Apple’s Q1 2021 results were the highest ever for the Cupertino giant, with a later iPhone release tablet and many other factors replacing really big results. Here’s a breakdown of key figures Apple has released about its holiday season fortunes.

On Wednesday, Apple held its regular press conference and analyst call to discuss its holiday season results. The quarter usually proves to be earning high due to seasonality, but other elements have come in to help push the company to new heights, and into the revenue sector. entered a hundred billion dollars for the first time.

Income and net profit

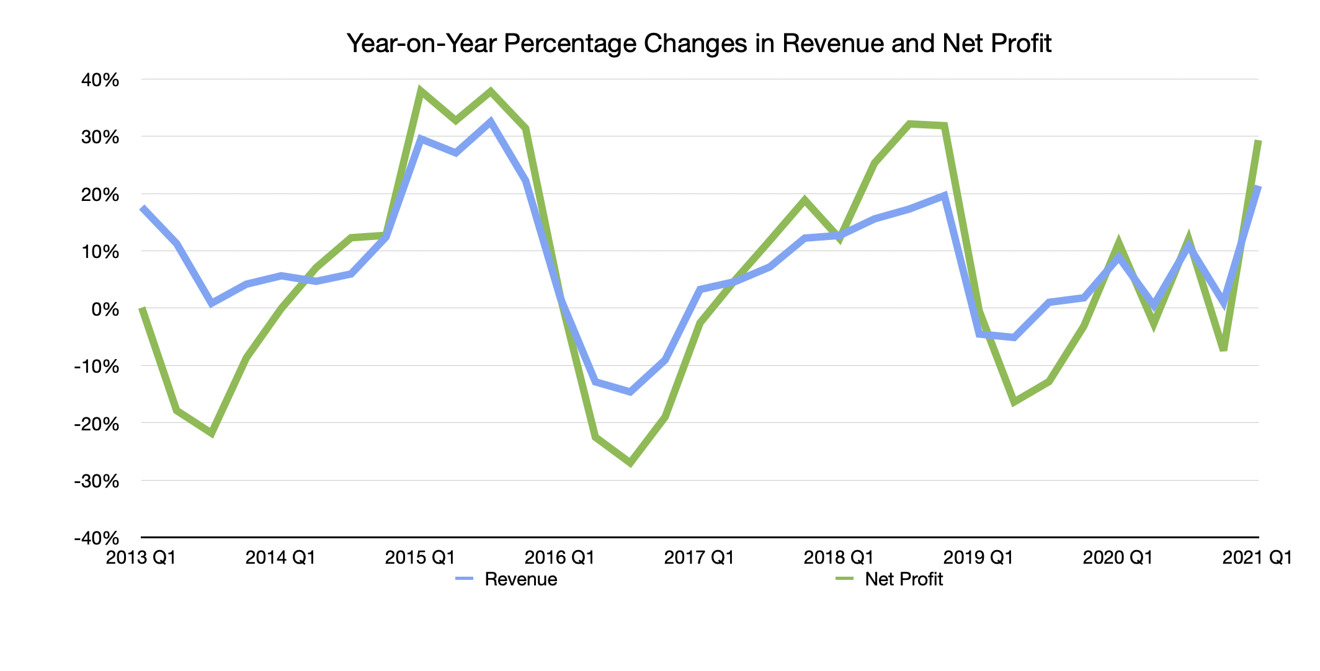

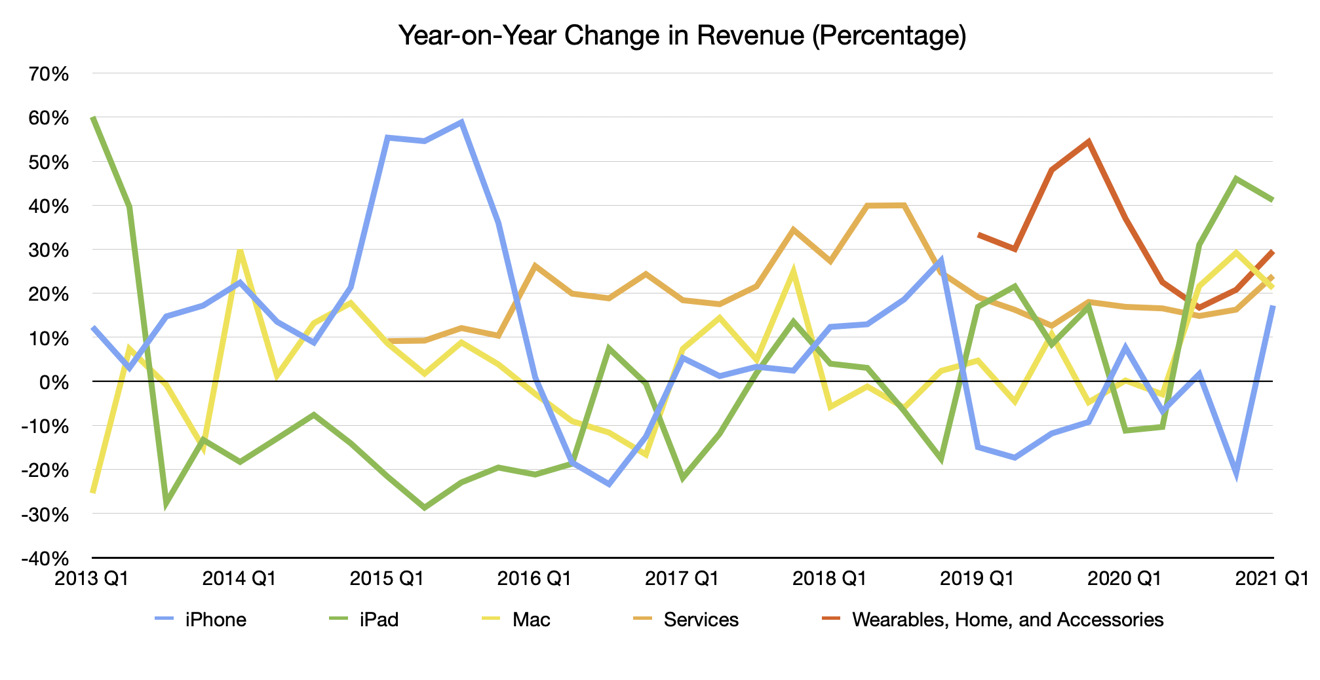

For the quarter, Apple reported that it had earned $ 111.4 billion in total revenue across all of its businesses. This set a new record for the company among others, down from its previous highest revenue of $ 91.8 billion since Q1 2020. This represented a year-on-year improvement of 21.4%, which is also the highest YoY increase in quarterly revenue for the company. from Q4 2015.

