Photographer: Chuanchai Pundej / EyeEm / Getty Images

Photographer: Chuanchai Pundej / EyeEm / Getty Images

Frenzied retailers buy parity criteria catapults to records. A number of mega companies have the upper hand, drawing every day warnings about nasal evaluation. Circulation suddenly takes hold, reviving left-wing businesses while crushing the market as a whole.

The 2021 establishment in stocks? Maybe. These are the same situations investors had two decades ago, when popping the long swoon dot-com bubble appeared in the S&P 500 and Nasdaq 100. A less debatable aspect of that event is that it has become a good time for stock- raising hedge funds, which may be able to lead three years of volatility to be a plan for success today.

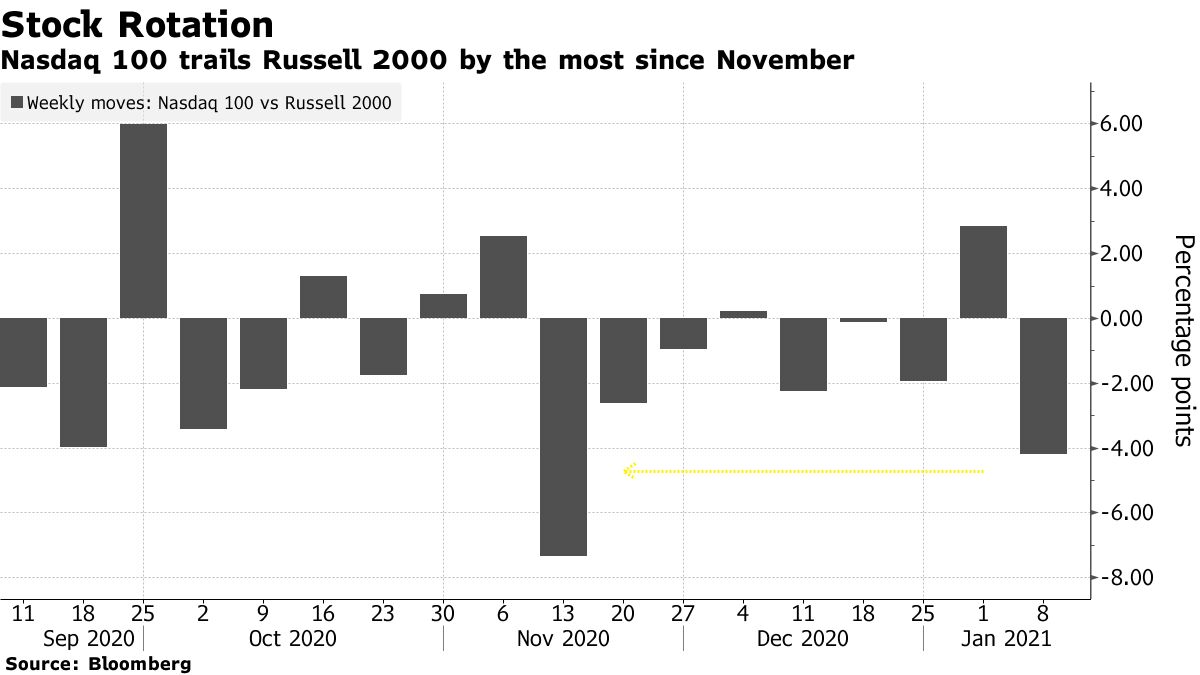

Although rotations have declined in recent months, the leadership of the industry is being challenged, with Democratic winnings in the Senate’s runoff encourage a bet on economic stimulus even as rising rates are holding back technology companies with valuable value. Shares of small caps rose nearly 6% in the past week, surpassing the Nasdaq 100 by a majority in two months, while a version of the current S&P 500 rose. eliminating market value bias and simultaneously releasing Faang block. four times the weight of a cap.

“If you just bend a little bit into the right segment in the coming months, you will be able to add significant value over resilience,” said Rich Weiss, chief investment officer. ioma-asset strategies at American Century Investments, the phone said. “A big turnaround is coming and that is forcing executive managers to take the lead.”

