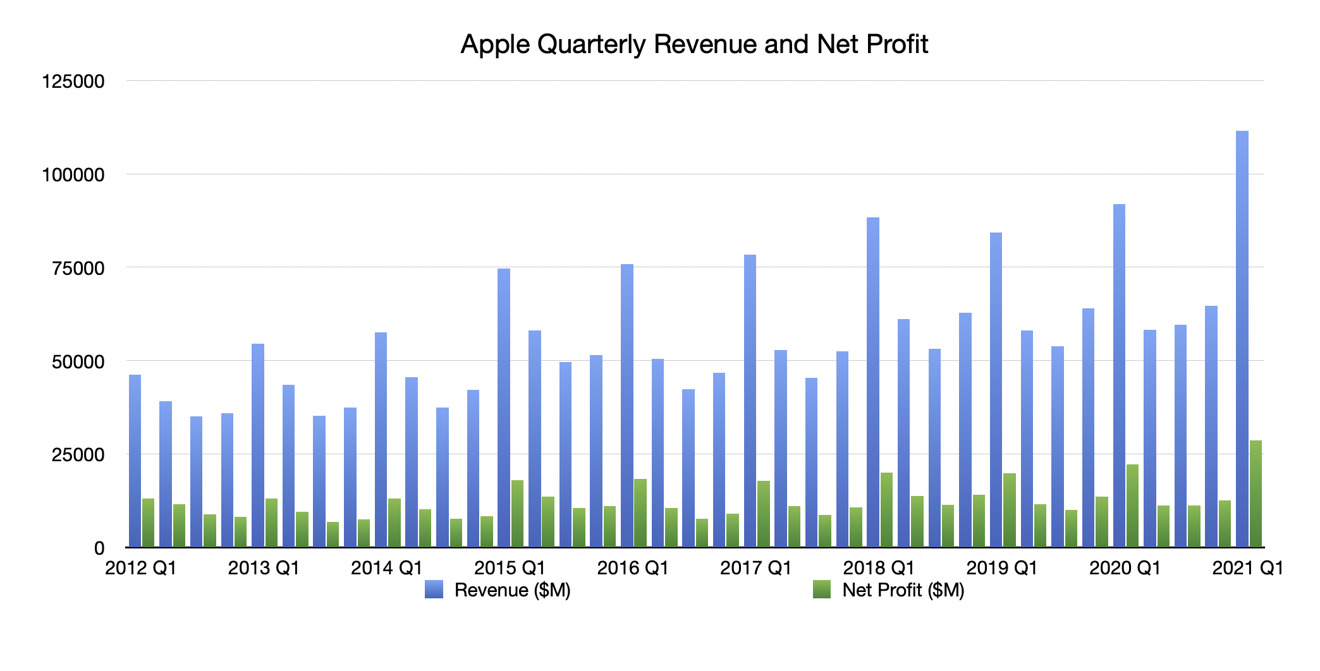

As a result of Apple’s stellar holiday season results, analysts have been quick to respond to the $ 111.4 billion in revenue and other data points that Apple has raised in its finances. Here’s what analysts think of the results – as well as how long they’ve been predicting.

Apple’s first-quarter earnings for 2021 were announced on January 27, with the iPhone maker earning very high revenue from sales over the holiday season. In addition to achieving $ 111.4 billion in revenue, the company saw significant growth across all product segments, with significant year-over-year growth expected for the iPad and Mac sectors.

Ahead of the results, analysts offered the forecast of what to expect from the company in their quarterly release, all of which were more optimistic than expected. Naturally, in the days after the results were announced, analysts returned to their keyboards to provide the hotspot of what Apple had achieved.

Cowen

Cowen considered the results to be “well above consensus forecasts” with strong year-on-year growth from all hardware sectors, and a full standing margin “provided by higher loads and a favorable mix iPhone 12 Pro / Max. ” Based on ideas about booster and switcher trends, as well as slower 5G deployments in Europe and Latin America, Cowen believes the 5G cycle can be “long and strong.”