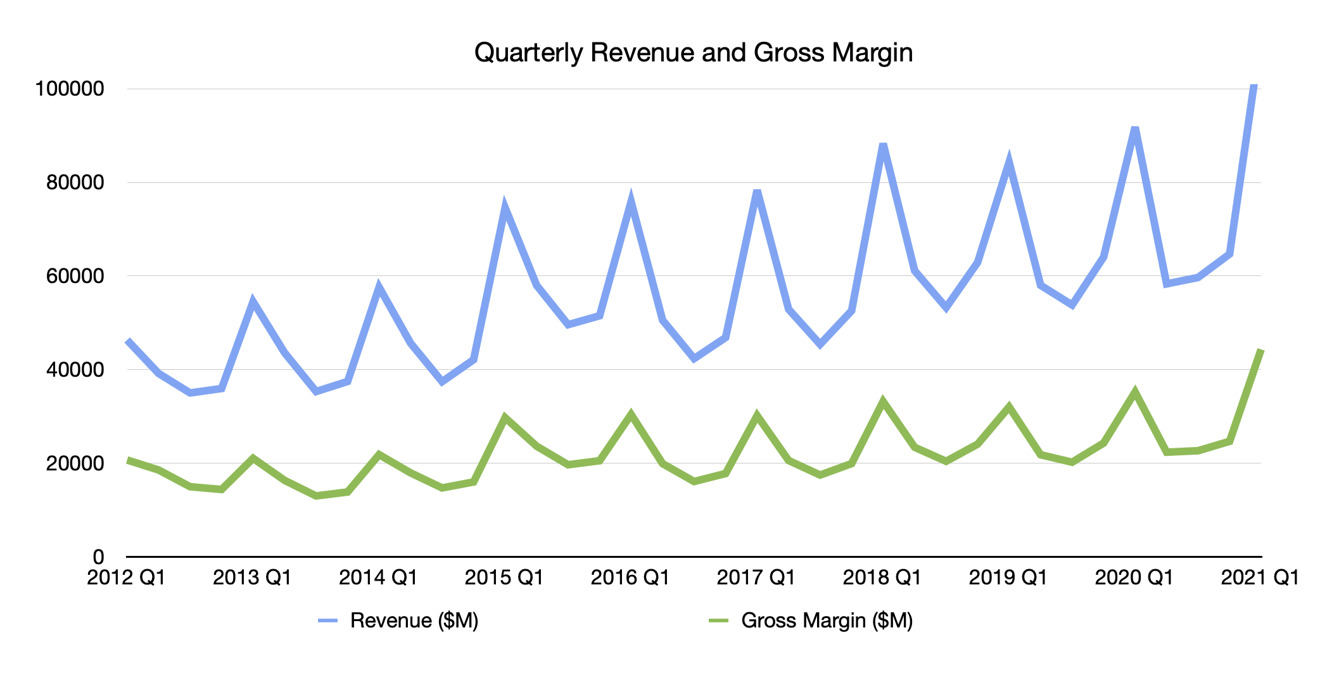

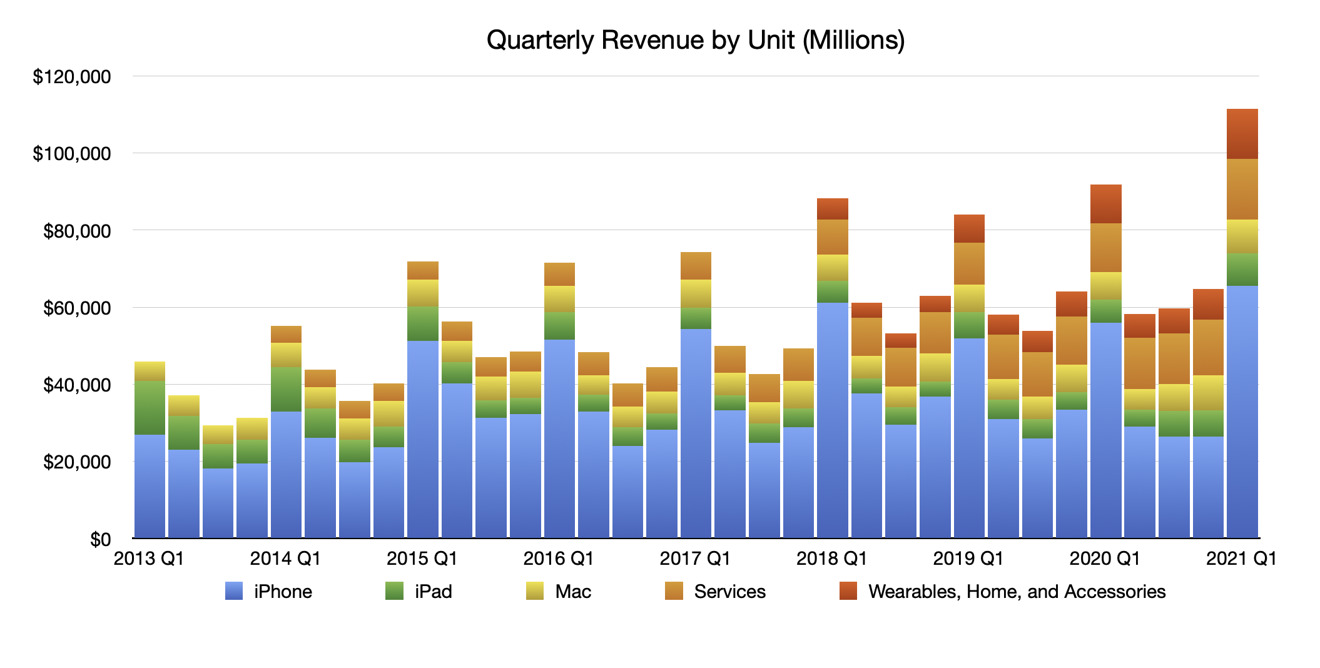

The graph shows Apple’s continued growth, as well as the actual quarter for revenue, driven by iPhone calls. Of all quarters in a year, Q1 had always been at an all-time high for Apple, with the candidate most likely to pass the $ 100 million revenue milestone .

