Raphael Warnock, center, and Jon Ossoff will attend a rally in Garden City, Georgia on Dec. 19.

Photographer: Colin Douglas Gray / Bloomberg

Photographer: Colin Douglas Gray / Bloomberg

Investors are not yet ready to put this chaotic year behind them. There is one more risky event to cross: the last races of 2020 elections that have come into next year.

While not as clear as the hedge seen around Election Day last month, options and volatility times reflect a growing concern over potential market turmoil. water running races Jan. 5 in Georgia that decides whether a Republican controls the Senate.

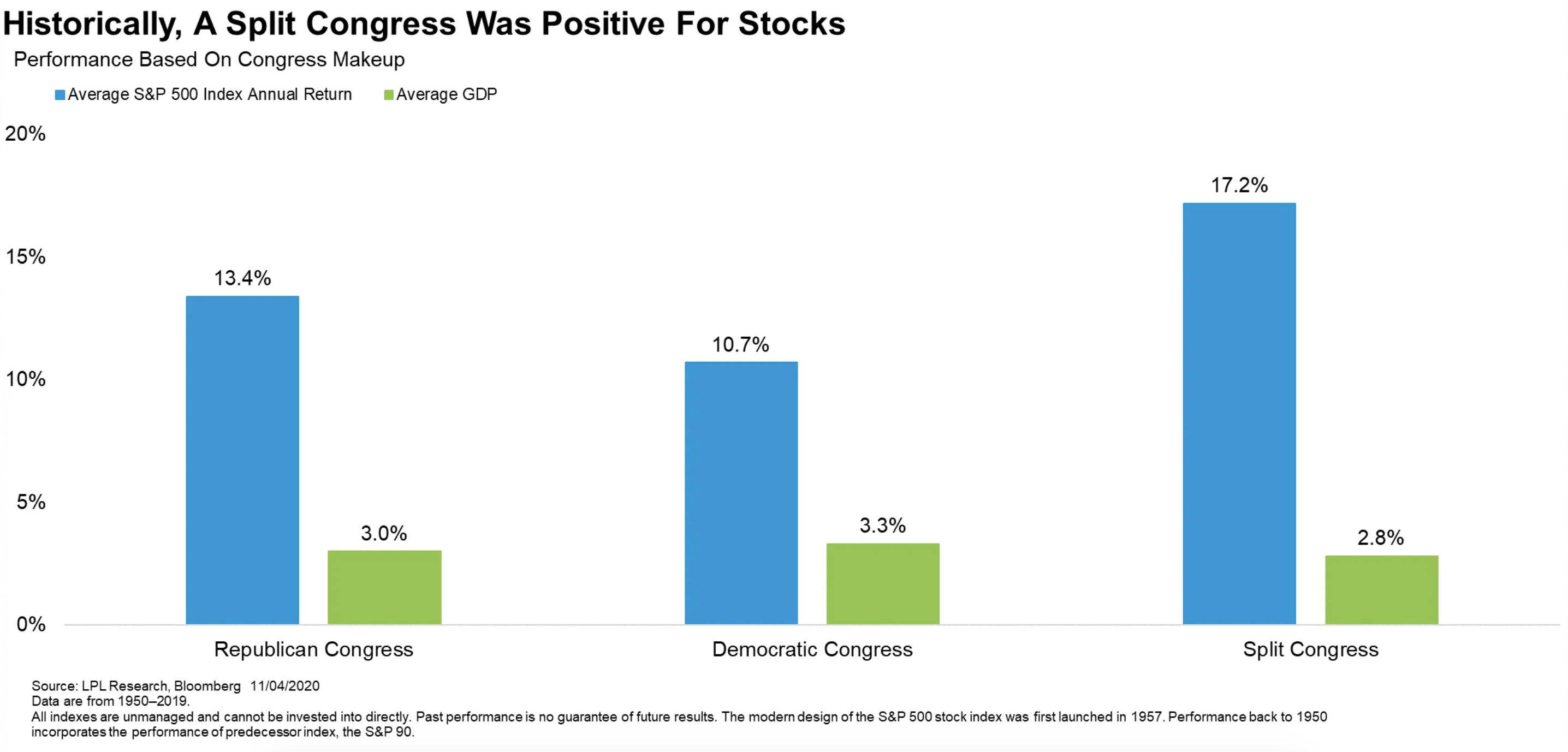

Prior to the November vote, Democrats were widely considered to be among the most bullish possible results for U.S. equality. Since then, however, the market has shown that it has become comfortable with the government’s continued possible separation control – a backdrop that has historically yielded strong results.

“There is no doubt that if you go from red to blue, you have to price something less favorable because of gridlock-friendly markets, markets enjoying the status quo,” said Phil Camporeale, director rule at ioma-asset solutions for JPMorgan Asset Management.

The focus on running water – and demand for hedges to protect against subsequent disruption – is based on uncertainty over exactly what investors should position themselves ahead of Joe Biden ‘s leadership. It needs to put Democratic control of the Senate on an agenda that would invigorate green energy companies at the expense of fossil fuel producers, while at the same time leading to more economic relief packages and infrastructure spending. But it could also help raise the corporate tax rate and increase regulatory scrutiny.

“It is impossible to determine the importance of these elections for the size, scale and pace of fiscal, tax and regulatory policy of 2021,” Cowen analyst Chris Krueger wrote in a note on December 21.

Hedges in place

There are potential winners and losers in each scenario and it is a debate that would be a better scenario for the overall stock market in the long run. But traders seem to be hedging against volatility that could go down in the short term if Georgia’s results cause investors to accumulate into overvalued beneficiaries. dumping as seen and dumping the seen.

The hedge also expresses concern that even small surprises could create turmoil in an equity market that the public must continue to invest in after an incredible run. The S&P 500 is up 65% from its March low, with a mix of valuation meters at its highest level in a decade or more.