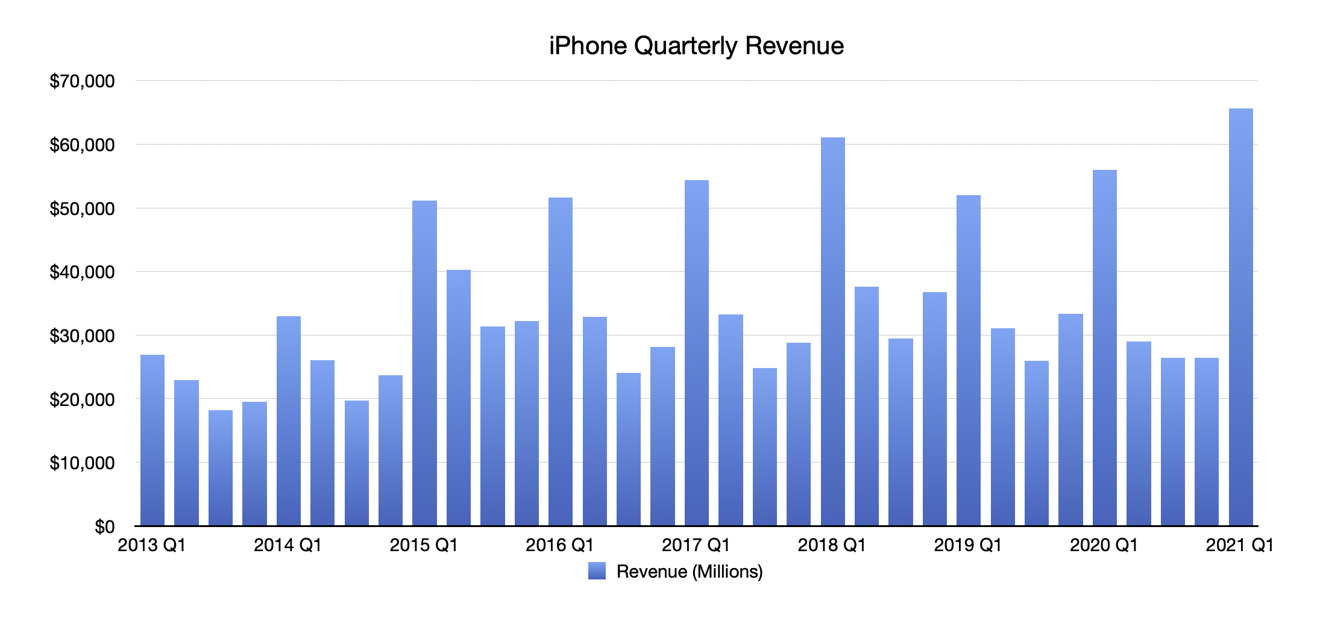

It estimates iPhone loads were around 80 million, more than the expected 77 million, with the YoY mixed average selling price 6% higher. China was a tailor for the quarter, because of the “pent-up demand,” while India could be a “long-term unit material driver” because of how it feels like China 8-10 years ago, with a nascent ecosystem developer and a lack of retail stores. ”

