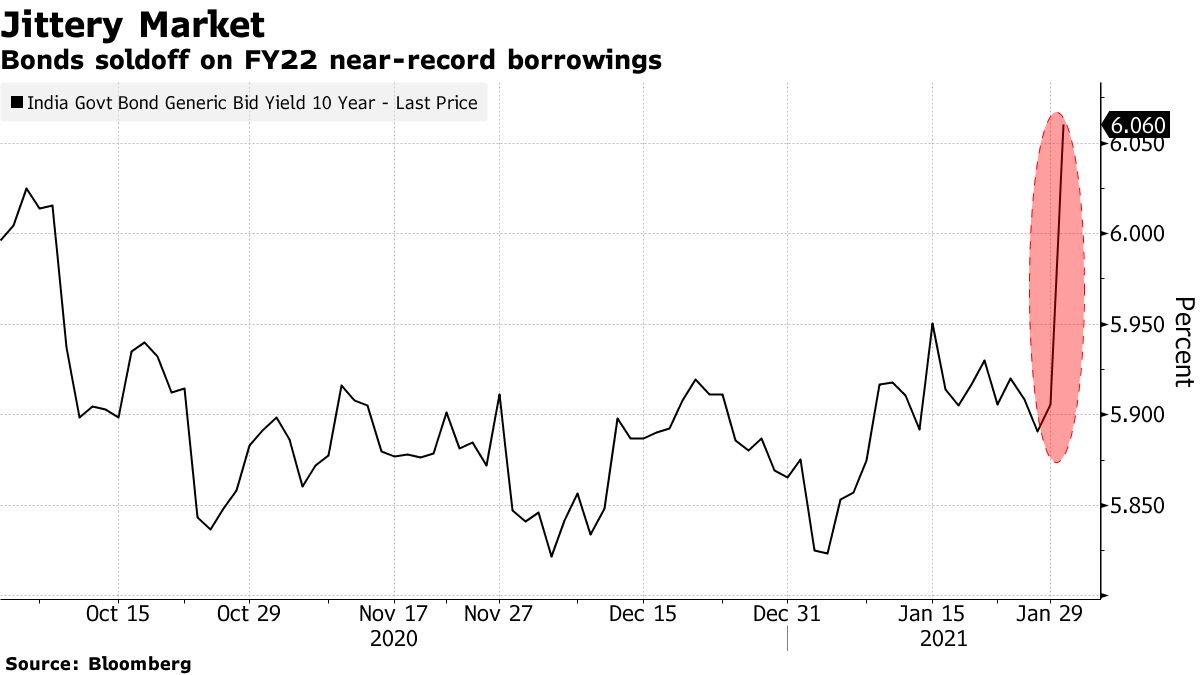

India will receive a loan of 12 trillion rupees ($ 164 billion) through bonds in the fiscal year beginning in April, Finance Minister Nirmala Sitharaman said Monday, higher than the 10.6 trillion rupees estimated in a study Bloomberg. Bond sales were named, with the 10-year benchmark yield rising 16 basis points to 6.06% while bond yields rose 5.15% 2025 27 basis points.

“Borrowing outweighs market pressures,” said Anoop Verma, senior vice president at DCB Bank Ltd. in Mumbai. “It will be difficult for the RBI to keep yields at around 6%.”

In contrast, the budget response from the Indian equity market was favorable. Shares of Indian lenders rose, with Bankex index rising on proposal to set up company bad bank lending management, which is expected to reach its highest levels this year.

But those looking at bond markets like Verma are asking the RBI to explain when and how much debt it will buy. The central bank has been using external and external Open Market Operations, as well as secondary individual market purchases and Operation Twists to track yields.

The battle between bond traders and the central bank played out for most of last year, with the money authority using what was known as much-understood yield control – a trying to keep the 10-year yield around the 6% mark.

However, the act became more difficult this year as the RBI they began to issue some emergency pandemic measures.

“The market needs to survive with the higher lending,” said Soumyajit Niyogi, associate director at India Ratings & Research in Mumbai. “We need continued support from the RBI.”