Really for a euphoric stock market? Next week is probably the closest thing to counting for bullish investors so far in 2021.

This is the busiest week of the employment season in the fourth quarter, marked by highly expected results from overweight companies such as AT&T T,

Apple Inc. AAPL,

Facebook FB,

and Tesla TSLA,

In total, some 118 companies expect quarterly reported results in the last trading week in January, including 13 parts of the Dow Jones blue-chip industry average DJIA,

John Butters, senior analyst at FactSet research told MarketWatch.

And more than 60% of that weekly attack will play out between January 27 and January 28.

The frenzied time could shape into a key part of a market that may be seeking its next spark as President Joe Biden’s new administration expands its policy initiatives and its plans to tackle the COVID-19 pandemic.

So far, optimism is high among equity investors, with sentiment data from Ned Davis Research reading at 74.4%, a rate that has only been achieved 7.4% of the time since 1994.

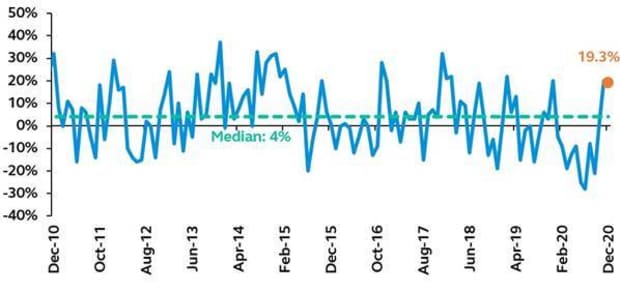

Similarly, the bull bear distribution is at 19.3% against an average of 4% as of December 31, according to a study by the American Association of Individual Investors.

Source: American Association of Individual Investors, Leading Global Investors

Ned Davis Research says the buying sentiment seems to have weighed on a bearish betan ‘s desire for a near – term correction in stock prices. “One thing investors have been doing is short selling short,” analysts Ed Clissold and Thanh Nguyen wrote in a research report on Jan. 19.

According to NDR data, the short sale ratio, the number of short selling shares divided by the total cases traded, hit the lowest level since 2011 back in November.

You don’t have to look far to find evidence of the terrible path facing short sellers these days.

Case in point, GME stock GameStop,

on track for the best monthly rise in its history, up 245%, as investment fans visited the stock and persuaded users on social platforms that financiers like Reddit aimed to buy the shares to push the active investor and noted Citron Andrew Left, the short seller. Research.

The actions of fanatical investor groups have outpaced the efforts of name-calling and scrutiny and have taken what Left said as “serious crimes such as harassment of young children, ”Wrote BarrW’s sister MarketWatch publication.

For some, this is apex market knowledge. Short sellers attracting and investing retail investors trying to show their new level.

Is this what a bubble preview feels like? Are we in one? When will it come in, then?

The Fed

That’s all the questions that could be put to the Federal Reserve when it provides background to the next major event for next week: the latest monetary policy update.

Chairman Jerome Powell is often blamed for helping prevent losses in financial markets when the outbreak of the coronavirus outbreak began in March last year as well as cultivate too much risk.

The Federal Open Market Committee, headed by Powell, quickly lowered interest rates to nearly 0% and injected trillions of dollars of liquidity into the financial market rocked by COVID-19.

But the Fed’s policies have fueled some of the dangers on display, some critics argue. Bears also argue that unlimited currency printing will ultimately have an impact on the U.S. dollar, the economy and financial markets.

Biden is proposing an additional $ 1.9 trillion in federal government spending to help lift the U.S. economy from a downturn as coronavirus cases and deaths reach new heights this month.

All that could add importance to next week’s Fed gathering.

“Chairman Powell will be looking at next week’s FOMC meeting. We look forward to a more optimistic but cautious tone, ”economists Lydia Boussour and Gregory Daco of Oxford Economics wrote in a research note on Friday.

In recent speeches, Powell has already stated that the Fed does not want an imminent withdrawal of monetary policy accommodations, either by raising interest rates from historical levels or reducing the purchase of assets, a source of support for financial markets.

The Fed meeting begins Tuesday, with Powell & Company delivering its policy update Wednesday at 2pm East, followed by a press conference held by the chairman.

US economic growth?

On Thursday, a day after the Fed’s decision, market participants will await the official report card on the health of the U.S. economy.

According to consensus estimates among U.S. economists surveyed by MarketWatch, the U.S. economy may have grown about 4% per year in the last three months of 2020, which would be surprisingly normal, but which will come on the heels of a 33.4% increase in the third quarter.

However, if the GDP reading continues to show upward progress, it may confirm that the economy is moving in the right direction even as coronavirus pandemic develops. growing.

After all that is said and done if the Dow, the S&P 500 SPX index,

and the Nasdaq Composite COMP,

still at the rate of splitting the highest levels, the bulls may be even more developed.