Net profit increased to $ 28.8 billion, an increase of 29.3% year-on-year. This increase in net profit relative to income may be good for investors, as it may indicate that Apple is earning more profit overall than last year.

Total margins

The full margin is usually a good indicator of Apple’s profit. For Q1 2021, the total margin of $ 44.3 billion is up 25.9% from the same period in 2020.

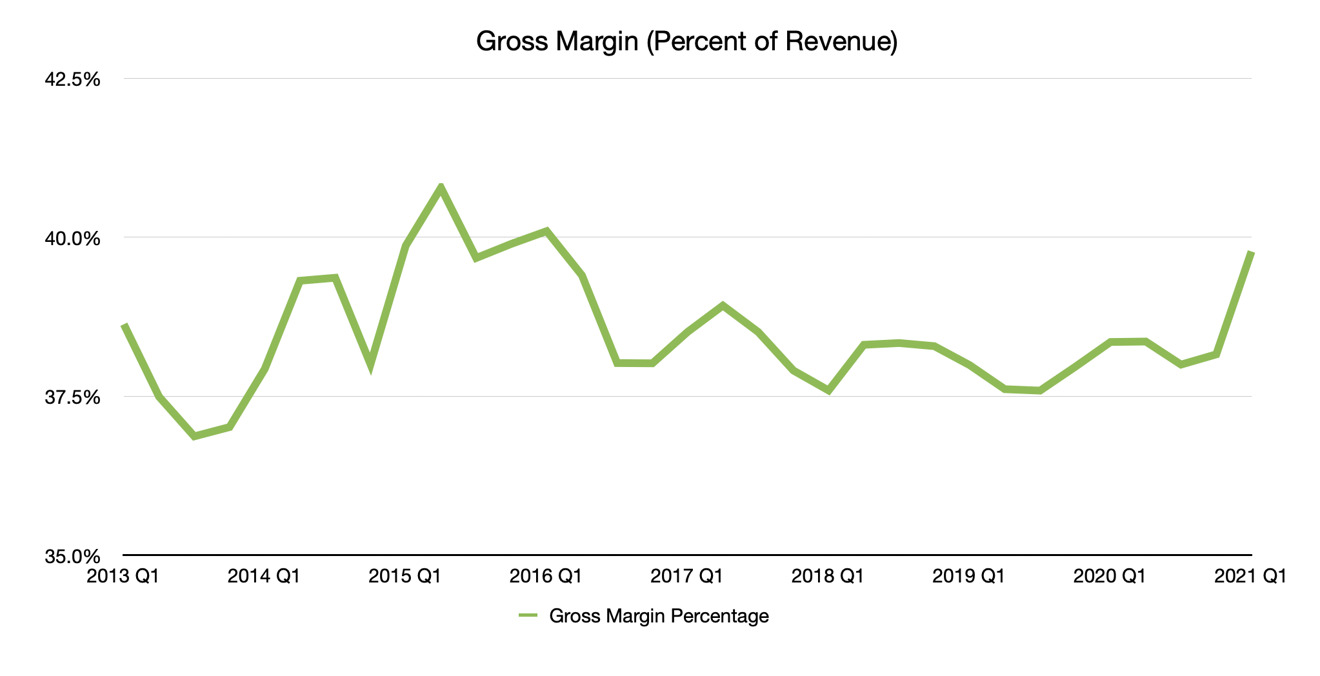

As a proportion of income, the total marginal percentage is 39.78%. This is less encouraging with the increase in net profit, as full margins are generally in the range of 37.5% to 40%, and while the quarter is certainly at the high end of the range, it is still below 40%.

Q1 2016 was the last time Apple saw a margin percentage above 40%, when it hit 40.1%.

Results

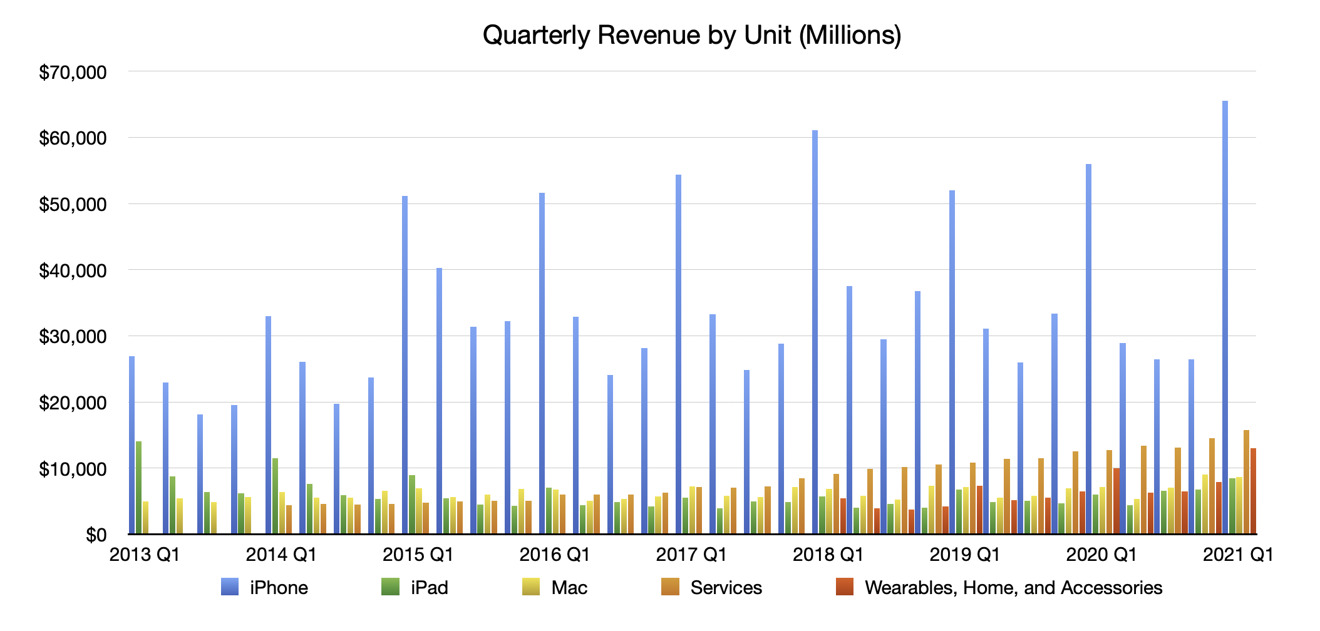

A regular viewer of Apple’s financial results will be familiar with the way Apple’s product revenues are controlled by the iPhone, and for Q1 2021 there is no exception. Putting all sorts of products together, it’s clear that there is a difference in what an iPhone pulls in over the rest.