“The idea is that fiscal policy and public procurement could be more important than employment and revenue – it’s a bit like 2020, isn’t it? – uncomfortably instinctive and supportive above normal volatility continues, ”wrote Julian Emanual, BTIG’s break-even equality strategy, in a recent note.

Biden stocks have a history and are fed on the side, without much else

The runoff in Georgia was sparked after any candidate for both states ’Senate seats captured the majority of the vote. Republican David Perdue is running for re-election against Jon Ossoff, while Senator Kelly Loeffler runs against Democrat Raphael Warnock. Censuses show fierce competition between Republican and Democratic rivals, and PredictIt’s pledge market shows little advantage for Republicans. President Donald Trump’s last-minute call for bigger payments to Americans as part of the Covid-19 relief package is also a wild card that could affect the vote.

The close proximity of the races has kept investors from becoming overly optimistic about what to expect early in Biden’s administration. If Democrats win both races, it will give them control of the Senate with the help of broken votes from Vice President Kamala Harris. (Two independent grandfathers caucus with Democrats.)

“We see both options too close to the call,” said Tom Hainlin, strategist at US Bank Wealth Management’s Ascent Private Wealth Management Group, adding that “some short-term volatility in the market is possible” after the vote if Democrats take both seats.

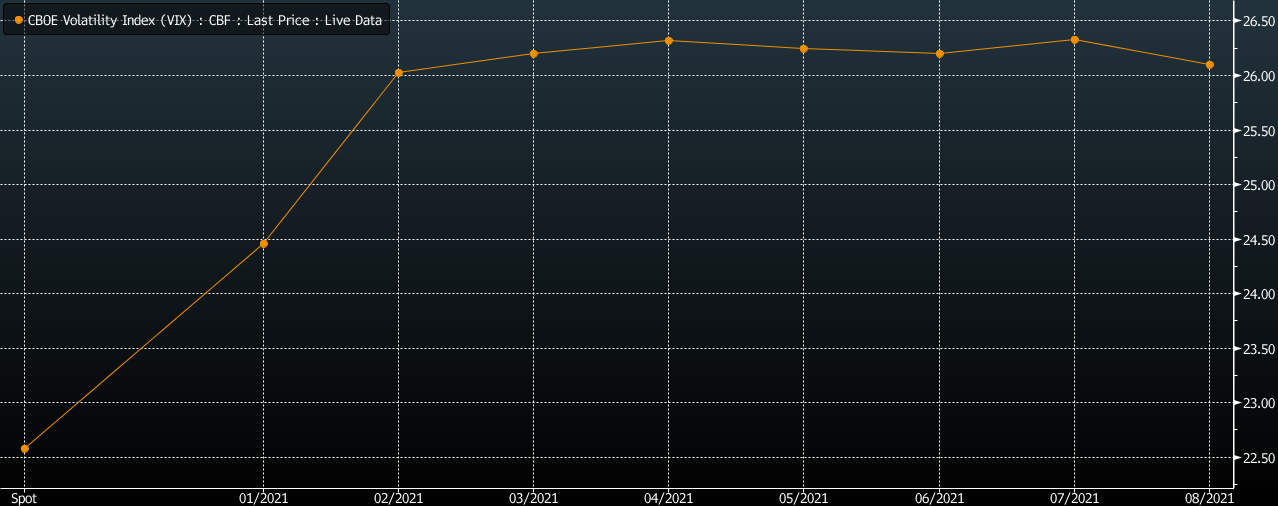

Evercore ISI strategists say the Cboe Volatility Index revenue curve is still “quite steep” due to Georgia events, similar to the situation heading into the races of the. November.

The VIX revenue curve is as of December 23rd

Meanwhile, a skew in the one-month S&P 500 button, or measure of cost in the bearish options, stood at the 92nd percentile of historical range, according to data compiled by Nomura Securities. “Focus shifts to defense after one hell of a run, and ahead of the macro-regime change threat from the Georgia Senate overflow,” Charlie McElligott, a cross-fund strategist at Nomura, wrote in a recent note to clients.

Many in the market accept that the Republican candidates will hold both sets, said Ryan Detrick, chief market strategist for LPL Financial, so any surprise would “disturb the apple card. ”

Things up

Research from LPL has found that Shared Transport has historically been good for the stock market – over the last seven decades, the S&P 500 has returned an average of 17.2% per annum when power was divided between the two parties. That compares with an increase of 10.7% when Democrats were in charge and 13.4% with Republicans leading in both chambers.

There is also activity warming up in the Treasury options market, marked by a contrarian bet that appeared late Monday. The bet was against the potential for aggressive fiscal stimulus to spur a chase in the long end of the bond market, and it is up to the payout whether any climb in yields is limited about 10 basis points from normal levels for about the next month. wager leaps against a topic that has been experiencing a major shift in Treasury options – the sale of Georgia could spur big sales in Finance.

Treasury Springs Options to Life as Georgia Runoffs Nearby

To be sure, there are many on Wall Street who don’t see Georgia racing as too much of a game changer. The Senate’s narrow majority for Democrats may not mean the immediate introduction of new policies, including the updating of tax rates, according to Art Hogan, a key strategist market at National Securities Corp.

“I don’t think it plays into this idea of,‘ Oh my god, instant higher corporate taxes and grandiose changes. ‘I think it’s a lot more than a central-minded mindset that we could have some gradual changes,’ “Hogan said over the phone. “The market statement moved very quickly too, after the election, saying, ‘Hey, wait a minute, we didn’t get the blue wave but we have a new president and with that there may be a calmer presence around international relations and tariffs and more normalization and trade. “I think the market has settled in that concept.”

– Supported by Lu Wang, and Sarah Ponczek