Investors are promising that lithium will return less than three years after the prices of the metal used in rechargeable batteries fell from a record and sent reel miners.

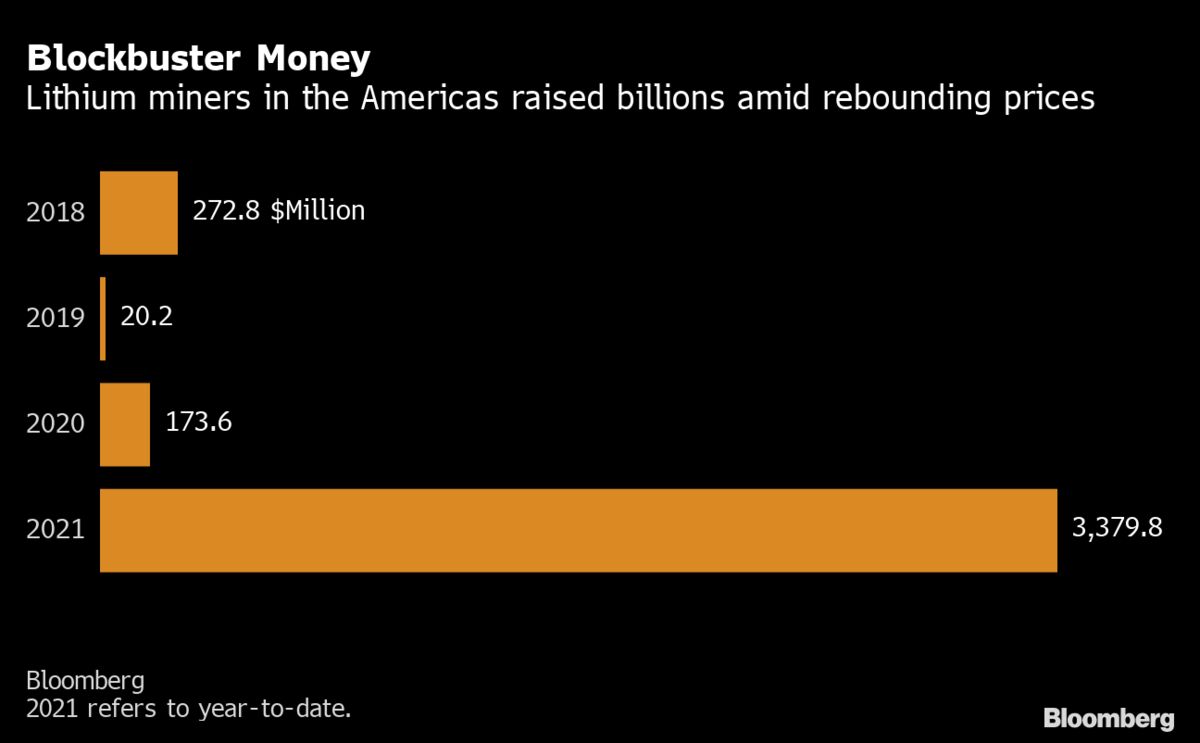

Producers of the shunted metal amid supply and supply overhangs have raised nearly $ 3.4 billion in equity bids in America so far this year, data compiled by Bloomberg. That’s seven times what was built from 2018 to 2020, when the industry was in decline.

Interest in the industry is reviving as electric vehicle targets are set by global manufacturers and a change in the U.S. administrative signal that its battery surge is finally gathering momentum. After punishing the three-year sale, white-on-white soft metal prices have begun to bounce back, with analysts including those at BloombergNEF expecting gains in addition to increased demand and supply tightness of lithium battery level.

Talks with investors and talks on possible supply agreements with car and battery equipment manufacturers “that were only a dream a year ago are now filling my calendar,” said Robert Mintak. , chief executive of Standard Lithium Ltd., based in Vancouver. phone.

Blockbuster Money

Lithium miners in America raised billions amid recurring prices

Bloomberg

Lithium price index compiled by Benchmark Mineral Intelligence jumped 32% this year through February, after falling 59% from mid-2018 to mid-2020. The metal reached a high in May 2018.

The investor pool has been “extended to technology investors and others,” said Mintak, as the huge determination of manufacturers to use hundreds of billions of dollars to electrify their fleets provides “safety that for investors there will be a supply pinch. ”

Most of the funding was done by the two best lithium miners in the world – Albemarle Corp. and SQM, or Soc. Quimica & Minera of Chile USA, as it is formally called – because they took advantage of their recent stock increases. Albemarle completed a a larger-than-expected $ 1.5 billion equity offer in early February, while SQM was based in Santiago it raised $ 1.1 billion in January.

Young miners, most of whom have not yet made much lithium, are also attracting a lot of interest from investors. Take the case of Standard Lithium, which opened its first direct lithium extraction plant in El Dorado, Arkansas, in September, with the facility using new technology that allows it to achieve a 90% lithium recovery rate. It C raised $ 34.53 million ($ 27.6 million) in oversubscribed share offer in December. Investor interest was so strong that it needed bids to turn more away, CEO Mintak said.

Lithium Americas Corp., which develops the Thacker Pass mine in Nevada, raised a total of $ 500 million through two primary allotment offers in October and January, respectively.

“The tide is finally turning, and much faster than I thought,” Chris Berry, president of House Mountain Partners, business consultant. “You see that with Lithium Americas being able to raise half a billion dollars recently. This is for a lithium revenue pre-production company. ”

Sigma Lithium Resources Corp., which is developing a solid lithium project in Brazil, had to raise its private position and raise the offer price, which “says a lot about investor demand for lithium disclosure, that asset, and the vision of that company,” Berry said.

Tidal turn

Investors are warming up to young lithium players in America

Bloomberg

Young lithium miners raised $ 529 million this year, Bloomberg data sheall. That’s about $ 63 million more than the total amount raised from 2018 to 2020.

Ford Motor Co. announced last month that they will have the vehicle range all-electric in Europe by 2030. General Motors Co. expect to sell only zero emission models by 2035. Volkswagen AG later announced this week plans to build six battery factories in Europe and global investment in charging stations, as ensuring battery scaling has become a key part of the EV race.

Batteries make up about 30% of the cost of an electric car. And appliance manufacturers around the world are looking to pivot to EVs, hoping to get batteries at the cheapest price possible but also get enough supply to meet those goals.

Greedy for Gigawatts

EVs are going to be the driving force for lithium-ion battery application

Source: BloombergNEF

Meanwhile, US President Joe Biden has pledged to rebuild the economy following the destruction of Covid-19 with cleaner energy and a lower carbon footprint. The administration said at the end of February that they would maintain a government a review of U.S. supply chains to try to end the country’s reliance on China and other enemies for essential goods.

Biden’s election is “a very favorable signal for investors” as it has boosted confidence that the transition to clean energy will accelerate, which together with existing subsidies and regulations in Europe and China will go well for products. needed for that energy shift, he said. Seth Goldstein, analyst at Morningstar Inc. The US is the second largest EV market, after China.

Andrew Bowering, director at Vancouver American Lithium Corp. called the U.S. review of supply chains “very large” for the lithium industry because it shows that the government understands the importance of the U.S. achieving security for products. such raw performance as lithium.

“Suddenly, after a three-year recession, commodity prices are starting to rise again and a change in U.S. administration is pushing for a new green contract and supporting a ‘big money going into the green car. business, ”said Bowering. “That brings investors in. ”