Christine Lagarde

Photographer: Thierry Monasse / Getty Images / Bloomberg

Photographer: Thierry Monasse / Getty Images / Bloomberg

European bond markets are growing cautious that the European Central Bank could simply discount gas.

German output to Italy rose after President Christine Lagarde stressed that the central bank’s 1.85-trillion-euro pandemic stimulus package may not be needed, given funding conditions in the eurozone still favorable. While Lagarde also said the program could be “equivalent” recycling, the concern for investors is whether the message translates to a slower pace of buying from the region’s largest debt buyer.

It is surprising that Goldman Sachs Group Inc. on “the peak of the ECB, ”now that most of the institution is an institution fire power to counteract possible coronavirus economic damage in the rearview mirror. Such a stance would coincide with the stance of the other major banks, from the US to Japan, which have indicated that there is currently enough money in the system to support recovery. And with European governments willing and able to embark on fiscal spending like never before, the conditions for maturity are higher.

“This is a terrible story,” said Peter Chatwell, chief executive ioma-asset strategy at Mizuho International Plc, behind the ECB’s decision. “Yield must rise as the price of this price comes in. ”

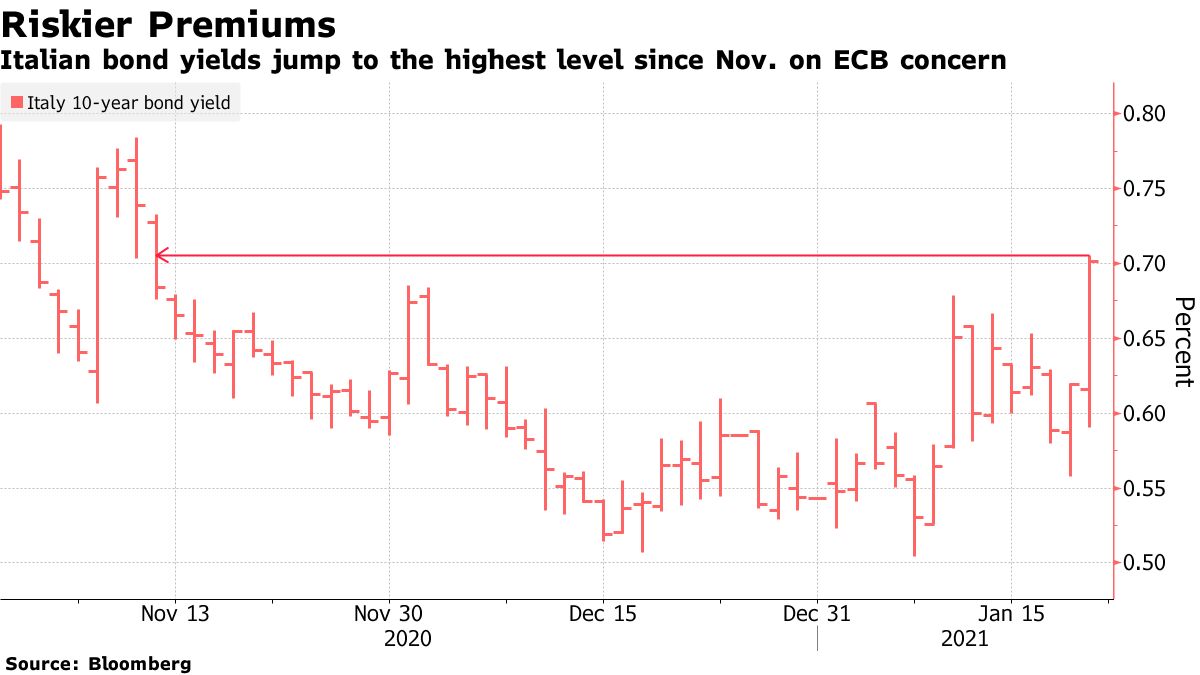

Spreads inspected

German 10-year bonds fell on Thursday. Yield rose as much as four basis points to -0.49%, a week high. Italian rates by date hit 0.71%, the highest level since November 12, while the euro rose as much as 0.6% to $ 1.2173.

Lagarde’s comments came Thursday after people familiar with the case The ECB said it was buying bonds to limit the gap in borrowing costs between the region’s strongest and weakest economies. The central bank has specific ideas on what spreads are appropriate, according to one of the people.

That policy had held on to the output of the most indebted countries in the euro area, such as Italy, which are in need of borrowing concentrated in the pandemic. The impact of the ECB’s purchasing power over markets was seen this month, when Italian output only briefly spun on the the threat of new elections.

Less support?

But with the Brexit deal secured, vaccines being rolled out, and the EU ‘s marked fiscal package going ahead, the ECB may have to continue to offer so much declining support.

It is an achievement that is similar to traders all over the world. Ten-year Treasury yields could nearly double to 2% by the end of this year, according to JPMorgan Asset Management, which expects the Federal Reserve to mark tapering of purchases by the end of the year. Bank of Canada Governor Tiff Macklem said the economy is full of momentum, with the Bank of Japan seeing a resurgence begin in April.

The key issue is the outlook for inflation, which has long been out of the eurozone. Five-year, five-year inflation exchanges, a measure of expectations for price increases over the next decade, have been steadily climbing from their nature in March 2020 to around 1.33% – well below target the ECB of just under 2%. The strength of the Euro, which could hurt import costs, adds to another problem.

‘Hawkish Trap’

While Lagarde said the central bank does not have to use the envelope full of bond purchases, she also stressed that “nothing is off the table. ”

European Central Bank President Christine Lagarde says the central bank is willing to change all instruments, not just the pace of purchase. Lagarde will speak at the ECB’s six-week preparatory meeting in Frankfurt. (

Traders could push European bond yields even higher and test the ECB’s approach to keep some of its holdings. fire power, according to Antoine Bouvet, high-level strategy at ING Groep NV.

“It’s a nice trap that the ECB is setting for itself,” Bouvet said. “If they want to spend less, they have to say they will cost a lot. If they don’t, the market will be in doubt and will test their solution. ”

– Supported by James Hirai