Nonetheless, the Services and Wearables, Home, and Accessories units are worth keeping an eye on, as they continue to grow.

After a year of COVID-19 and increased demand for hardware, Apple’s arms are expected to see positive revenue changes over the previous year. He is the outlier of the iPad group, which has enjoyed stellar sales for the time being.

In this graph, it is much easier to see the growth of Services and Wearables, Home, and Accessories arms from quarter to quarter, generating a larger proportion of revenue per hour.

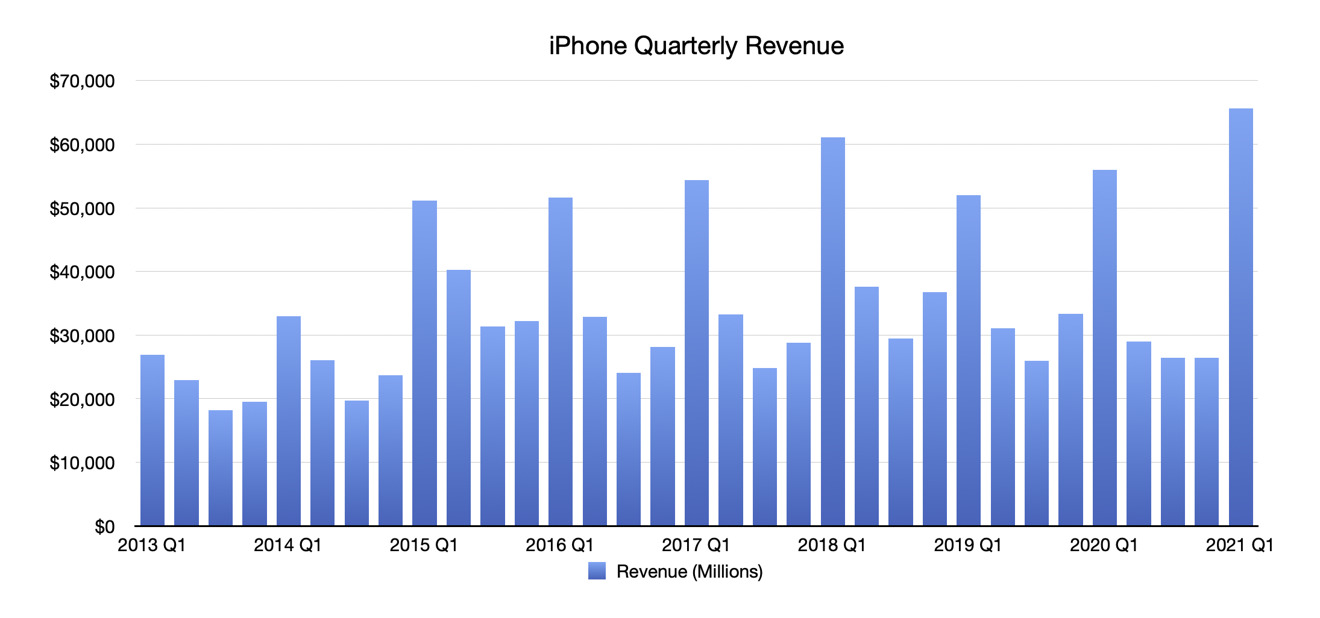

iPhone

A later launch of the iPhone 12 range in the quarter helped boost holiday season sales slightly, rather than impacting the tail end of the previous season. This, combined with higher demand for the more expensive models, boosted revenue for the quarter to $ 65.6 billion, up 17.2% year-over-year.

Apple CEO Tim Cook is confident that there is more room for growth, with “not everyone having an iPhone,” as well as the company not yet reaching a majority share in any market. Cook said more than 1 billion iPhones are now in active use, which will help his Services arm grow.