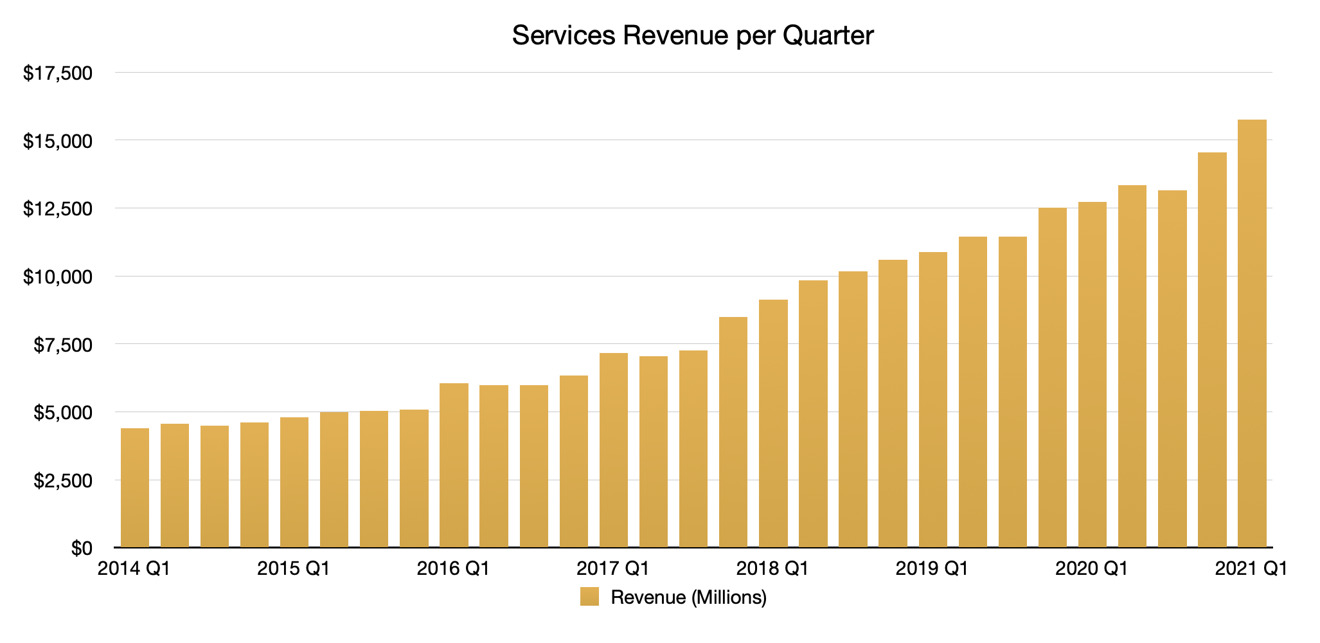

In its preliminary results forecast, Cowen estimated that Apple would reach $ 104.5 billion for the quarter, with iPhone revenue at $ 60 billion and Services revenue at $ 16 billion. In fact, iPhone revenue hit $ 65.6 billion, while Services managed $ 15.8 billion.

Wedbush

Marking the results as a “jaw dropper,” Wedbush believed that Apple’s results were “far above even the most bullish whiskey numbers. “The success of the iPhone 12” was like Usain Bolt, “and he’s well on his way to meeting” supercycle hype. ”

“Based on the core strength of the iPhone 12 5G sypercycle with China growing 57% YoY, the fact has even surpassed the hype with Cook & Co. delivering a product cycle for the ages that will help ‘transforms Apple to its next level of growth,’ ‘analysts believe.

IPhone quarterly income

Demand in China is a “linchpin” for the supercycle, with estimates of 20% of iPhone updates coming from the region in the coming year. Apple’s march to the $ 3 trillion market cap is also “firmly on track” to take place next year, with a “large $ 1 trillion services business” that could be a catalyst for activity sections for the coming numbers.

The forecast expected iPhone shipments “eye-popping” in the low to mid 90 million range, with total revenues of $ 100.2 billion.

Loup Campaigns

The statement for Loup Ventures was that the results showed “accelerating digital transformation” for the company and society, with the upside “led by almost all product segments ”As well as the supply-constrained Mac segment. “Further evidence of this change is that the company is reporting historical revenue at a time of financial pressure for consumers. ”

He believes Apple has “the best days yet” due to a digital transformation “that we still can’t fully comprehend.” This acceleration will continue to impact revenue 2021, with more people accustomed to working, learning, and playing at home, providing a “continuous tailwind” for iPad and Mac could grow by 10% or more in 2021 and 2022.

Apple Services quarterly revenue

The growth of services that benefit from “pandemic-related consumer practices” will please the extra tail for the better part of 2021, in theory. At the same time, the commitment to 5G will “grow in the back half of the year,” to start a two- or three-year iPhone update cycle.

Loup Ventures had revenue of $ 109.5 billion, with iPhone up to $ 64.9 billion, iPad at $ 8 billion, Mac at $ 10 billion, Wearables up 17% YoY, and Services at $ 15 billion.

Morgan Stanley

Following Apple’s results, Morgan Stanley raised its price target for the company again to $ 164, with ambitions in the results including “faster iPhone share gains, fixed base growth, and services monetization . ” These elements, in addition to ongoing remote work and education and an updated product line, could encourage double-digit growth for several quarters.

Acceleration of Apple’s installation base growth from 7% to 10% and monetization of services, coupled with oversupply of the Chinese market, also reflect faster growth in the long run.

Apple’s quarterly revenue from Greater China

For the March quarter, quarterly growth is seen for iPhone, iPad, and Mac, with Services forecasts improved due to better performance in the Q1 quarter.

Prior to the results, Morgan Stanley raised its price target from $ 144 to $ 152, as well as forecasting revenue of $ 108.2 billion, 78 million iPhone shipments, and $ 63.9 billion in iPhone revenue.