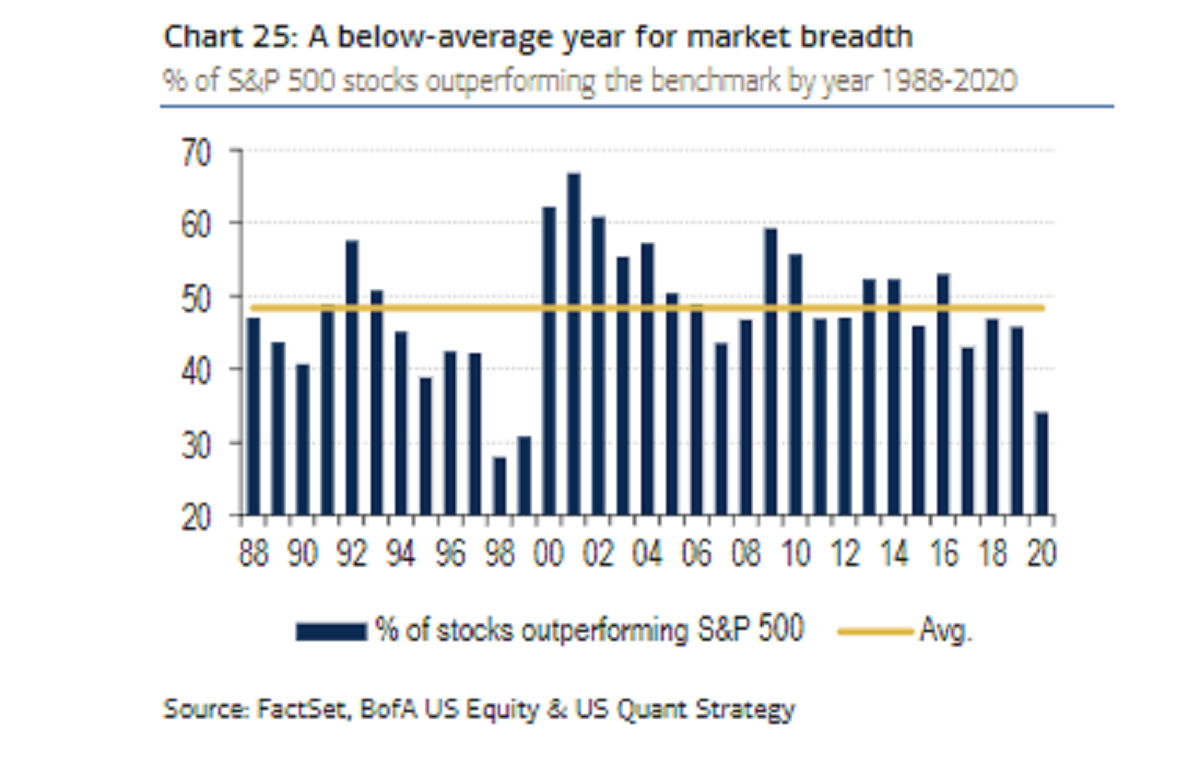

The development of market scope has been good for stockholders in the past, regardless of the direction of the market as a whole. Between 2000 and 2002, when the S&P 500 fell at least 10% in three straight years, managers made speculative currencies that make a bullish and bearish bet well with their clients. The industry delivered gains in the first two years – up 9% in 2000 and 0.4% in 2001, according to data compiled by Hedge Fund Research. In 2002, when their results turned negative, the loss of 4.7% was only one-fifth of the market value.

Short positions helped reduce hedge funds on the downside as the market fell. Also in their favor was a growing collection of winners. Although the S&P 500 fell in 2000, the equivalent weight weighed nearly 8%.

Among long-term currencies only, broad gains also boost yields. Take 2009, the same year when the average stock performed better than in 2000. That year, only 40.7% of equity funds followed the criterion, a decade low, according to data released by S&P Dow Jones together Index.

A market gathering of more than 10 or 15 stocks is “beneficial for managers,” said Brent Schutte, chief investment strategy at Northwestern Mutual Wealth Management. “These stocks may not be overstretched by an executive manager as they should be in that kind of environment. As it expands, it opens up more opportunities for achievement. ”

Of course, what is happening now does not match the events of 20 years ago in terms of how bad they were. Back then, tech was at the center of a major meltdown driven by the often-forgotten investment in nonprofits. Today the country is recovering from an economic downturn. Instead of making a contract as in 2000, a computer and software company profits are declining broadly and expanding.

However, there is a chance that a handful of market behemoths will reduce the grip. As the Senate overrun in Georgia expected Democrats to encourage impetus and tighten regulation, four of the Fagans fell, destroying $ 75 billion in total value. Meanwhile, the KBW Bank Index rose nearly 9% while energy shares in the S&P 500 jumped 9.3% as a group.

While there is only a scant week of evidence of sustained movement, it will take anyway hope to keep stockbrokers under trade control stay at home. Driven by the trend, the S&P 500 equivalent weight index climbed 2.9%, compared to a gain of 1.8% in the traditional measure.

Last year was very poor for active investment as only 37% of S&P 500 stocks outperformed the broad benchmark, the lowest proportion since 1999, data released by Bank of America Corp. . Less than 20% of major cap assets outperformed their benchmark, down from 28% a year earlier.

A quick rollout out of tech megacaps would be welcome news for executive managers who have typically failed enough Faang stocks to keep up with criteria. Among about 200 assets that have been benchmarked for the S&P 500 that have at least $ 500 million in assets are those with at least a fifth of their money in Facebook Inc., Amazon.com Inc., Apple Inc., Microsoft Corp. and Alphabet Inc. has returned an average of 24% over the last 12 months. That gives those who have nothing at all a 17% advantage.

Gains from value shares and small installments could be well-suited for active money by expanding the number of winning stocks after a year when half of the S&P 500 advance was available with five tech megacaps. Less than a third of the companies in the S&P 1500 Composite outperformed the S&P 500 on a 12-month slowing basis through November, according to data compiled by Leuthold Group. That share is likely to double in the coming year, the company ‘s chief investment officer Doug Ramsey recently wrote.

“Extensive market performance does not always equate to major market gains, but active managers rejoice,” Ramsey said in an email Wednesday. “The percentage of performing stock is even better, and I expect it to explode. ”

– Supported by Claire Ballentine