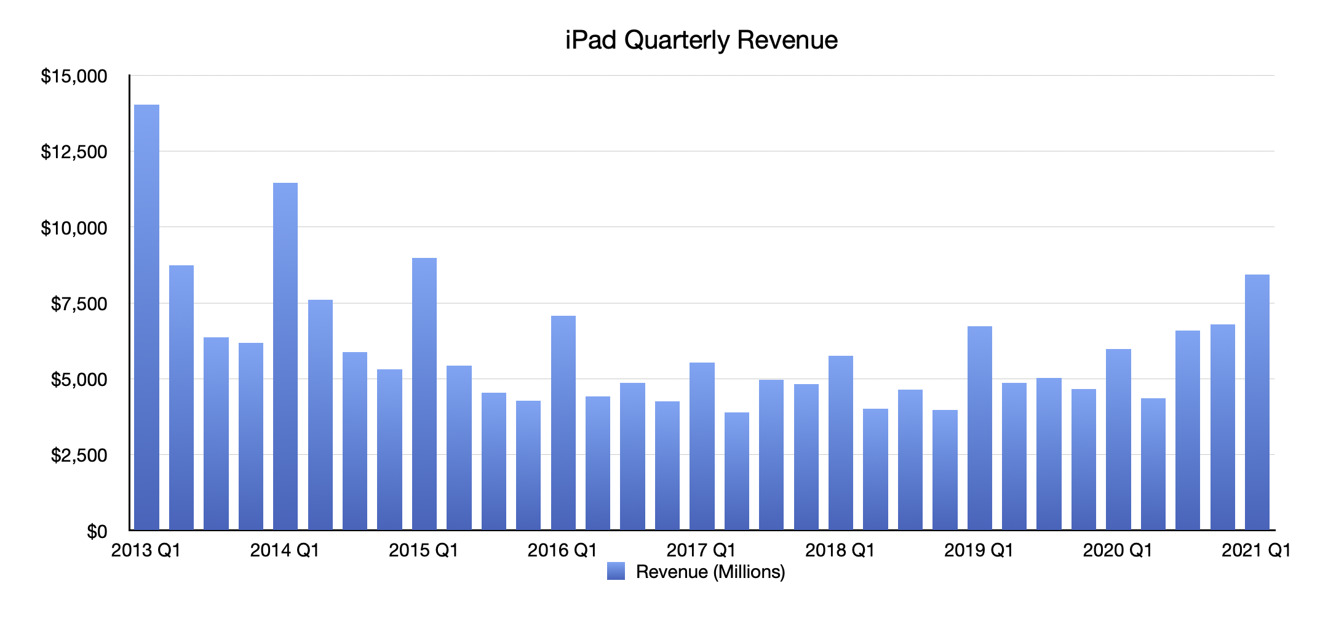

iPad

While not as high-income as the iPhone, it seems that many would consider the iPad to be the most impressive unit for the company in the fourth quarter. While its $ 8.4 billion is a bit far from the iPhone’s revenue, it’s also a staggering 41.1% YoY increase.

Even more so, this follows a Q4 quarter, when the spurt unit saw 46% YoY growth, again driven by the social speed of COVID-19 and work-from-home initiatives.

son

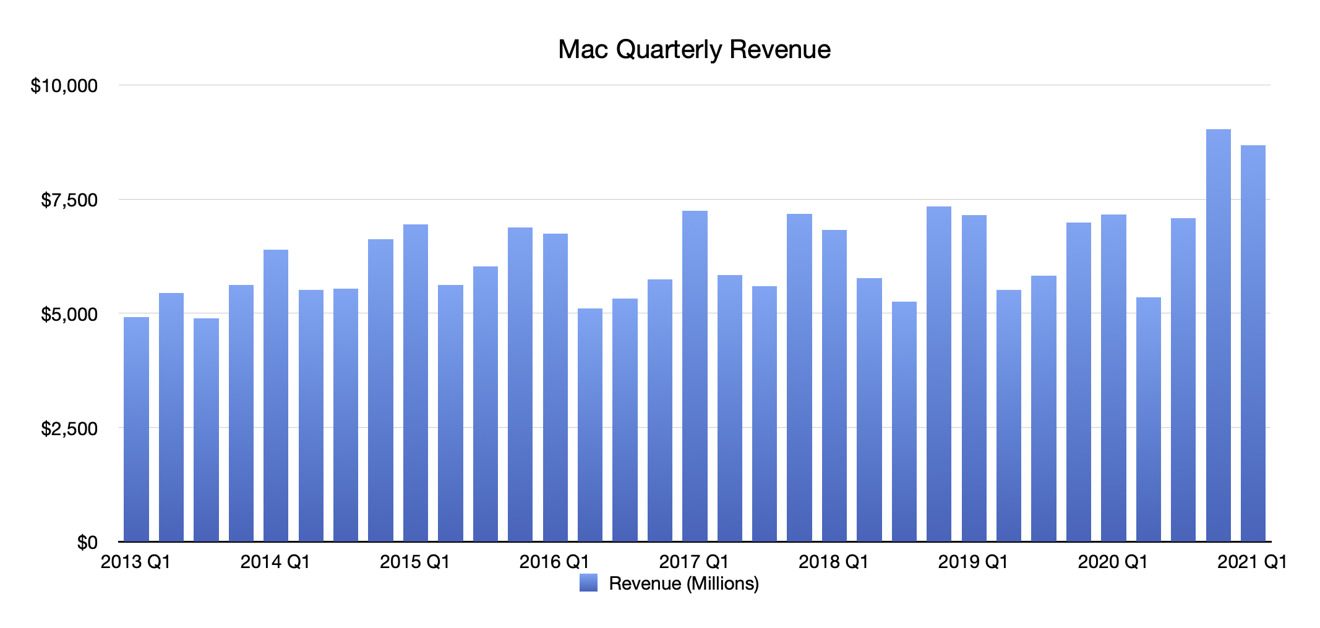

Just like the iPad, the Mac segment has continued to benefit from social distance measures, and has done so for the third consecutive season. Revenue of $ 8.7 billion gives it a growth of 21.2%, which is not the same as the 29.2% seen in the last quarter, but which is still significantly better than the Q1 2020 “growth” of 0.2 %.

Services

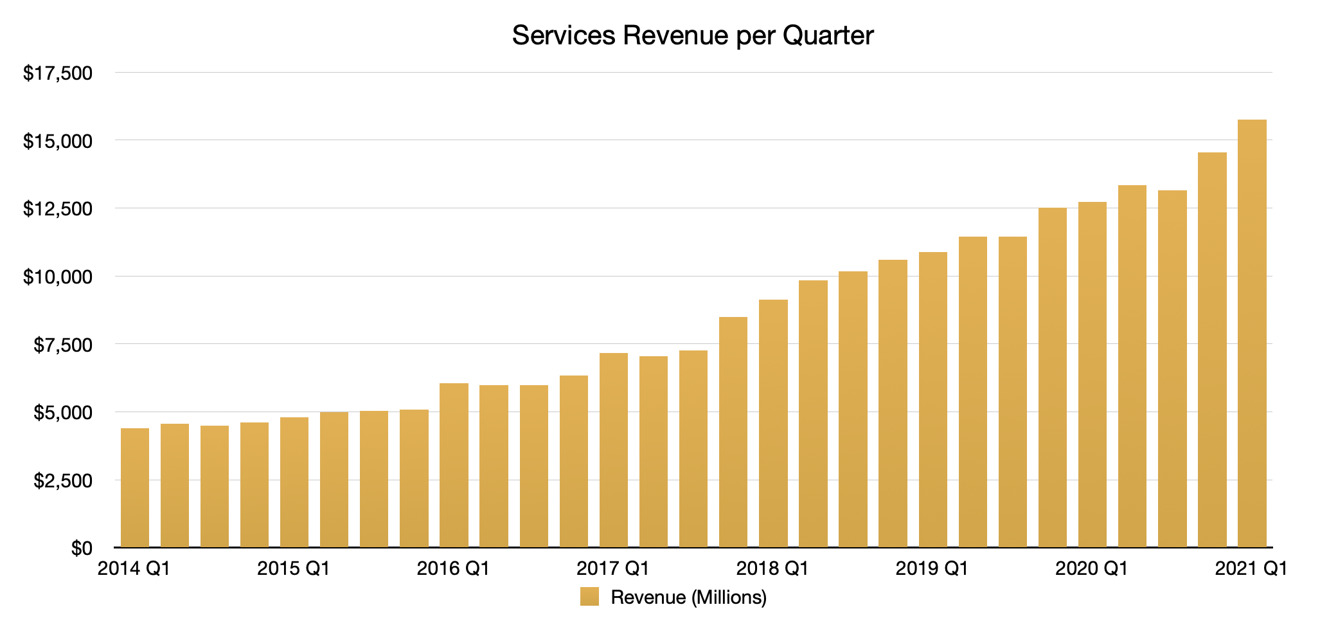

The Services arm has always been a trusted business for Apple since it began counting it as its own division in 2014. For Q1 2021, it has reached its peak, at $ 15.8 billion in revenue- in, and again, people are likely to benefit from staying at home and using their appliances more often.

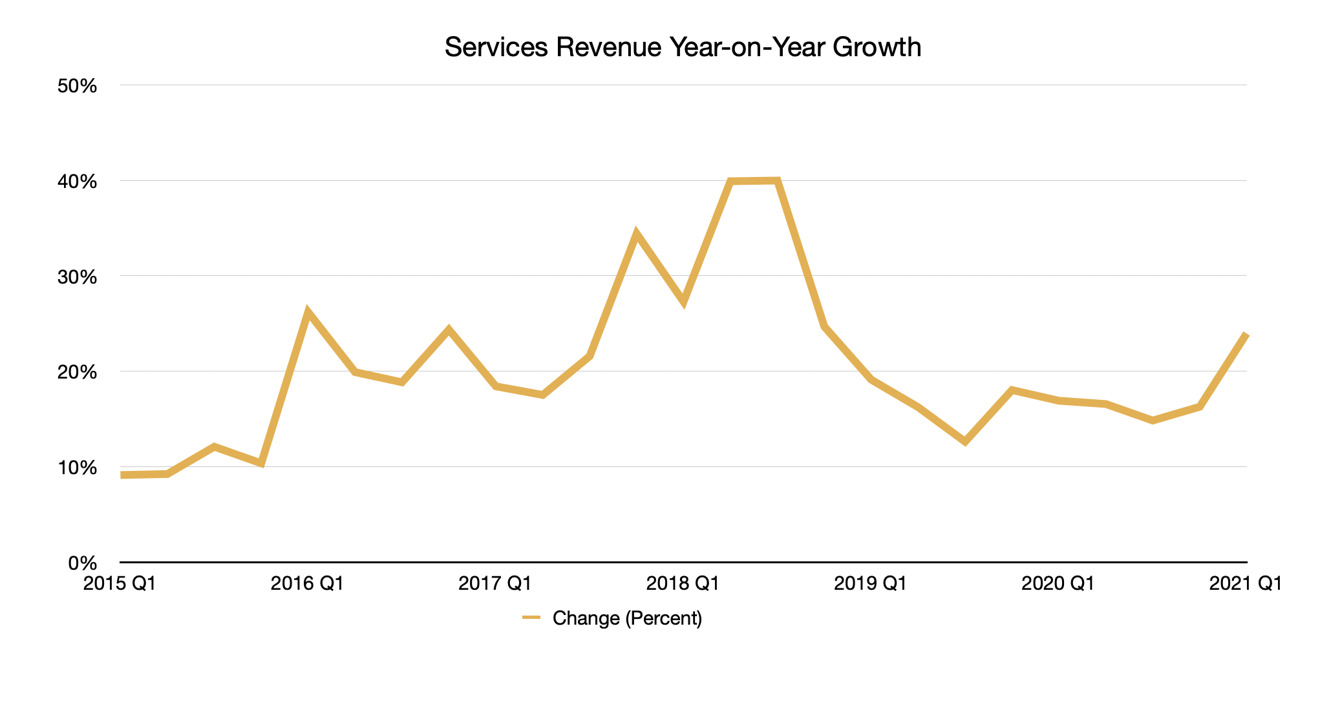

More importantly for Services, this is another quarter that has seen YoY grow. Moreover, at 24%, it is a significant improvement on the under-20% growth seen in the last eight quarters.

Unlike the other product-driven corporate segments, the Services arm is more likely to be a stable source of finance for Apple, as it relies on devices used for App Store purchases and memberships, rather than sales. hardware. While other sectors may decline in the future, Services may continue for a long period of time without much change, short of a major negative event for the company.

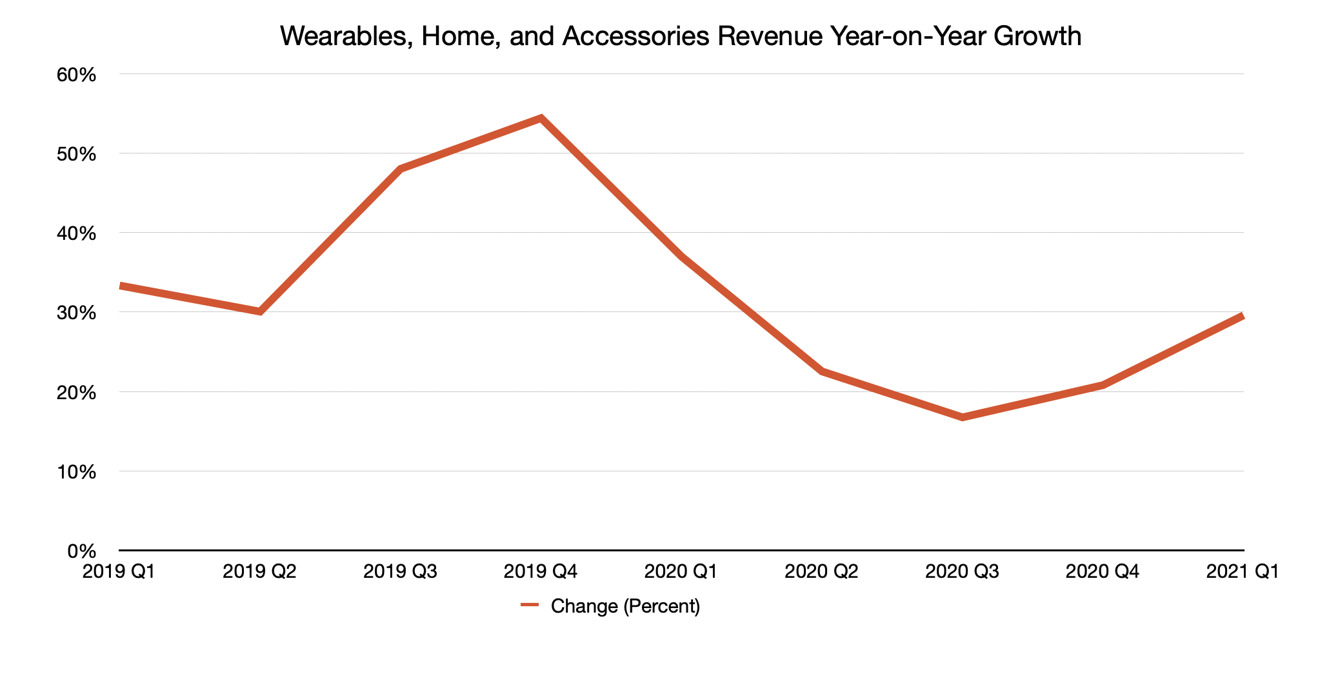

Wearables, Home, and Accessories

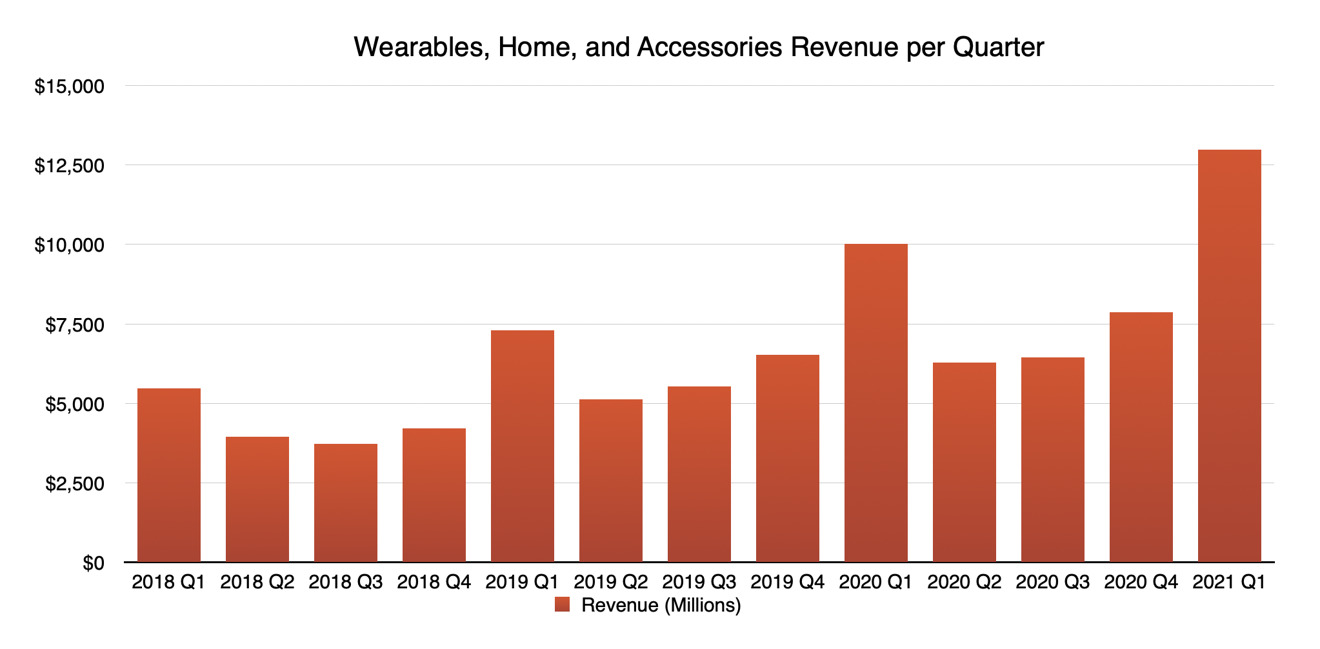

The newcomer to the units, the Wearables, Home, and Accessories division continues to see high revenue gains, exceeding $ 10 billion for the second time by $ 13 billion. Within a few years, the division, which covers AirPods, the Apple Watch, and other products, has thrived to more than double in value for the company, climbing iPad and Mac with Services firmly the scenes.

Just like Services, this sector is experiencing significant year – on – year growth that is highly reliable, but with higher percentages. For the quarter, it saw growth of 29.6% YoY, a percentage that has again impacted on Coronavirus-driven user trends.

Departmental income

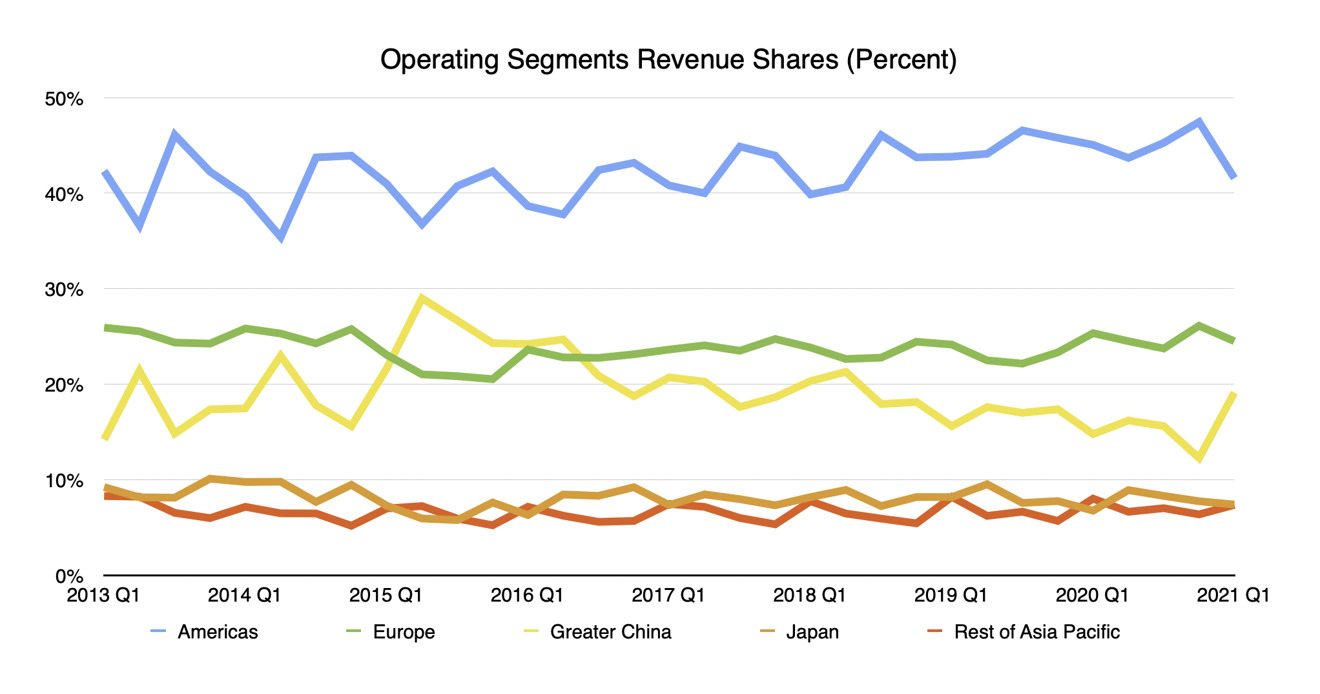

On a terrestrial basis, Apple’s main revenue comes from America specifically at $ 46.3 billion, followed by Europe at $ 27.3 billion, Greater China at $ 21.3 billion, Japan at $ 8.26 billion, and the then the rest of Asia Pacific with $ 8.23 billion.

YoY growth was in all areas, but some are well above average. Along with a massive 57% growth spurt in China, Japan also saw a 32.8% YoY rise, with Europe up 17.3% YoY, Americans by 11.9%, and the rest of Asia Pacific surrounds the group at 11.5%.

If you look at its limited income, you can see that both Europe and America fell a few percentage points to 24.5% and 41.6% respectively, both for series quarters and when the resistance Q1 2020. In comparison, China saw its balloon revenue share from Q1’s 14.8% to 19.1%.

Again, China is growing bigger for Apple.

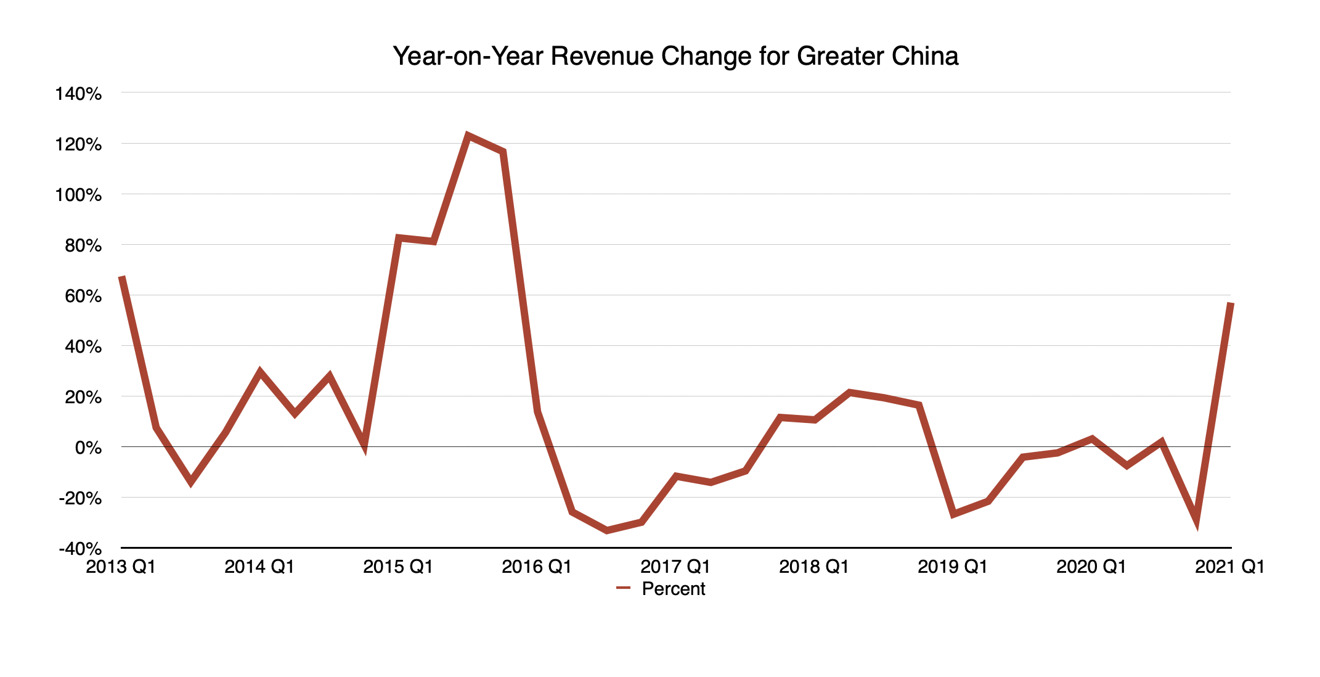

China

Although China tends to be in the same season as other regions, this is the most volatile level among the group. Just looking at revenues in China for Q1 in 2019 and 2020, you can see a drop from what was seen in 2018, something this year’s figures strongly oppose.

The last two years seem to have been a shame for Apple, and something about the fourth holiday has given a boost to the Chinese market. As Cook said, it was “more than an iPhone story,” although he also admitted that there was a pent-up application for the iPhone 5G that helped matters.

Looking at the growth of YoY in China, it is clear to see some stagnation in the last few years, a trend that the latest results are certainly going. It may be a bit far from the stratospheric growth seen in 2015, but it is certainly a sign that such heights are entirely possible for the company in the future, under the right conditions.